Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 03, 2015

Brazil PMI points to recession extending into fourth quarter

Official data released on 1st December showed Brazil's recession extending into the third quarter, and survey data are already indicating that the downturn persisted into the closing quarter of the year.

Recession pushes into fourth quarter

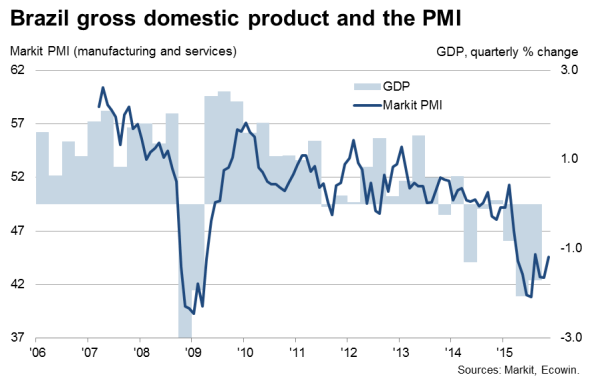

The Markit Composite PMI, covering both services and manufacturing in Brazil, remained firmly in negative territory in November, pointing to a further drop in gross domestic product.

The data come hot on the heels of official numbers, which confirmed the severe downturn that the survey data had warned of earlier in the year.

Back in September we had indicated how the PMI data were consistent with "the economy contracting in the third quarter at a similar rate to the severe 1.9% rate of GDP decline seen in the second quarter". In fact, the new official data show GDP falling 1.7% in the three months to September, with the second quarter revised down to show a larger, 2.1%, drop.

Another severe drop in GDP is signalled by the PMI for the fourth quarter, albeit with the rate of decline easing.

The PMI had inched up from 42.7 to 42.8 on average between the second and third quarters, but has so far improved to 43.6 in the fourth quarter, with the index rising to 44.5 in November. However, that still points to a marked drop in GDP in the closing quarter of the year of at least 1%.

We therefore stand by our asserting from September that the data "indicate a strong likelihood of the economy contracting by over 3%, more than double the IMF's current estimate of a 1.5% decline". The IMF revised its projection in October to anticipate a 3.0% GDP decline in 2015, but a 3.7% drop looks likely given the recent data flow.

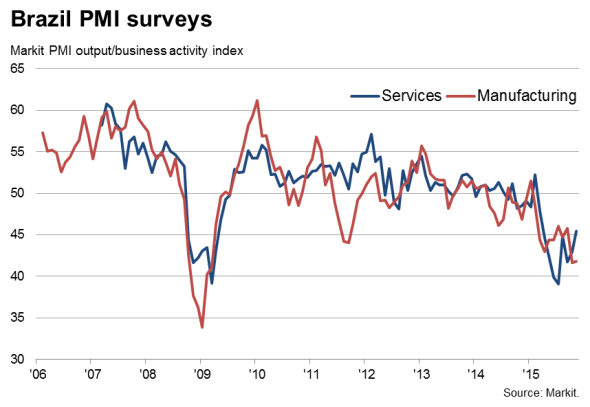

The PMI data showed the downturn in the service sector easing to the weakest in eight months during November, but the manufacturing sector saw production collapse at a rate similar to October, and therefore suffering one of the sharpest deteriorations since the height of the global financial crisis.

A further easing in rates of contraction is possible in December, as both sectors saw new business inflows drop at reduced rates, adding weight to the suggestion that the worst may be over in terms of the pace of economic decline. However, a return to growth any time soon remains unlikely, given the ongoing economic and political uncertainty.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Brazil-PMI-points-to-recession-extending-into-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Brazil-PMI-points-to-recession-extending-into-fourth-quarter.html&text=Brazil+PMI+points+to+recession+extending+into+fourth+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Brazil-PMI-points-to-recession-extending-into-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=Brazil PMI points to recession extending into fourth quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Brazil-PMI-points-to-recession-extending-into-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil+PMI+points+to+recession+extending+into+fourth+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-Brazil-PMI-points-to-recession-extending-into-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}