Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2016

Eurozone economy slows at start of the year and price fall intensifies

A disappointing eurozone PMI survey for January indicated one of the weakest expansions seen over the past year and raises the prospect of further stimulus.

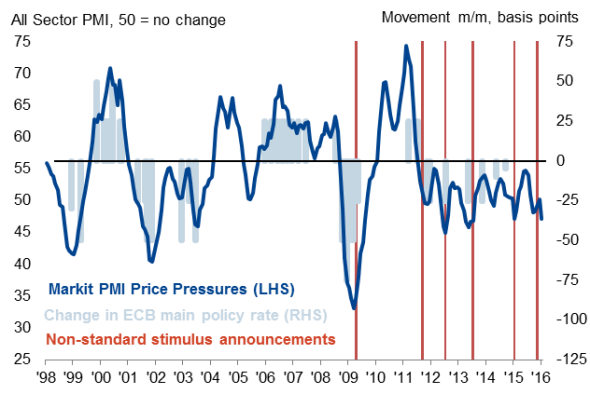

Business activity, order book and employment growth all lost momentum, but perhaps most worrying of all from a policymaker's perspective is the intensification of deflationary pressures. Average prices charged for goods and services dropped at the fastest rate since last March.

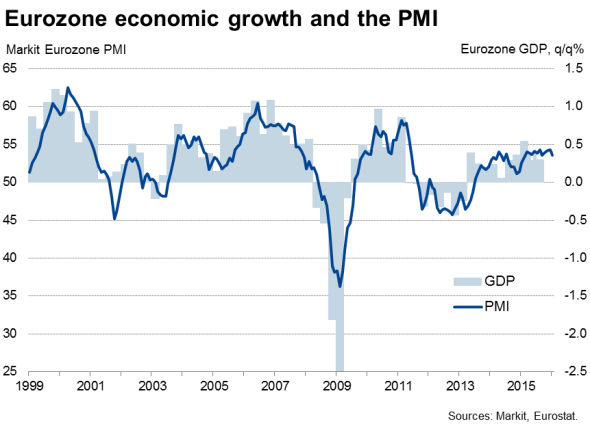

The Markit Eurozone PMI fell from 54.3 in December to 53.6 in January, its joint-lowest since February of last year. Historical comparisons of the PMI with GDP (which show the PMI to have an 83% correlation with the official quarterly growth rate) indicate that the survey data signal a quarterly GDP growth rate for the region of just 0.4% at the start of the year.

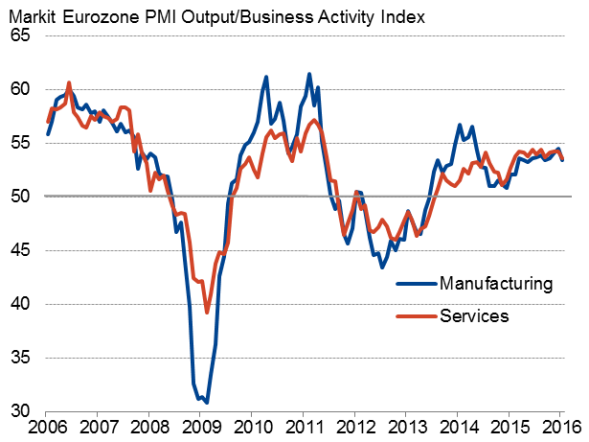

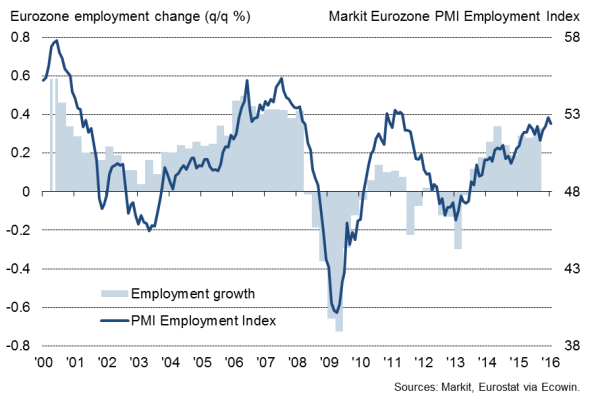

Growth slowed in both manufacturing and services, though in both cases remained robust if not impressive. Employment also continued to grow at a solid pace, weakening compared with December but broadly consistent with a 0.4% quarterly rate of employment growth.

Output by sector

Employment

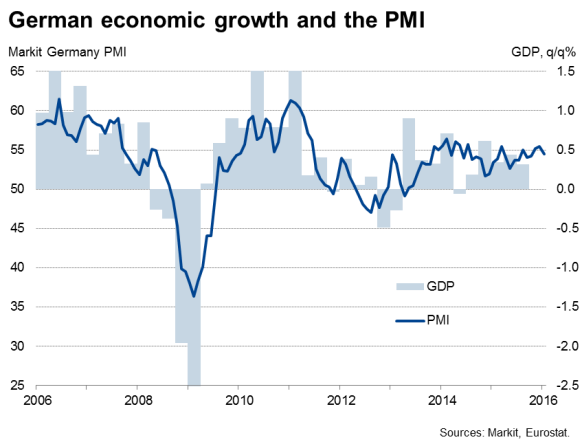

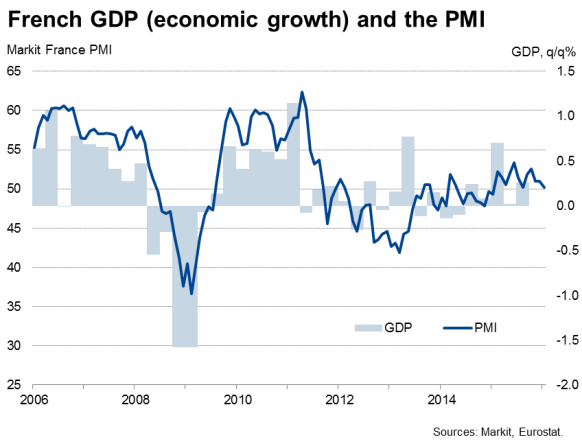

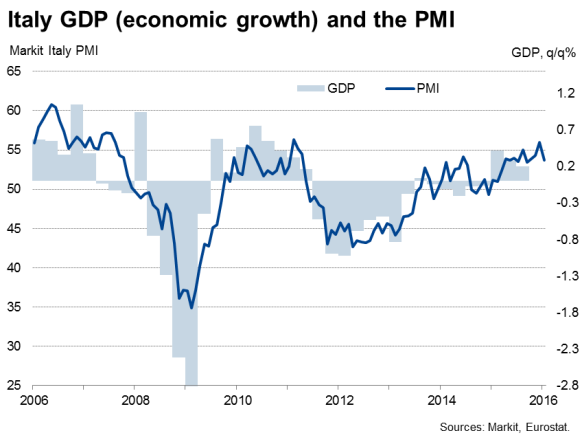

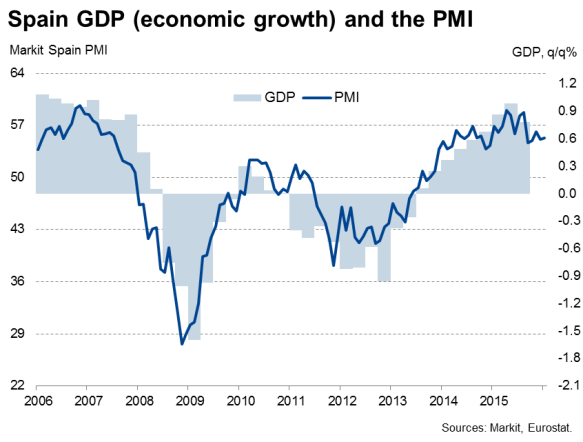

National divergences

Business conditions continued to diverge markedly by country, however, led by Spain, where the PMI signals a buoyant 0.75% economic growth rate, followed by Germany, for which a near 0.5% expansion is indicated. However, Italy's growth rate looks to have slipped to just 0.3% and France, once again the laggard, has returned to stagnation.

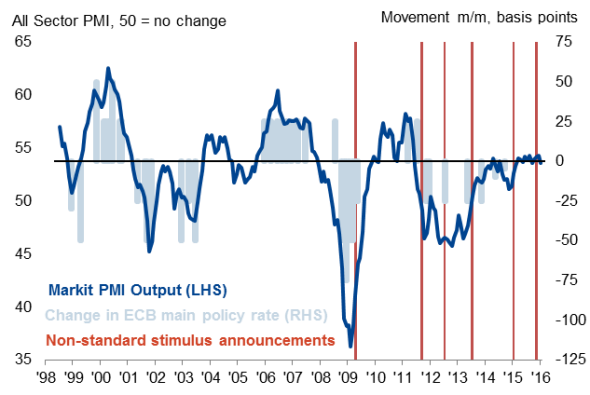

Policy stimulus

The PMI data follow news that the ECB will "review and possibly reconsider" its stimulus package as soon as March. The ECB disappointed markets with a smaller than anticipated stimulus in December, cutting its deposit rate by 10 basis points to a new low of -0.3% and extending its quantitative easing programme of "60bn per month by six months through to March 2017. Markets clearly thought more was warranted, and since then the ECB looks to have coalesced.

The concerns facing policymakers are that, across the region as a whole, growth and inflation have clearly failed to pick up over the past year despite past stimulus efforts from the ECB. This of course raises the question of not just whether existing stimulus has simply been insufficient, but also whether monetary policy is proving ineffective. This is especially true for France, where the ECB are likely to once again point at structural reforms as being necessary accompaniments to monetary policy. However, the lack of growth also looks set to bring the discussion of fiscal policy further into the limelight.

ECB policy and PMI business activity

ECB policy and PMI price pressures

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Eurozone-economy-slows-at-start-of-the-year-and-price-fall-intensifies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Eurozone-economy-slows-at-start-of-the-year-and-price-fall-intensifies.html&text=Eurozone+economy+slows+at+start+of+the+year+and+price+fall+intensifies","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Eurozone-economy-slows-at-start-of-the-year-and-price-fall-intensifies.html","enabled":true},{"name":"email","url":"?subject=Eurozone economy slows at start of the year and price fall intensifies&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Eurozone-economy-slows-at-start-of-the-year-and-price-fall-intensifies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+economy+slows+at+start+of+the+year+and+price+fall+intensifies http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Eurozone-economy-slows-at-start-of-the-year-and-price-fall-intensifies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}