Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 03, 2015

China PMI surveys signal return to growth in November

China's economy expanded, albeit only modestly, for the first time in four months, according to November's Caixin PMI surveys, heralding a welcome return to growth. However, inflows of new orders fell slightly, employment continued to drop and average prices charged for goods and services decreased at the fastest rate for 20 months, highlighting an intensification of deflationary pressures during the month.

But not all sectors are struggling, and the weak headline data conceal pockets of strong growth.

PMI signals a return to growth (just)

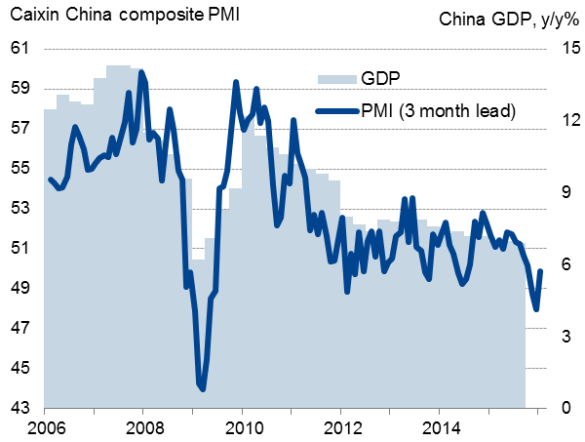

The weighted average of the Output Indices from the manufacturing and services PMI surveys, compiled by Markit, rose from 49.9 in October to a five-month high of 50.5 in November, its first foray above the 50.0 no-change level since July but still signalling a near-stagnation of business activity.

Economic growth gauges

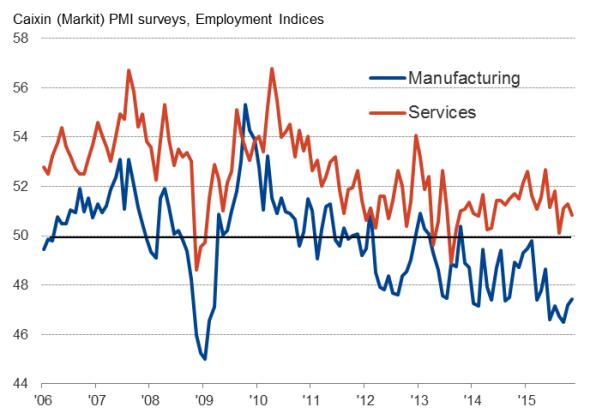

Inflows of new orders fell slightly, down for the third time in the past four months, promoting firms to trim headcounts for the eighth time in the past nine months.

Price cutting also became more widespread, with average selling prices dropping at the sharpest rate since March 2014 as a result. Pressure on margins was ameliorated, however, by input costs falling to the greatest extent since April, linked in many cases to lower oil prices.

Some pockets of strong growth

With the survey data presenting an overall picture of an economy stuck in a period of malaise, it is important to drill down into the sector data, where signs of vibrancy can be found.

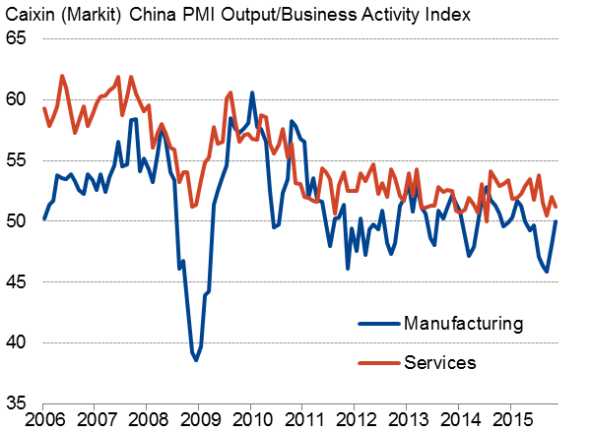

Manufacturing output stagnated in November, though that represented an improvement on the declines seen in the prior six months. Service sector activity continued to expand, but only modestly as an easing in the rate of growth was recorded.

Manufacturing v services output

Manufacturing v services employment

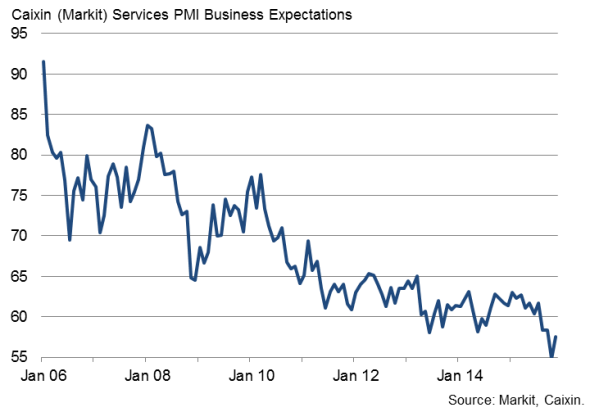

At first glance, the ongoing weakness of the services PMI survey data contradicts suggestions that the Chinese economy is successfully transitioning away from manufacturing. In particular, service sector confidence about the year ahead also remained close to October's record low. However, a deeper dig into the data reveals encouraging signs of strong growth in certain key areas of activity.

Service sector confidence

The survey data show that main sub-sectors of the services economy are currently driving growth: Post & communications, financial services and consumer services (the latter excluding hotels and restaurants but including all other leisure and household activities).

Overall growth in the service sector has been dragged down, however, by declining (or near-stagnant), activity in the transport sector throughout much of the past year, linked in turn in many cases to the downturn in trade and manufacturing activity. Similarly, many business-to-business services have also suffered alongside the manufacturing malaise this year.

A near-stagnation has meanwhile been evident in the hotels and restaurants sector. However, this can be partly linked to reduced corporate spend in the industrial sector, as well of course to the clamp down on extravagant expenditure by government officials.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-China-PMI-surveys-signal-return-to-growth-in-November.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-China-PMI-surveys-signal-return-to-growth-in-November.html&text=China+PMI+surveys+signal+return+to+growth+in+November","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-China-PMI-surveys-signal-return-to-growth-in-November.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys signal return to growth in November&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-China-PMI-surveys-signal-return-to-growth-in-November.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+signal+return+to+growth+in+November http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-China-PMI-surveys-signal-return-to-growth-in-November.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}