Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 02, 2015

Eurozone manufacturing suffers ongoing malaise but looks poised for upturn

While flash euro area PMI data showed a welcome upsurge in service sector economic activity, things are looking less rosy in the goods producing sector. At 51.0, the final eurozone manufacturing PMI showed the sector barely expanding in February, highlighting the malaise that still hangs over the region's goods-producing economy as a whole.

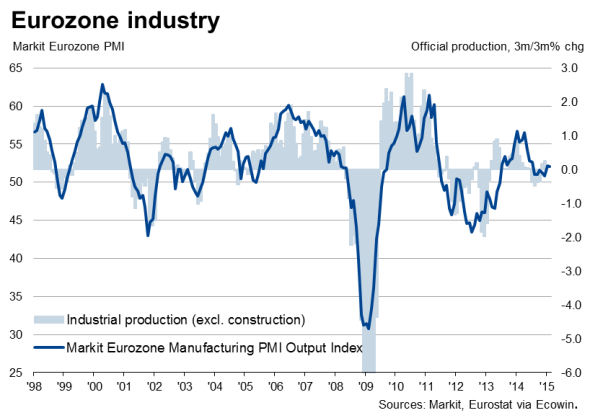

The survey's output index has a strong (84%) correlation with actual industrial production, but is of course available well ahead of the official numbers (see chart). The latest readings suggest that industrial production will have made only a very modest contribution to the economy's performance in the first quarter.

Triple boost

The coming months will hopefully see all countries' manufacturing sectors pick up speed, based on three factors.

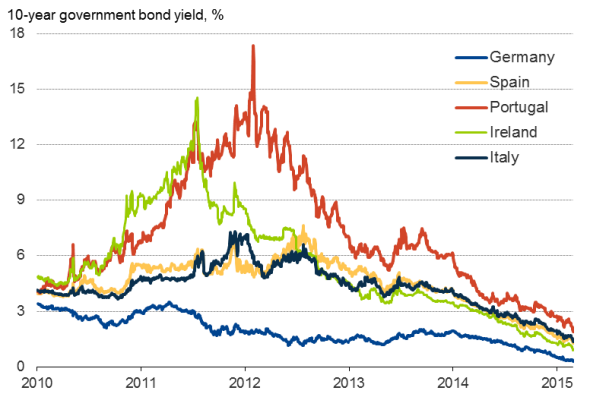

First, business and consumer confidence are set to be buoyed by ECB stimulus. The central bank commences its €60 billion per month asset purchase programme in March. Bond yields have already fallen sharply as markets have cheered the long-awaited quantitative easing programme. Ten-year German bonds now yield just 0.3%, and French 10-year notes are down to 0.6%. Ireland's 10-year borrowing costs have meanwhile dropped below 0.9%, Spain's have slipped to 1.3% and Portugal's to 1.8%, according to Markit data.

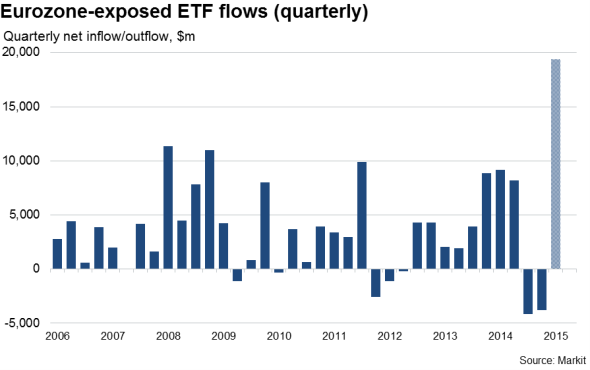

Bond yields should fall further and equity prices rise as the programme gets underway, boosting risk appetite in the region. Investors have already piled into eurozone-exposed equity and fixed-income to the greatest extent seen on record in the first quarter so far, according to Markit fund flow data. ETF inflows have reached $19.3 billion so far this year, already almost double the prior record for any calendar quarter, of which $15.4 billion has flowed into equity funds.

Shaded bar shows data for first two months of quarter only.

Second, the recent fall in the euro should also provide a noticeable stimulant to export sales, as well as leading to greater import substitution by making imported goods more expensive.

Third, worries over "Grexit' have eased, effectively removing a worrying source of uncertainty to the economic outlook and helping boost business and household confidence further. Having been signalling a near-80% chance of Greek default back in January, credit default swaps are now signalling a 65% probability.

Parts moving at different speeds

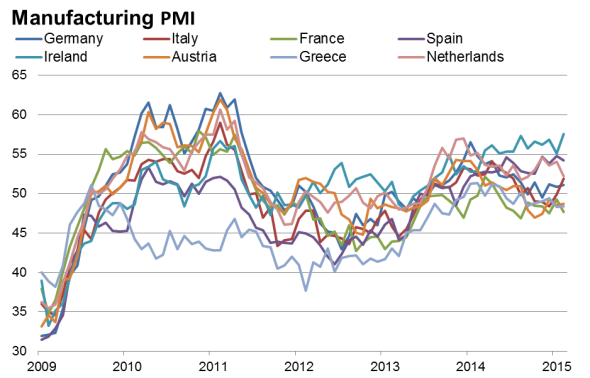

However, in the meantime, different parts of the manufacturing economy are clearly moving at very different speeds, ranging from a Celtic boom to a Gallic slump.

Source: Markit

Way out in the fast lane is Ireland, where the strongest growth in 15 years is generating near-record job creation and suggests the economy continues to boom. Spain is also enjoying impressive export-led manufacturing gains, boding well for another quarter of robust economic growth in the first quarter.

Germany, the Netherlands and Italy are meanwhile only managing to eke out mediocre rates of expansion, though in the case of Italy it is encouraging to see that growth is at least picking up, fuelled by rising exports. The sluggishness of manufacturing in Germany (and its exporters) remains a particular concern.

France, Greece and Austria are the slow lane stragglers, with all three seeing their manufacturing economies contract again February. France is the most worrying, not just because it trails behind all other countries, but it is also the only country seeing a steepening downturn.

Government borrowing costs

Source: Markit

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Eurozone-manufacturing-suffers-ongoing-malaise-but-looks-poised-for-upturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Eurozone-manufacturing-suffers-ongoing-malaise-but-looks-poised-for-upturn.html&text=Eurozone+manufacturing+suffers+ongoing+malaise+but+looks+poised+for+upturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Eurozone-manufacturing-suffers-ongoing-malaise-but-looks-poised-for-upturn.html","enabled":true},{"name":"email","url":"?subject=Eurozone manufacturing suffers ongoing malaise but looks poised for upturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Eurozone-manufacturing-suffers-ongoing-malaise-but-looks-poised-for-upturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+manufacturing+suffers+ongoing+malaise+but+looks+poised+for+upturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Eurozone-manufacturing-suffers-ongoing-malaise-but-looks-poised-for-upturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}