Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 03, 2017

UK PMI surveys signal sustained modest growth amid subdued optimism

The July PMI surveys signalled another month of steady economic growth, with hiring gathering pace to an 18-month high as firms continued to boost capacity. However, business confidence remained subdued amid heightened uncertainty about the economic outlook and Brexit process, suggesting risks to the outlook remain biased to the downside.

Steady but sluggish growth

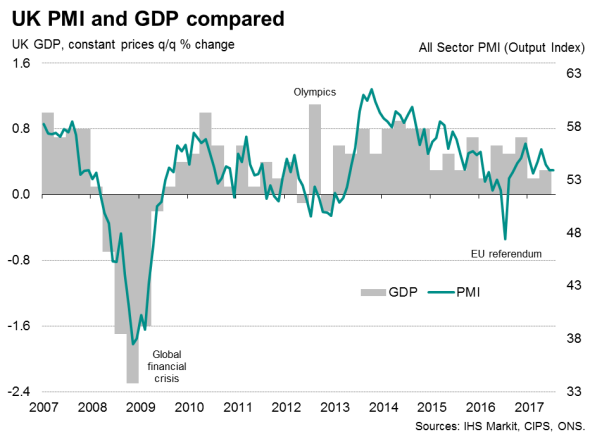

The current picture remained one of an economy showing overall resilience in the face of concerns about the outlook. The 'all-sector' IHS Markit/CIPS PMI was unchanged at 53.9 in July, indicating that the rate of growth of business activity held steady on June's four-month low.

The survey is running at a level broadly consistent with economic growth of just over 0.3%, putting the country on course for another steady but sluggish expansion in the third quarter.

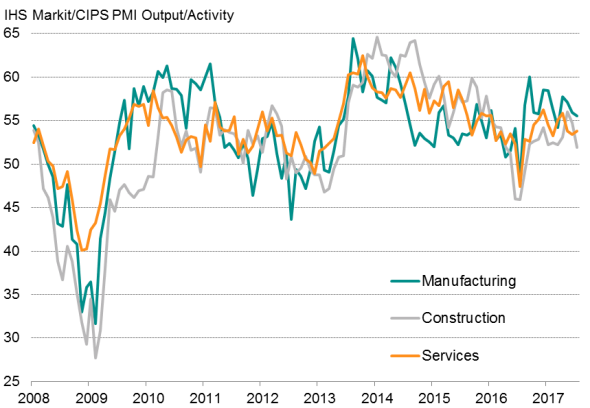

The strongest upturn was again seen in manufacturing, where output was boosted by a near-record rise in exports, followed by services, where growth of activity lifted higher from June's four-month low. Construction growth meanwhile slowed sharply, slipping for a second month running to its weakest since the decline seen last August, dragged lower by reduced commercial building.

Output of the three main sectors

Uncertain outlook

Forward-looking indicators were mixed: growth of new orders perked up slightly, suggesting activity will continue to rise at a steady pace in August, but the rise was nevertheless the second-weakest recorded over the past ten months.

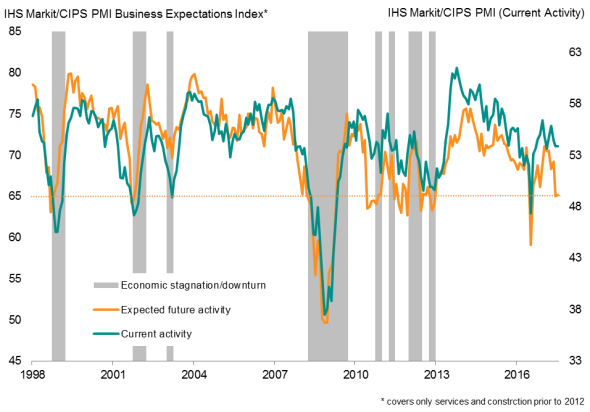

Looking further out, firms' expectations about activity over the coming year remained very subdued, running at a level that has previously been indicative of the economy stalling or even contracting. Optimism was largely unchanged from the post-election slump seen in June, which had been the second-lowest since 2012 (the weakness exceeded only by the drop in sentiment seen straight after last year's referendum).

UK PMI survey future expectations

Confidence about business prospects remained below that seen earlier in the year in all three sectors, commonly linked to widespread uncertainty about the impact of Brexit, in terms of both how the process of leaving the EU might affect individual businesses (such as via tariffs and reduced staff availability) and the potential impact on the wider economy.

However, despite the post-election drop in optimism, employment growth rose to the highest for one-and-a-half years, with companies generally citing the need to raise staffing levels to meet rising workloads.

The concern is that, with backlogs of uncompleted work falling (albeit marginally) for the first time in five months, the hiring trend may soon start to moderate. The current resilience of recruiting nevertheless underscores the message from the surveys that businesses remain in expansion mode despite the heightened uncertainty about the outlook.

Inflation pressures

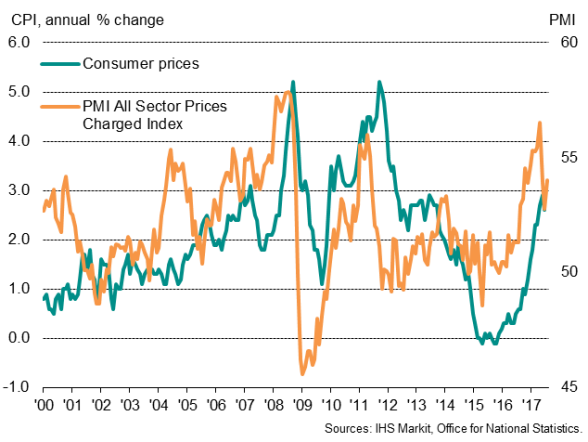

Price pressures picked up in July, though remained below levels seen earlier in the year. Input cost inflation edged up for a second successive month, driven by a faster increase in service sector costs, often in turn linked to rising wages, which countered slower rates of purchase price inflation in manufacturing and construction.

Average prices charged meanwhile rose to the greatest extent since April, as slower growth of manufacturing prices was offset by an upturn in service sector selling price inflation.

Inflation

Dovish policy bias

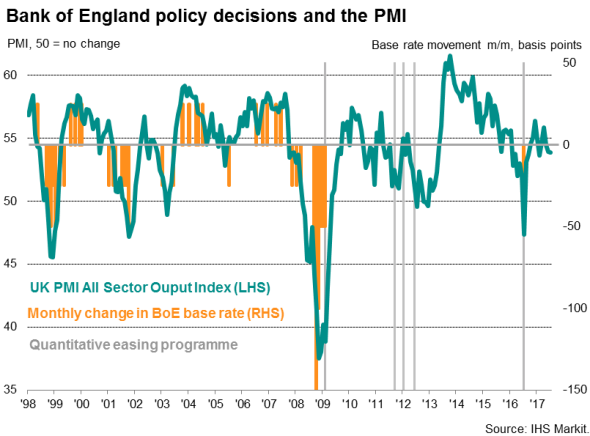

The current reading of the PMI remains historically consistent with a slight easing bias as far as monetary policy is concerned. The Bank of England's Monetary Policy Committee has never hiked interest rates when the most recent all-sector PMI reading has been below 54.3 (as was the case in 1998, after which much higher thresholds have needed to be breached before the MPC voting for a tightening of policy). It would therefore be a surprise to see policymakers vote for a rate increase given the PMI's recent readings of 53.9.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-UK-PMI-surveys-signal-sustained-modest-growth-amid-subdued-optimism.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-UK-PMI-surveys-signal-sustained-modest-growth-amid-subdued-optimism.html&text=UK+PMI+surveys+signal+sustained+modest+growth+amid+subdued+optimism","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-UK-PMI-surveys-signal-sustained-modest-growth-amid-subdued-optimism.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys signal sustained modest growth amid subdued optimism&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-UK-PMI-surveys-signal-sustained-modest-growth-amid-subdued-optimism.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+signal+sustained+modest+growth+amid+subdued+optimism http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-UK-PMI-surveys-signal-sustained-modest-growth-amid-subdued-optimism.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}