Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 03, 2015

Developed world growth picks up alongside steadier emerging markets

The global economy grew at a slightly faster rate in November, led by upturns in the US, UK, Japan and the eurozone, which all saw either faster rates of expansion or robust growth holding steady at October's rate. Emerging markets also stabilised, helped in particular by a return to growth in China, although downturns in other emerging Asian countries and Brazil remain a key source of concern.

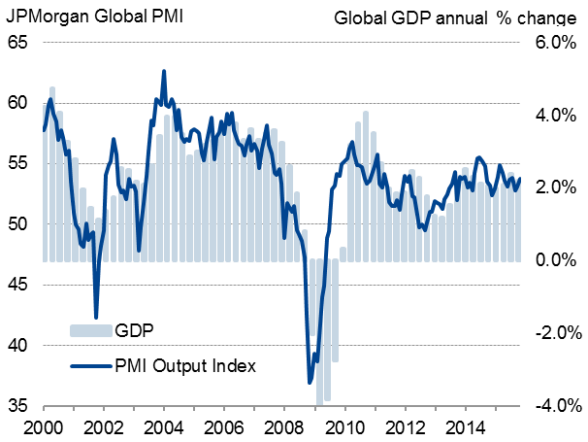

The JPMorgan Global PMI, compiled by Markit from its national business survey data, rose from 53.1 in October to 53.7 in November. The index rose for a second successive month to a level just above the average seen previously in the year to date. The survey is broadly consistent with annual global GDP growth of just over 2%.

Global economic growth

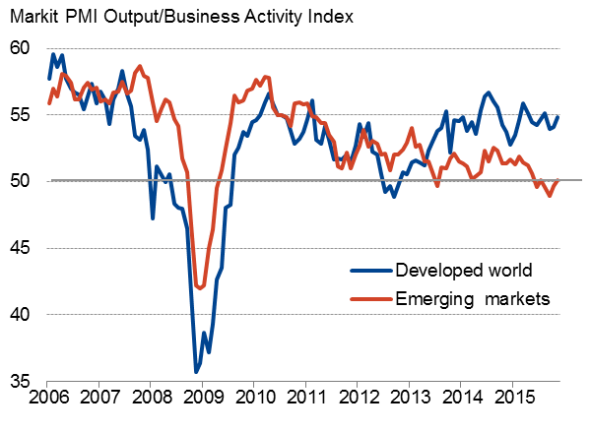

Growth accelerated to a three-month high in the developed world. The rise in the PMI to 54.8 brought the surveys in line with GDP growth of just under 2%, so remaining below the 2-2.5% annual growth rate that is widely considered to be a sustainable long term trend for a developed economy.

The PMI for the emerging markets also picked up, rising to 50.1 to register the first expansion of business activity since July. However, the survey data remain indicative of only 4% annual GDP growth in the emerging markets, therefore remaining well below (more than half) the rate of expansion seen prior to the global financial crisis.

Developed v emerging markets

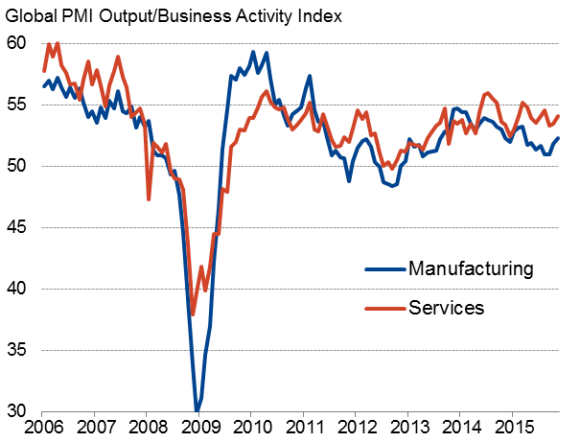

The global upturn continued to be led by the service sector, where growth picked up for a second month running to reach a three-month high on the back of a faster rate of expansion in the developed world. Emerging market services barely expanded, having more or less stagnated over the past four months.

Growth also accelerated in manufacturing, however, reaching an eight-month peak. Factory production grew at the fastest rate for eight months in the developed world, while the emerging markets saw the smallest - only marginal - contraction since production began falling back in May.

Manufacturing v services

Solid US and UK expansions accompanied by steady eurozone and Japanese growth

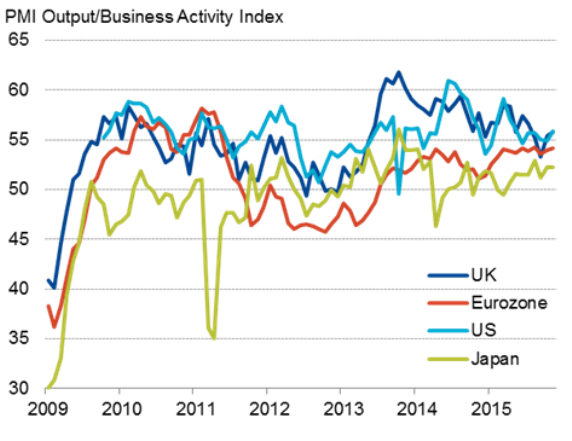

Global growth continued to be powered by a robust US expansion. The all-sector PMI rose to a nine-month high of 55.9, indicating 0.5% (2% annualised) GDP growth so far in the fourth quarter. With the survey also signalling resilient employment growth of 180,000 in November, the data add grist to the mill to those calling for higher interest rates.

The UK likewise saw strong growth, with the all-sector PMI of 55.7 indicating 0.6% quarterly GDP growth (2.2% annualised). The sustained strong expansion of the UK economy therefore likewise supports the case for monetary policy to be tightened.

The eurozone also saw a reassuring uplift in growth, with the PMI reading of 54.2 suggesting the single currency area is on course for a 0.4% (1.6% annualised) expansion in the closing quarter of the year. Faster growth in Germany, Spain and Italy (the latter topping the global PMI rankings in terms of manufacturing growth) contrasted with a slowing in the already lacklustre French economy. Falling prices, however, strengthened arguments for the ECB to do more to ward off deflation.

Japan's Nikkei all-sector PMI meanwhile held at 52.3, suggesting the economy will have pulled out of its recession in the fourth quarter. The surveys showed a boost from exports driving manufacturing growth to the highest for 20 months, linked to the weaker yen, alongside a further moderate service sector expansion. The upturn implies that any further stimulus from the Bank of Japan may be limited in scope.

Developed world

Mixed news in emerging markets

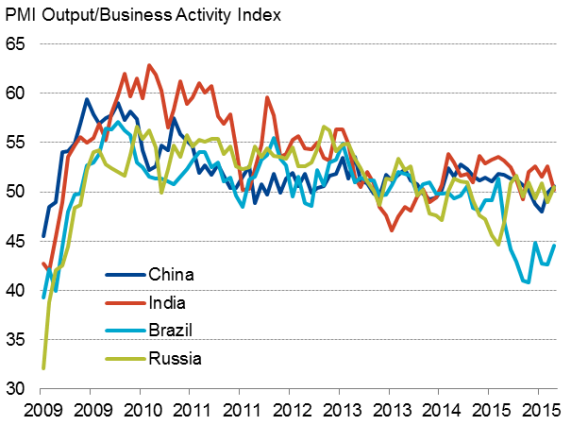

Japan bucked the trend in an Asian continent that continued to stagnate in November. Excluding Japan, Asian manufacturing in fact contracted once again, albeit at a reduced rate that could in turn be attributed to signs of renewed life in China. At 50.5, the Caixin composite PMI showed China returning to growth after three months of decline, as a stabilisation of manufacturing output accompanied steady services growth.

India's economy meanwhile almost stalled, with an all-sector Nikkei PMI down to 50.3 suggesting GDP growth will deteriorate again after both the official and survey and signalled a third quarter acceleration.

Brazil's downturn also remains a major concern, with the PMI all-sector reading of 44.5 merely indicating some moderation in the severe rate of decline seen in prior months.

There was better news in Russia, where the PMI reading of 50.5 heralded a return to modest growth, led by an upturn in manufacturing and a slower rate of decline in services. After the PMI had signalled a steep rate of Russian decline at the start of the year, the past eight months have seen only marginal declines and even some months of slight growth.

Emerging markets

Sources for all charts: Markit, JPMorgan, Caixin, Nikkei

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Developed-world-growth-picks-up-alongside-steadier-emerging-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Developed-world-growth-picks-up-alongside-steadier-emerging-markets.html&text=Developed+world+growth+picks+up+alongside+steadier+emerging+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Developed-world-growth-picks-up-alongside-steadier-emerging-markets.html","enabled":true},{"name":"email","url":"?subject=Developed world growth picks up alongside steadier emerging markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Developed-world-growth-picks-up-alongside-steadier-emerging-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Developed+world+growth+picks+up+alongside+steadier+emerging+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Developed-world-growth-picks-up-alongside-steadier-emerging-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}