Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2025

Week Ahead Economic Preview: Week of 8 December 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Global markets brace for US FOMC rates decision

The highlight of the coming week will be the US Federal Reserve's monetary policy meeting, where a rate cut is widely anticipated. Key statistical releases include US job openings and employment cost data, monthly GDP numbers and the November recruitment industry survey results for the UK, plus inflation numbers from mainland China and industrial production for Germany. There are also interest rate decisions from Canada, Brazil, Switzerland, Australia, Turkey and the Philippines.

Despite the November meeting seeing divisions among US policymakers on the FOMC, and Fed Chair Powell stating that "a further reduction in the policy rate is not a foregone conclusion — far from it", markets are firmly pricing in a 25-basis point December rate cut.

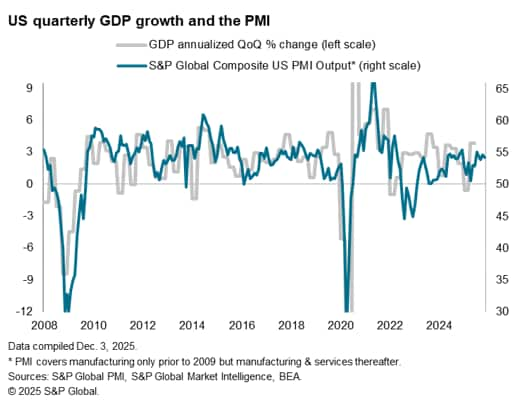

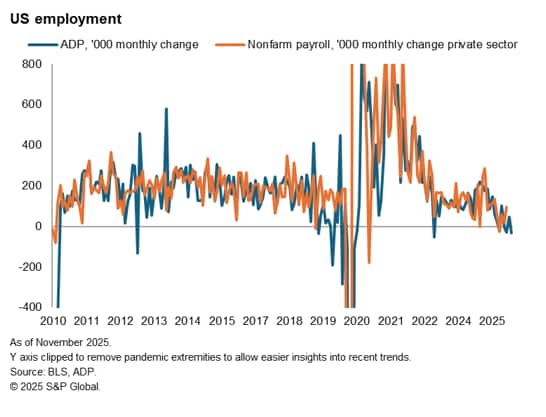

A rate cut would come despite US consumer price inflation having accelerated to 3.0% in September and despite concerns that the pass-through of tariffs could also exert further inflationary pressures, as indicated by business survey price gauges. Furthermore, business activity indicators, such as the ISM surveys and PMI from S&P Global, hint at robust fourth quarter GDP growth. However, the case for lower rates lies largely with the labour market, especially after the ADP payroll report signalled falling private sector jobs.

While the current case for lower rates in December is by no means clear-cut, there is even greater uncertainty about the outlook for rates next year. Hence the markets will be particularly eager to assess the Fed's revised forecasts and digest clues about appetite for any further loosening of policy in 2026. Our analysts expect two more 25 bps cuts in 2026 after the December cut, though with the first not occurring until June, as the FOMC awaits confirmation of an improving inflation picture.

Our pick of the data releases is UK GDP for October. September's data showed the economy shrinking by 0.1% in September, though this in part reflected the shutdown of the JLR car plant after a cyber attack. October should therefore see a car sector rebound, as signalled by the PMI, though the survey data suggest underlying economic growth remains close to stalled.

Institutional investment sentiment toward the US equity market will meanwhile be tracked through the December edition of the Investment Manager Index (IMI). November saw risk appetite at the highest so far this year.

PMI surveys signalled a further robust expansion of the US economy in November. ISM data also indicated the sharpest upturn in output across goods and services since March. The survey data therefore point to underlying US GDP strength in Q4. However, employment indicators have been weakening.

Key diary events

Monday 8 Dec

Americas

- US Consumer Inflation Expectations (Nov)

EMEA

- Germany Industrial Production (Oct)

- Switzerland Consumer Confidence (Nov)

- UK KPMG/REC Report on Jobs* (Nov)

APAC

Philippines Market Holiday

- Japan GDP (Q3, final)

- China (Mainland) Balance of Trade (Nov)

Tuesday 9 Dec

S&P Global Investment Manager Index* (Dec)

Americas

- Mexico Inflation (Nov)

- US ADP Weekly Employment Change

- US JOLTs Job Openings (Oct)

EMEA

UAE Market Holiday

- Germany Balance of Trade (Oct)

- UK Regional Growth Tracker* (Nov)

APAC

- Australia NAB Business Confidence (Nov)

- Australia Building Permits (Oct, final)

- Philippines Industrial Production (Oct)

- Australia RBA Interest Rate Decision

- Taiwan Trade Balance (Nov)

Wednesday 10 Dec

GEP Global Supply Chain Volatility Index* (Nov)

Americas

- Brazil Inflation Rate (Nov)

- Canada BoC Interest Rate Decision

- US Wholesale Inventories (Oct)

- US Employment Cost Index (Q3)

- US FOMC Interest Rate Decision

- Brazil BCB Interest Rate Decision

EMEA

- Norway Inflation (Nov)

- Sweden GDP (Oct)

- Türkiye Industrial Production (Oct)

- Italy Industrial Production (Oct)

APAC

Thailand Market Holiday

- South Korea Unemployment Rate (Nov)

- Japan PPI (Nov)

- China (Mainland) CPI, PPI (Nov)

Thursday 11 Dec

Americas

- Brazil Retail Sales (Oct)

- Canada Balance of Trade (Sep)

- US PPI (Nov)

- Brazil Business Confidence (Dec)

EMEA

- Sweden Inflation (Nov, final)

- Switzerland SNB Interest Rate Decision

- Türkiye TCMB Interest Rate Decision

APAC

- Philippines BSP Interest Rate Decision

Friday 12 Dec

Americas

Mexico Market Holiday

- Mexico Industrial Production (Oct)

- Canada Building Permits (Oct)

EMEA

- Germany Inflation (Nov, final)

- UK Goods Trade Balance (Oct)

- United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Oct)

- France Inflation (Nov, final)

- Spain Inflation (Nov, final)

APAC

- Malaysia Industrial Production (Oct)

- Japan Industrial Production (Oct, final)

- India Inflation (Nov)

- China (Mainland) M2, New Yuan Loans, Loan Growth (Nov)

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-december-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-december-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+8+December+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-december-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 8 December 2025 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-december-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+8+December+2025+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-8-december-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}