Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 27, 2015

Sharper than previously thought GDP slowdown unlikely to worry US policymakers

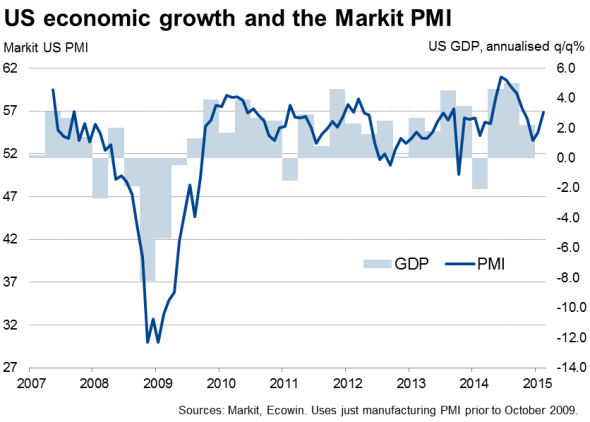

The US economy slowed to a greater extent than initially thought at the end of last year. Updated statistics from the Commerce Department reveal that gross domestic product expanded at an annualised rate of 2.2% in the final three months of the year, down sharply from 5.0% in the three months to September. Economists were expecting a slowdown to 2.1%.

The slowdown is unlikely to worry Fed policymakers, however, who are likely to 'keep calm and carry on' with contemplating an initial rate hike in the summer, possibly as early as June.

Not much to worry the Fed

One reason for the lack of concern is that the slowdown was due in part to a far smaller than previously estimated inventory build-up, in turn thought to be partly reflective of port strikes. The weaker stock build-up late last year bodes well for first quarter growth.

There was also better news on investment, with business spending on equipment rising at a 0.9% annualised rate instead of falling 1.9%, as initially thought.

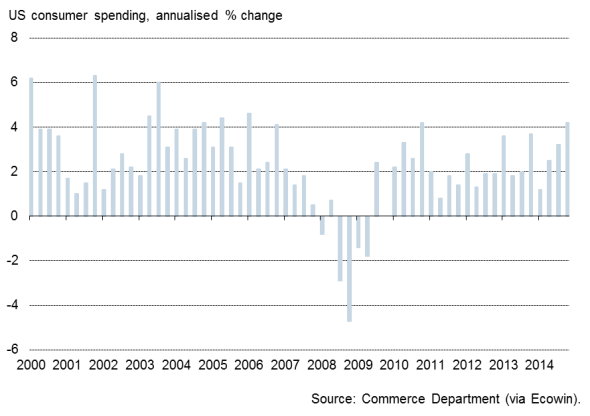

Consumer spending growth meanwhile remained solid, revised down only marginally to an annualised rate of 4.2%, its fastest since the start of 2006.

Consumer spending

Business and consumer spending are therefore both still rising at decent rates and, importantly from a policy perspective, employers have continued to hire staff in impressive numbers, pointing to a general expectation of ongoing strong growth in 2015.

Growth reviving

There are already signs that the economy has picked up speed again so far this year. Markit's 'flash' PMI surveys, which accurately anticipated the slowdown late last year, signalled a marked improvement in the service sector in February alongside an upturn in manufacturing. The two PMI surveys are so far signalling at least 3.0% annualised GDP growth in the first quarter.

One area of concern reflected in the PMI survey responses is the impact of the stronger US dollar, up 10% on a trade-weighted basis since last September, which is hitting export performance. The widening trade deficit took 1.15% off GDP growth in the fourth quarter of last year.

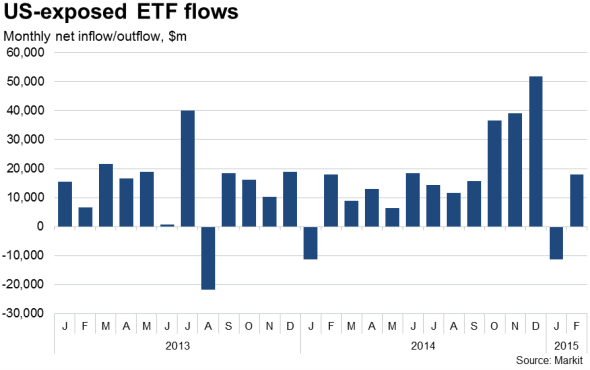

Investor appetite wanes

Worries about the stronger dollar and the prospect of the Fed tightening policy, especially at a time when policy is being loosened in Europe and Japan, are clearly affecting investor sentiment. After seeing record inflows in the closing months of last year, US-exposed ETFs have seen a mixed year so far in 2015. While steady, strong inflows into fixed-income funds have been recorded, January saw a strong outflow from equity funds which was only partially reversed in February.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Economics-Sharper-than-previously-thought-GDP-slowdown-unlikely-to-worry-US-policymakers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Economics-Sharper-than-previously-thought-GDP-slowdown-unlikely-to-worry-US-policymakers.html&text=Sharper+than+previously+thought+GDP+slowdown+unlikely+to+worry+US+policymakers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Economics-Sharper-than-previously-thought-GDP-slowdown-unlikely-to-worry-US-policymakers.html","enabled":true},{"name":"email","url":"?subject=Sharper than previously thought GDP slowdown unlikely to worry US policymakers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Economics-Sharper-than-previously-thought-GDP-slowdown-unlikely-to-worry-US-policymakers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sharper+than+previously+thought+GDP+slowdown+unlikely+to+worry+US+policymakers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27022015-Economics-Sharper-than-previously-thought-GDP-slowdown-unlikely-to-worry-US-policymakers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}