Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 03, 2017

PMI surveys show Japan's economy slowing at start of Q3

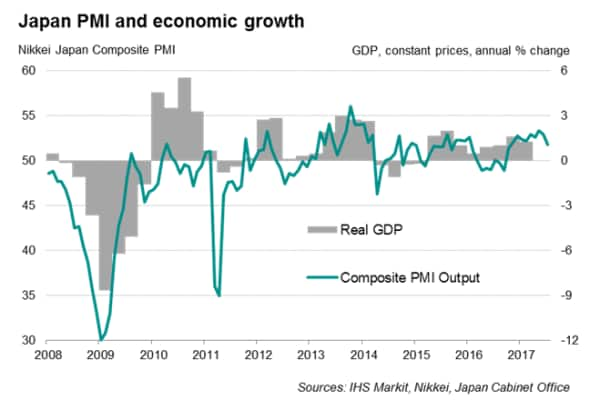

Japan's economy saw further signs of losing momentum at the start of the third quarter, with PMI surveys recording the weakest rate of expansion since last October. That in turn saw employment growth slip to a three-month low.

The Nikkei Composite PMI, compiled by IHS Markit, fell from 52.9 in June to a nine-month low of 51.8 in July. While still representing an expansion in output, the latest reading indicates that the economy lost momentum at the start of the second half of the year, with the PMI having signalled robust growth rates in each of the previous three quarters.

Weaker export growth

July saw a notable slowdown in manufacturing output growth, with the latest expansion the weakest since September last year. Services also grew at a slower pace, registering the smallest increase in business activity since February.

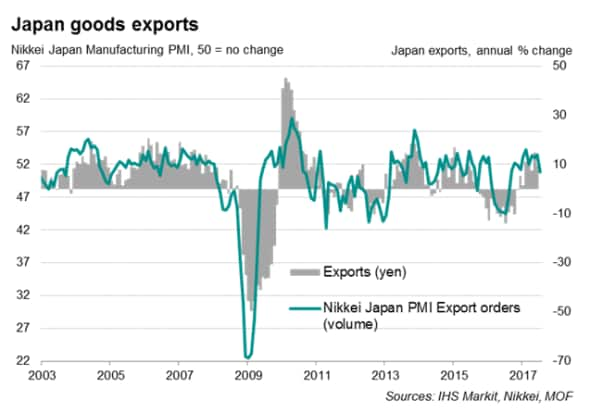

Slowing export trade weighed on manufacturing production. Export order growth cooled considerably in July, with the rate of increase well below that seen in the first half of the year. Anecdotal evidence from surveyed companies cited lower demand from China and Taiwan " which account for nearly a quarter of Japan's export value.

With foreign demand having played a key role in the country's recent economic upturn, the concern is that a further slowdown in trade will have an impact on manufacturing activity, which will in turn affect GDP growth.

The slowdown was not confined to manufacturing: the service sector also showed signs of weaker growth after reaching a near two-year high in June. The slower upturn in service sector activity hinted at a moderation in domestic demand and reflected the second-smallest increase in new business inflows in the sector since last November.

Monetary policy

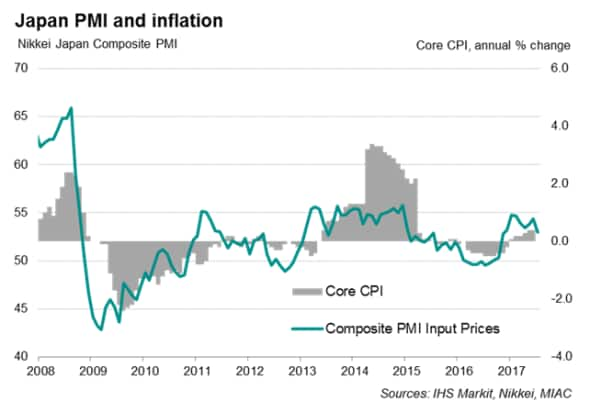

If the domestic market shows further signs of weaker demand in the coming months, the recent upgrades to the Bank of Japan's GDP forecasts could be at risk. That will add to arguments for the BOJ to maintain the current accommodative policy settings, especially when the 2% inflation target remains out of reach.

PMI surveys indicated an easing in inflationary pressures at the start of the third quarter, with both input costs and output charges increasing at the weakest rates seen so far this year.

Strong optimism

However, the policy case is not clear-cut. Although rates of expansion in output, new business and employment all eased during July, Japanese companies " especially manufacturers " remained confident of an increase in output in the year ahead. In fact, July data showed that expectations about future output were among the strongest for four years. Notably, optimism in the manufacturing sector hit a survey high (the future expectations series began in July 2012), suggesting that the recent slowdown could be brief.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-PMI-surveys-show-Japan-s-economy-slowing-at-start-of-Q3.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-PMI-surveys-show-Japan-s-economy-slowing-at-start-of-Q3.html&text=PMI+surveys+show+Japan%27s+economy+slowing+at+start+of+Q3","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-PMI-surveys-show-Japan-s-economy-slowing-at-start-of-Q3.html","enabled":true},{"name":"email","url":"?subject=PMI surveys show Japan's economy slowing at start of Q3&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-PMI-surveys-show-Japan-s-economy-slowing-at-start-of-Q3.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+show+Japan%27s+economy+slowing+at+start+of+Q3 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-PMI-surveys-show-Japan-s-economy-slowing-at-start-of-Q3.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}