Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 03, 2017

Zambian economic recovery gathers pace in July

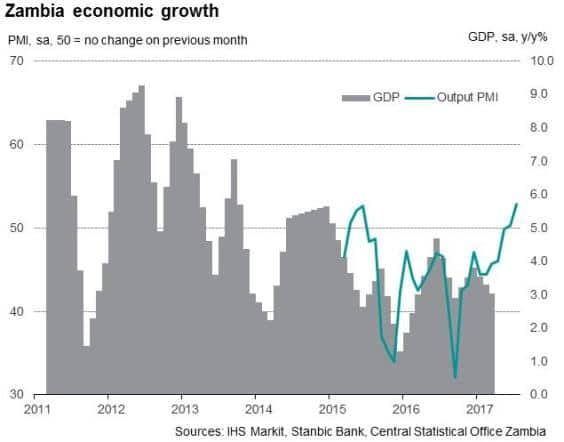

July 2017 saw IHS Markit and Stanbic Bank launch a new PMI survey for Zambia, offering timely insights into the health of the country's business sector. The latest data point to gathering momentum in growth of both output and new orders, offering signs of a recovery from weakness in 2015 in particular. In fact, July saw the fastest rise in output since the survey began in March 2015.

Economy suffered in late-2015

Much of the Zambian PMI survey history so far has reflected the downturn which reached its nadir in late-2015. In line with the trends indicated by the PMI, Zambian GDP data subsequently showed growth having slowed towards the end of the year, with Q4 2015 seeing a rise of just 1.3% year-on-year.

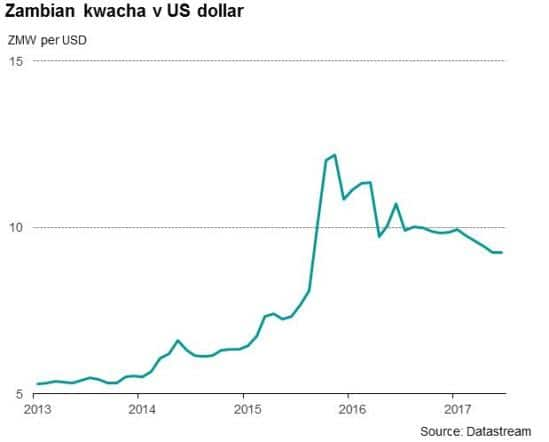

Central to this bout of economic weakness was a drop in the price of copper, which is integral to the Zambian economy, accounting for a large proportion of the country's exports. The fall in the copper price put pressure on the Zambian kwacha. In fact, by November 2015 the currency had nearly halved in value versus the US dollar compared to the position at the start of the year.

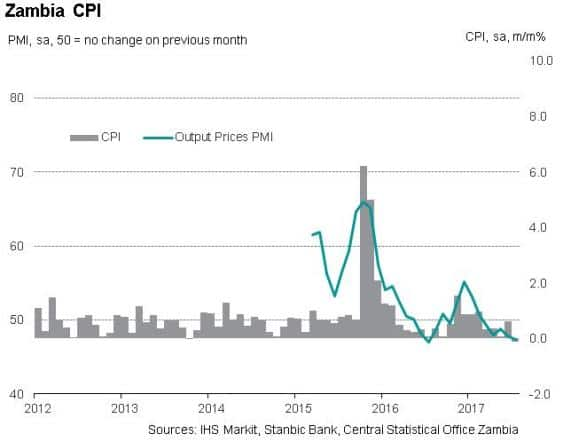

The sharp decline in the value of the currency contributed to an increase in inflationary pressures. Companies reported substantial rises in both input costs and output prices, with the PMI data providing advance warning of the spike in consumer price inflation in the final quarter of 2015.

With companies raising their selling prices, increasing difficulties were reported in securing new business. New orders consequently fell substantially on a monthly basis from September 2015, with order books finally stabilising mid-way through 2016.

Signs of recovery mid-way through 2017

While 2016 was generally a year of stabilisation (punctuated by a decline in output around the time of the general election), 2017 has generally seen a more positive performance of the Zambian economy, as the factors behind the downturn have unwound somewhat.

The kwacha has regained some ground against the US dollar, helping to bring down inflation. In fact, July saw broadly no change in input costs and an accelerated reduction in output prices as panellists reported lower selling prices in order to attract clients.

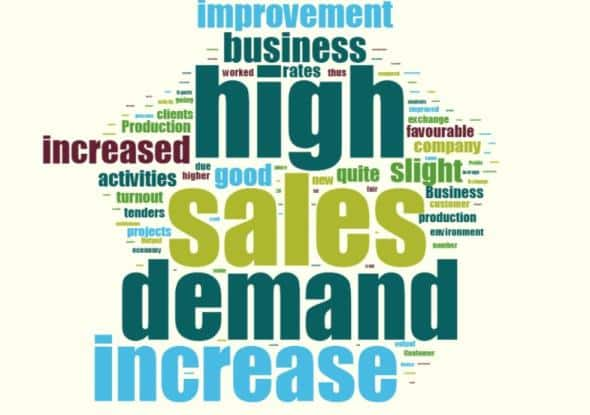

Competitive pricing and stronger demand led to a continual rise in new orders in the four months to July, a period during which the rate of growth has gradually gathered pace. This was a key factor behind the return to expansion of output.

GDP growth has picked up accordingly, with PMI data suggesting that a further acceleration during the second quarter of the year is likely.

This also supports the current IHS Markit forecasts, which point to GDP growth picking up in 2017 amid decreasing interest rates as inflationary pressures ease.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-Zambian-economic-recovery-gathers-pace-in-July.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-Zambian-economic-recovery-gathers-pace-in-July.html&text=Zambian+economic+recovery+gathers+pace+in+July","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-Zambian-economic-recovery-gathers-pace-in-July.html","enabled":true},{"name":"email","url":"?subject=Zambian economic recovery gathers pace in July&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-Zambian-economic-recovery-gathers-pace-in-July.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Zambian+economic+recovery+gathers+pace+in+July http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-Zambian-economic-recovery-gathers-pace-in-July.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}