Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 02, 2015

Consumers help UK manufacturing revival gain momentum

An upsurge in demand for consumer goods boosted the UK manufacturing economy in February, pushing growth of factory activity to the highest since last July. With factory prices meanwhile dropping at the fastest rate since 2009, further falls in consumer prices are also signalled.

However, the survey raises further concerns over business investment and exports, with signs of renewed weakness in both raising questions over the health of the recovery.

Faster factory output

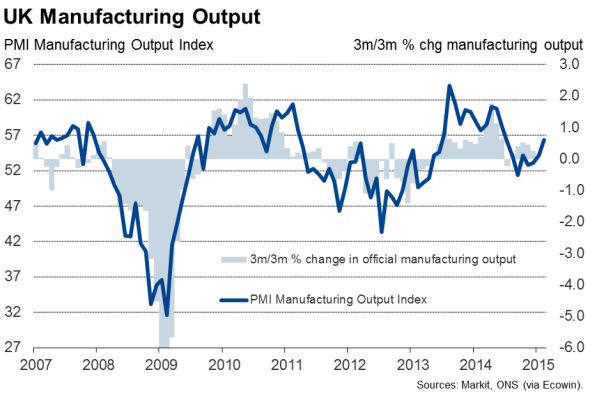

The headline manufacturing PMI rose from 53.1 in January to a seven-month high of 54.1. Factories reported the largest monthly jump in new orders since November, which in turn drove the strongest increase in production since last June.

The latest reading is consistent with factory output rising up to 0.6% in the first quarter so far, therefore providing a considerably stronger contribution to the economy than the 0.3% expansion seen in the fourth quarter of last year.

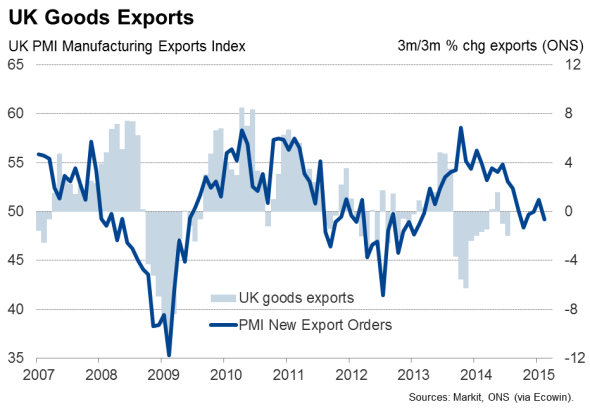

The upturn was fuelled by rising domestic demand. Export orders fell, on the other hand, down for the fourth time in the past five months, as companies reported ongoing soft demand in many countries as well as a loss of competitiveness due to sterling's appreciation, notably against the euro. The pound has appreciated almost 6% against the euro so far this year (and by 12% over the past year), taking it to the highest since late-2007. Against a trade-weighted basket of currencies, the pound is up a more modest 2% so far this year, but is still up to its highest since late-2008.

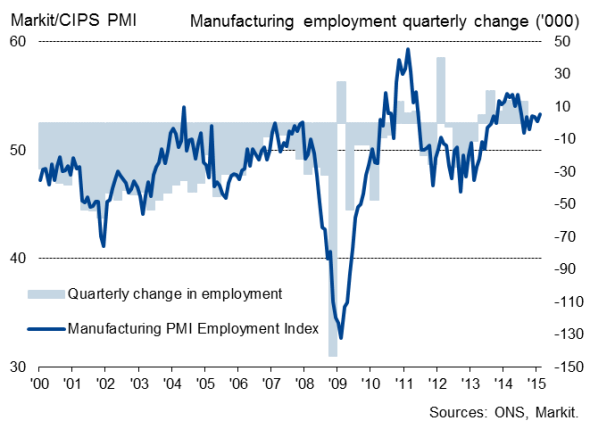

Manufacturing Employment

Consumer upturn contrasts with weak investment

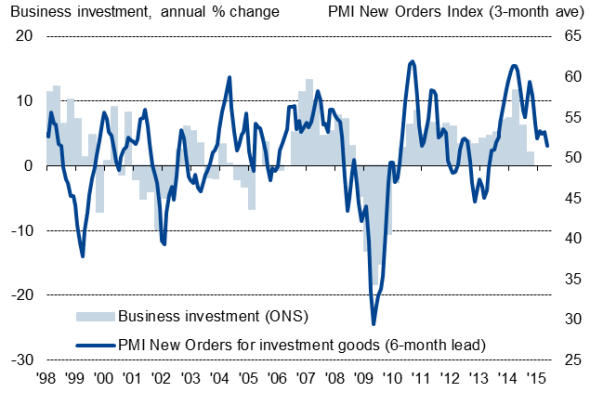

A deeper delve into the survey responses indicates that consumers are leading the upturn. Business investment, however, is showing signs of renewed weakness.

Producers of consumer goods reported the largest rise in production and new orders since last June, with a strong rise in domestic demand accompanied by a more modest upturn in export orders. The survey therefore suggests that low inflation and falling fuel prices are helping to boost consumer spending.

Producers of investment goods such as plant and machinery, on the other hand, reported that output rose at the slowest rate since September amid a near-stalling of order book growth. Export orders for capital goods were especially disappointing, showing the second-largest monthly decline since November 2012.

The stalling in demand for plant and machinery points to a growing reluctance for companies to invest, linked in part to rising risk aversion in the light of worries over Greece and Russia, as well as domestic politics, such as uncertainty over the outcome of the General Election and the UK's role in the EU.

Investment

Sources: Markit, ONS

The data follow official numbers for late last year, which showed consumer spending rising 0.5% in the fourth quarter but business investment down 1.4%, its largest fall since the second quarter of 2009. The PMI data therefore suggest that this lop-sided upturn with a bias towards consumer-driven growth, has persisted into the first quarter of 2015.

Manufacturers were, however, eager to boost capacity by taking on more staff, with employment growth picking up slightly as a result.

Manufacturing Employment

Prices fall at fastest rate since 2009

Falling factory gate prices meanwhile point to further downward pressure on consumer prices in coming months. Prices charged for goods fell for a second successive month, dropping at the steepest rate since the height of the global financial crisis in September 2009. Input costs also fell sharply, showing the second-steepest fall since May 2009, the rate of decline just shy of January's post-crisis peak.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-economics-consumers-help-uk-manufacturing-revival-gain-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-economics-consumers-help-uk-manufacturing-revival-gain-momentum.html&text=Consumers+help+UK+manufacturing+revival+gain+momentum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-economics-consumers-help-uk-manufacturing-revival-gain-momentum.html","enabled":true},{"name":"email","url":"?subject=Consumers help UK manufacturing revival gain momentum&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-economics-consumers-help-uk-manufacturing-revival-gain-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Consumers+help+UK+manufacturing+revival+gain+momentum http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-economics-consumers-help-uk-manufacturing-revival-gain-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}