Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 02, 2015

Week Ahead Economic Overview

Worldwide services PMI releases, plus industrial production data for a number of European countries are data highlights of the week. Interest rate decisions at the Bank of England and the Bank of Japan are the policy highlights.

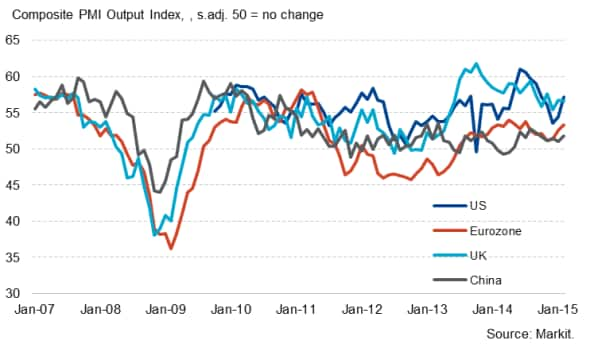

Composite PMI

The Bank of England will announce its latest monetary policy decision on Thursday, after the bank held interest rates at 0.5% at its March meeting, marking the six-year anniversary of record-low interest rates. There are many reasons to believe that any increase in rates looks a long way off, despite the UK enjoying solid economic growth. Wage growth is still muted by historical standards, the housing market is showing signs of cooling and uncertainty about the General Election is likely to deter policymakers from adding further uncertainty about monetary policy.

Meanwhile, the latest Markit/CIPS UK Services PMI" is released on Tuesday and will give further insight into the UK's economic performance at the end of the first quarter. Manufacturing showed signs of strengthening, with the PMI rising to an eight-month high, but growth in construction activity slowed to a three-month low. Furthermore, the Office for National Statistics updates industrial production numbers for February. The PMI is currently pointing to the goods-producing sector growing by around 0.6% in the first three months of 2015.

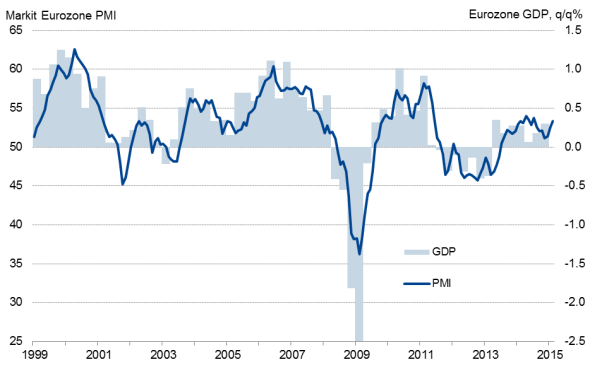

With quantitative easing under way in the eurozone, policymakers will be interested to see if any positive effects are reflected in the latest survey data. Services PMI results for March are updated in the currency union on Tuesday, after manufacturing expanded at the strongest rate for ten months.

Eurozone GDP and the PMI

Sources: Markit, Ecowin.

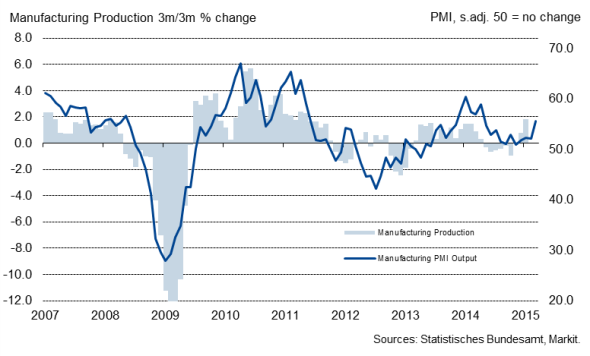

Elsewhere in the euro area, Germany sees the release of factory orders and industrial production numbers. Industrial output increased 1.6% in the three months to January and PMI data point to further growth, with the goods-producing sector likely to have a positive contribution to first quarter GDP.

German industrial production and the PMI

Services PMI data are also updated in the US and are eagerly awaited by policymakers, after the FOMC dropped the word "patient" from its policy statement at its March meeting, leaving the door open to hike rates any time from June onwards. The release of Flash PMI data pointed to the US economy gaining momentum, with economic growth likely to accelerate in the spring. If confirmed by the final data, this will add to the likelihood of interest rates starting to rise in September.

Over in Asia, the Bank of Japan announces its latest monetary policy decision and inflation numbers are updated in China. Although consumer price inflation picked up from 0.8% to 1.4% in February, producer prices fell at an annual rate of 4.8%, the steepest decline since late-2009. The weakness of the producer price and PMI numbers therefore suggest consumer price inflation could ease again in coming months.

Monday 6 April

A number of PMI results, including the US Services PMI are released by Markit.

In Japan, the Leading Economic Index is released, while inflation numbers are out in Russia.

The US Conference Board Employment Trends Index is updated.

Tuesday 7 April

Services PMI results are released across Europe.

In Australia, retail sales figures and the AIG Services Index are issued and the Reserve Bank holds an interest rate meeting.

The Indian central bank and the Bank of Japan announce their latest interest rate decisions.

Trade data are meanwhile updated in Russia.

The Sentix Investor Confidence Index is published for the eurozone, while producer price figures are also out in the currency union.

Auto sales numbers are issued in Brazil.

Wednesday 8 April

The Eurozone Retail PMI and Germany Construction PMI are released by Markit.

Current account numbers are meanwhile updated in Japan.

France sees the release of trade balance data, while industrial orders numbers are out in Germany.

Eurostat issues retail sales figures for the currency bloc.

Inflation numbers are out in Brazil.

Consumer credit information is released by the Board of Governors of the Federal Reserve in the US.

Thursday 9 April

Markit releases its global sector PMI data.

Australia sees the release of the AIG Construction Index.

The Bank of England announces its latest interest rate decision, while trade data are also released in the UK.

Inflation numbers, industrial output data and unemployment figures are published in Greece.

In Germany, trade balance data and industrial production numbers are out.

South Africa sees the release of business confidence data and manufacturing production figures.

House price numbers are meanwhile issued in Canada.

Initial jobless claims figures are out in the US.

Friday 10 April

The KPMG/REC UK & English Regions Report on Jobs is out.

Inflation figures are issued in China.

Trade data are updated in India.

Industrial production numbers are out in Spain, France and the UK, with the latter also seeing the release of construction output figures.

In Canada, housing starts numbers and unemployment data are issued.

Import and export prices are meanwhile updated in the US.

Oliver Kolodseike, Economist at Markit

Posted 2 April 2015

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}