Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2016

Brazil's downturn shows signs of moderating at start of year

Brazil remained in a state of severe economic contraction at the start of the year, though the downturn showed signs of moderating.

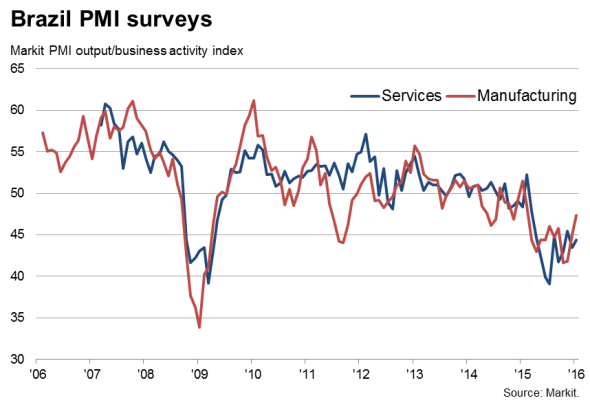

Markit's composite PMI survey - covering both manufacturing and services - remained deep in contraction territory in January, the extent of the decline being highlighted by Brazil's manufacturing sector recording the lowest PMI reading of all countries covered by Markit's surveys in January.

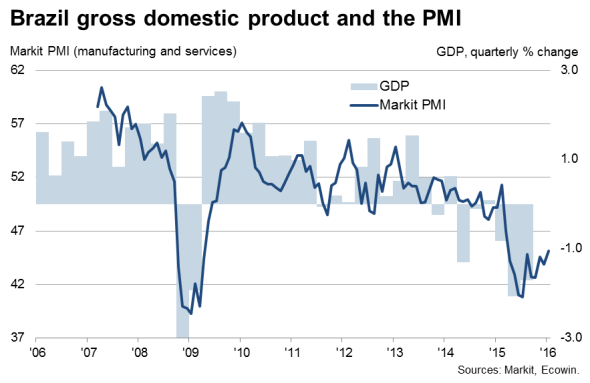

The composite index rose from 43.9 in December to 45.1 in January, however, well above the low of 40.8 plumbed in July, to signal the weakest monthly drop in business activity since March of last year.

Although the survey signals an ongoing substantial downturn in the economy, the rate of decline has therefore eased. The latest reading is commensurate with gross domestic product declining at a quarterly rate of approximately 1.0% at the start of the year, steep but less than the 2.1% and 1.7% rates of decline seen in the second and third quarters of last year respectively (fourth quarter GDP numbers have not yet been published).

New orders continued to deteriorate at a marked rate, and employment likewise fell sharply, the latter down for an eleventh successive month, though in both cases rates of decline eased, adding to hopes that the recession has bottomed out.

The IMF, which downgraded its outlook for Brazil as economic data rapidly deteriorated last year, is currently projecting a 3.5% drop in GDP in 2016 after an estimated 3.8% decline in 2015, with a stabilisation of the economy predicted in 2017. However, the upturn in the PMI in January bodes well for an earlier lift out of recession than the IMF is estimating.

Exchange rate boost

Downturns in fact eased in both manufacturing and services, with the latter seeing the steeper rate of decline. The manufacturing decline moderated mainly due to an increase in new export orders, indicating that domestic demand remained the key source of economic malaise, and that rising exports - buoyed by the steep drop in the exchange rate - are providing a much-needed boost to the economy.

The flip side of the weaker exchange rate is of course more expensive imports, with the January survey showing yet another strong monthly rise in firms' average costs, which will keep upward pressure on consumer price inflation and continue to complicate the policy response from the central bank.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Brazil-s-downturn-shows-signs-of-moderating-at-start-of-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Brazil-s-downturn-shows-signs-of-moderating-at-start-of-year.html&text=Brazil%27s+downturn+shows+signs+of+moderating+at+start+of+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Brazil-s-downturn-shows-signs-of-moderating-at-start-of-year.html","enabled":true},{"name":"email","url":"?subject=Brazil's downturn shows signs of moderating at start of year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Brazil-s-downturn-shows-signs-of-moderating-at-start-of-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil%27s+downturn+shows+signs+of+moderating+at+start+of+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022016-Economics-Brazil-s-downturn-shows-signs-of-moderating-at-start-of-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}