Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 26, 2015

US Flash PMI data point to economy gaining momentum in second quarter

The US economy is showing signs of regaining momentum after the slowdown seen at the turn of the year, increasing the likelihood of interest rates starting to rise in September.

The flash PMI" surveys registered faster growth of both service sector activity and factory output at the end of the first quarter, as well as ongoing strong hiring. The data bode well for an acceleration of economic growth in the spring. The Markit Flash US Composite PMI hit a six-month high of 58.5 in March, up from 57.2 in February and continuing the ascent from the recent low of 53.5 back in December.

An upturn in new orders also points to stronger growth in April, with new business rising at the fastest rate for six months when measured across both manufacturing and services. Employment growth also hit a four-month high as firms prepared for higher workloads.

The survey data indicate that resilient domestic demand is offsetting weaker export performance. Although the recent appreciation of the dollar has the benefit of helping keep inflation down, by reducing the cost of imports, the flipside is a loss of export competitiveness. The flash manufacturing PMI survey indicated a drop in export orders in March as firms struggled with the higher exchange rate.

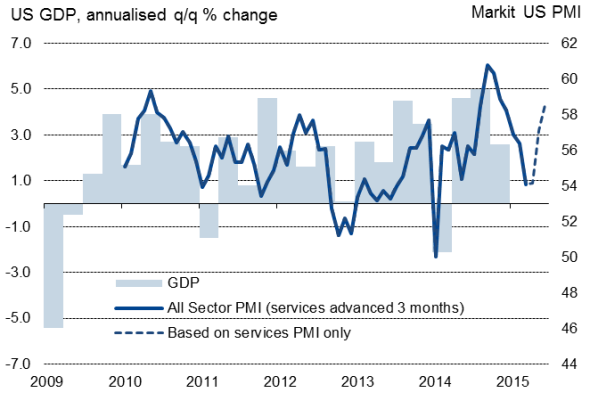

US PMI surveys and economic growth

Stronger growth returns

Together with a growing body of other data, including retail sales, industrial production and factory orders, the PMI surveys indicate that economic growth will have slowed in the first quarter from the already-modest 2.2% pace seen in the final quarter of last year. However, given the forward-looking properties of the surveys, the upturn in the March composite PMI bodes well for the return of stronger economic growth in the second quarter.

The best fit of the monthly PMI data with quarterly GDP numbers is achieved by taking a weighted average of the two manufacturing and service sector PMI output indexes, but for the latter to be advanced, reflecting what appears to be an inherent lag in the official data (which is something we have observed in other countries when comparing PMI data with GDP).

The resulting PMI-based indicator, shown in the chart, points to a marked slowdown in economic growth up to March, after which the pace of expansion picks up again.

September rate rise

With the Fed 'data dependent' in relation to the timing of the first rate hike, having opened the door to raise interest rates at any time, GDP numbers will be of particular importance.

Given the recent data flow, it's clear that the first quarter advance GDP estimate, due on 29 April, is likely to disappoint and dissuade policymakers from hiking rates in June (there is no May meeting). The FOMC will most likely choose instead to await evidence of a stronger economy.

With the PMI suggesting that the second quarter GDP release, due on July 30, will provide encouraging news of faster economic growth, the FOMC therefore looks likely to hike interest rates at the following meeting, in mid-September. That is, of course, assuming the data continue to signal robust economic growth in the coming months, and most importantly the labour market data continue to impress.

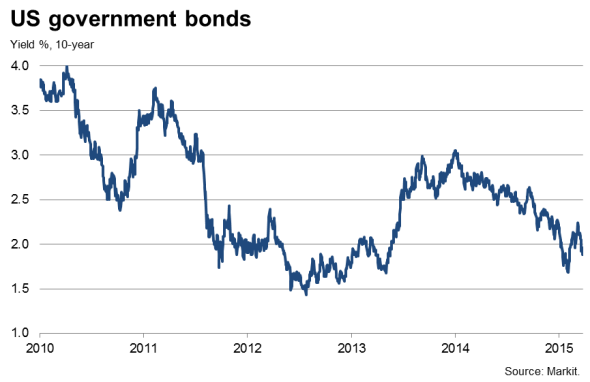

Market volatility

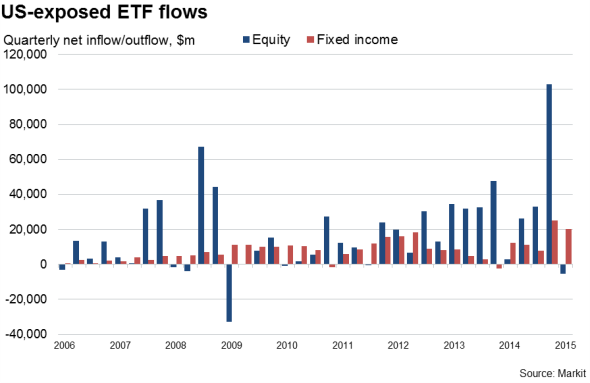

Any upturn in the economic data and associated prospect of higher interest rates will inevitably feed through to ongoing financial market volatility. US-exposed fixed-income funds have seen net inflows of some $20bn so far this year, building on a record net $25bn inflow in the fourth quarter of last year, as investors chase yield: The ten-year Treasury yield has dropped below 1.9% after having been as high as 2.24% in early March, but this still represents a better return relative to yields offered in other markets, notably the eurozone and Japan.

Equity funds, in contrast, have seen a net outflow so far this year, suffering the largest quarterly net outpouring since early-2009, as investors worry about the impact of higher interest rates and the stronger currency.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Economics-US-Flash-PMI-data-point-to-economy-gaining-momentum-in-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Economics-US-Flash-PMI-data-point-to-economy-gaining-momentum-in-second-quarter.html&text=US+Flash+PMI+data+point+to+economy+gaining+momentum+in+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Economics-US-Flash-PMI-data-point-to-economy-gaining-momentum-in-second-quarter.html","enabled":true},{"name":"email","url":"?subject=US Flash PMI data point to economy gaining momentum in second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Economics-US-Flash-PMI-data-point-to-economy-gaining-momentum-in-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Flash+PMI+data+point+to+economy+gaining+momentum+in+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26032015-Economics-US-Flash-PMI-data-point-to-economy-gaining-momentum-in-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}