Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 01, 2015

UK consumers help manufacturing regain strong momentum in March

UK manufacturers enjoyed a strong end to the first quarter, according to PMI survey data, buoyed in particular by rising demand for consumer goods. The upturn adds to evidence which suggests the economy is picking up momentum again after slowing at the turn of the year, but the survey also further highlights the economy's growing dependence on consumer spending while investment spending weakens.

Strengthening upturn

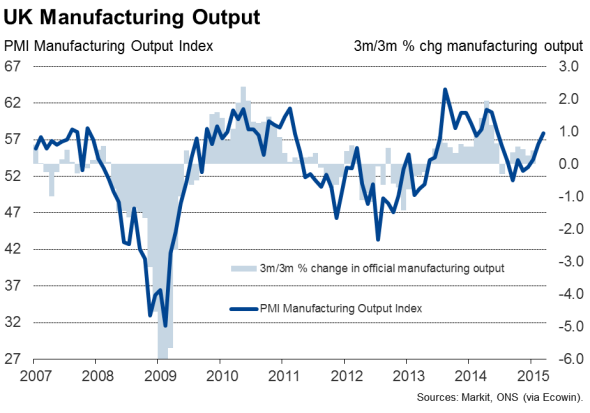

The headline Markit/CIPS manufacturing PMI rose from 54.0 in February to an eight-month high of 54.4 in March. The improvement in the PMI suggests the sector will have made a stronger contribution to economic growth than seen late last year.

The weakening of the PMI towards the end of 2014 was followed by official data showing manufacturing output rising just 0.2% in the final three months of the year, compared to growth of 0.6% in the economy as a whole. The PMI is pointing to the goods-producing sector growing by around 0.6% in the first three months of 2015, with the pace of expansion rising to 1.0% in March after the somewhat disappointing start to the year.

Consumers drive recovery

The upturn was largely driven by rising domestic demand, though export orders also picked up, growing at the fastest rate since last August. Although the strong pound continued to hit competitiveness, rising demand in key markets such as the eurozone appears to have helped boost overseas sales.

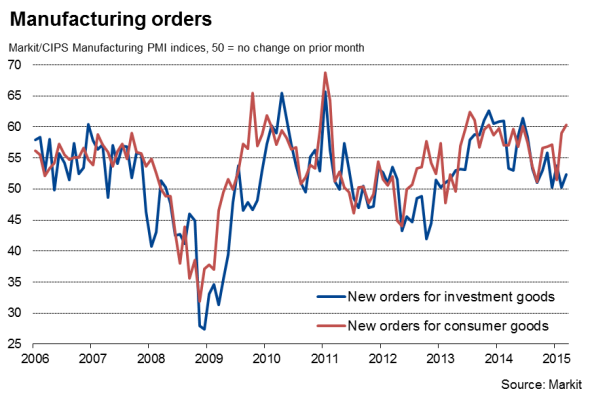

By far the strongest source of growth was an upturn in new orders for consumer goods, which showed the largest monthly increase since November 2013. The improved order book situation among consumer goods producers led to higher output and employment in the sector.

By comparison, only modest growth was again seen for new orders for investment goods, such as a plant and machinery, growth of which has slumped from buoyant rates seen last summer.

The divergent trends in demand reported for consumer goods and investment goods highlight the economy's increased dependence on rising household spending to support growth. Consumer spending has in turn been fuelled by falling prices, which represents a potential threat to the economy if prices were to start rising again.

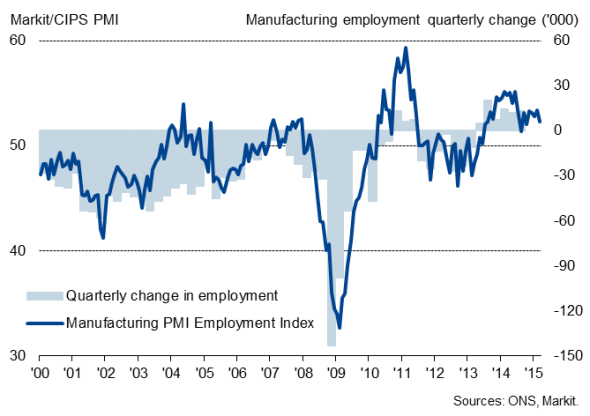

Manufacturing Employment

Business investment slowdown

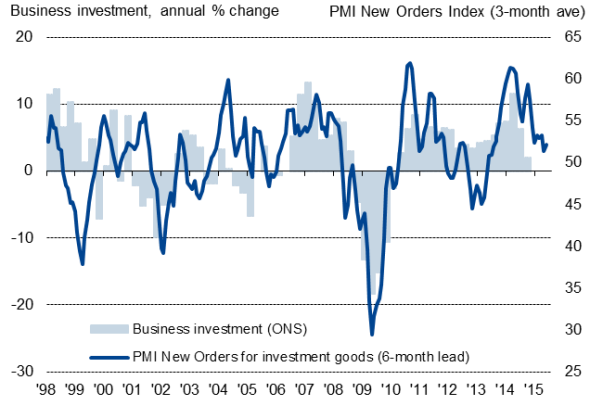

The ongoing weakness of demand for investment goods is also a concern, as the deterioration in the PMI survey for these types of goods late last year was mirrored by GDP data showing a steep downturn in the rate of growth of business investment spending. The PMI therefore suggests that this trend has continued in more recent months, highlighting growing uncertainty about the outlook among firms.

Such growing uncertainty was reflected in the survey showing hiring having slowed a five month low in March.

Investment

Sources: Markit, ONS

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-Economics-UK-consumers-help-manufacturing-regain-strong-momentum-in-March.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-Economics-UK-consumers-help-manufacturing-regain-strong-momentum-in-March.html&text=UK+consumers+help+manufacturing+regain+strong+momentum+in+March","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-Economics-UK-consumers-help-manufacturing-regain-strong-momentum-in-March.html","enabled":true},{"name":"email","url":"?subject=UK consumers help manufacturing regain strong momentum in March&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-Economics-UK-consumers-help-manufacturing-regain-strong-momentum-in-March.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+consumers+help+manufacturing+regain+strong+momentum+in+March http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-Economics-UK-consumers-help-manufacturing-regain-strong-momentum-in-March.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}