Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2025

Global trade stabilises in November

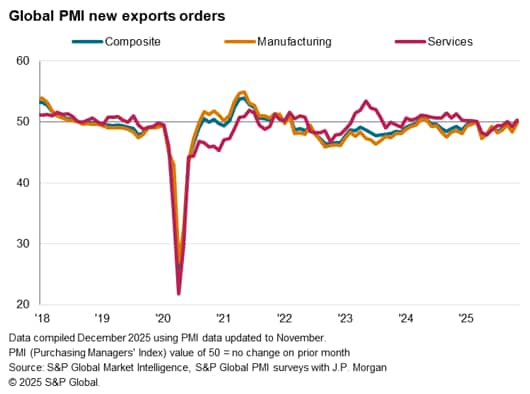

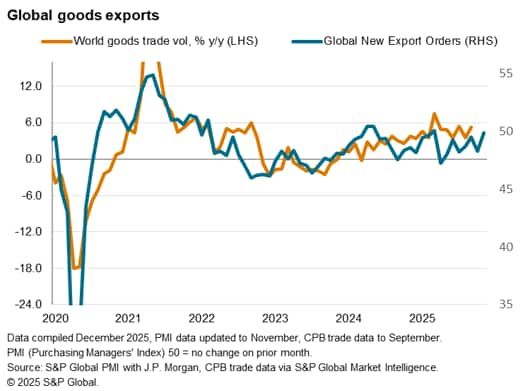

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade stabilised in the penultimate month of the year. The seasonally adjusted Global PMI New Export Orders Index, sponsored by J.P.Morgan and compiled by S&P Global, posted at the 50.0 neutral mark in November, up from 48.5 in October. This indicated a steadying of global trade following seven straight months of contraction.

Manufacturing trade near stabilisation while growth in exchange of services renews

Sector data from November revealed that the manufacturing sector recorded a near-stabilisation of trade activity midway through the fourth quarter. Posting just below the 50.0 no-change mark, the seasonally adjusted manufacturing New Export Orders Index signalled only a fractional reduction in overseas demand for goods and to the least pronounced extent in eight months.

The easing of the global manufacturing exports downturn was largely attributed to an improvement in external demand for manufactured goods from mainland China. Following the announcement of a trade truce between the US and mainland China at the end of October, trade activity has recovered for mainland China as tensions dissipated, while manufacturers also reported that successful business development efforts in November, including at trade fairs, helped to drive external sales.

Excluding mainland China, global goods exports shrank at a slightly sharper pace compared to October. This was set against a backdrop of slowing manufacturing demand and production growth in November. Overall new orders rose globally at only a marginal rate that was the softest in the current four-month sequence of expansion. This reflected a further fading of demand strength following rounds of front-loading of goods orders ahead of US tariffs earlier in the year. Global purchasing and hiring activities also declined among goods producers, coinciding with a renewed depletion of both pre- and post-production inventories.

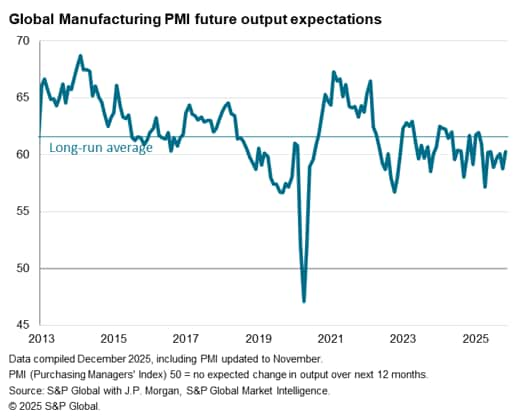

Despite softening demand growth and trade activity outside of mainland China, business sentiment notably improved globally among manufacturers midway through the final quarter of 2025. Optimism about output in the next 12 months rose to the highest level since June. Unlike the recovery in exports, the latest uplift in confidence was relatively broad-based as optimism levels rose not only in mainland China but also touched a five-month high in the rest of the World, thereby hinting at the likelihood for better global manufacturing sector conditions in the coming year.

Services exports meanwhile returned to expansion after shrinking in October. Although marginal, the rate of growth was the quickest in nearly a year and marked only the second expansion in services trade since the announcement of widespread tariffs in April. Similar to the trend for manufacturing, an improvement in services trade in mainland China was a key driver for the latest renewal in services exports growth, though improvements were also noted for the US and Australia, among others.

Detailed sector PMI showed a mix of services and manufacturing sectors in the lead for export growth. The best performers in November were Banks, Tourism & Recreation, and Household & Personal Use Products. On the other hand, Healthcare Services, Metals & Mining and Resources led the downturn in new export business globally.

Growth in new export business renews for emerging markets

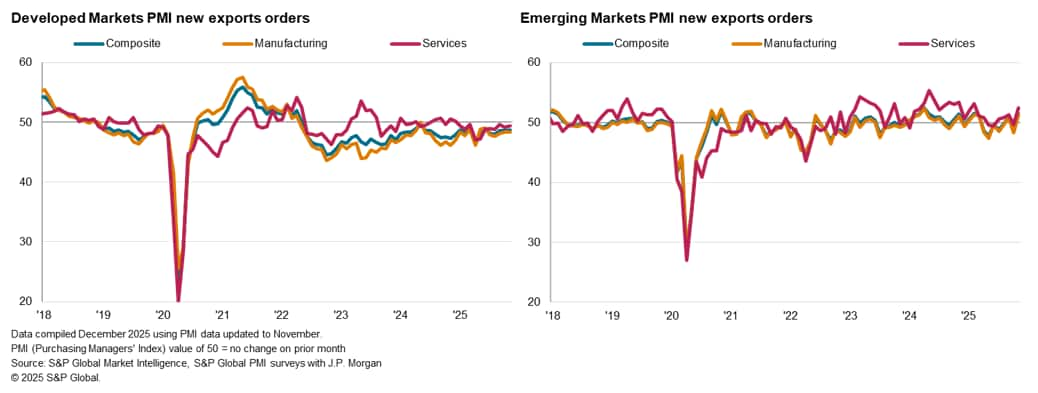

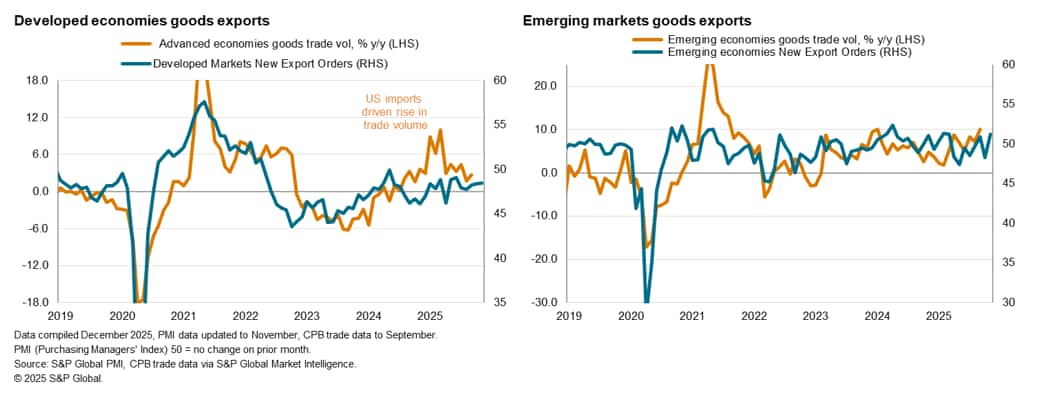

Regionally, a fresh rise in new export business for emerging markets contrasted with a sustained contraction for developed economies.

Emerging market (EM) companies recorded the second increase in new export business in three months and at the sharpest pace in nine months. While mainland China's contribution to the renewed rise in EM exports was undeniable, though even excluding mainland China new export business expanded for the third month in a row and at a rate unchanged from October. Both EM manufacturers and service providers seeing fresh increases in new business from abroad and at the quickest pace since February.

On the other hand, developed markets continued to report lower new export business in November, extending the sequence of contraction that began in June 2022. The rate of reduction was little changed from October with manufacturers continuing to see a steeper decline in new export orders compared with services companies.

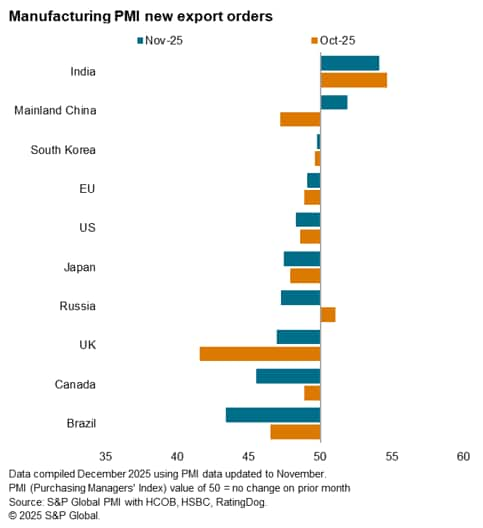

India and mainland China lead the expansion in goods trade

The number of top ten trading economies recording higher goods exports remained at just two in November, unchanged from October. That said, mainland China replaced Russia in being the only economy beside India recording growth in goods new export orders in the penultimate month of the year. While modest, the rate at which new export orders rose in the Chinese manufacturing sector was the quickest in eight months. According to manufacturers, successful business development efforts helped to support the renewed rise in new orders from abroad in November.

Meanwhile, improvements in international demand continue to underpin the latest solid uptick in new export sales for Indian manufacturers. However, there was a mild loss of overall growth momentum to the weakest in just over a year against a backdrop of slower manufacturing sector growth for India.

On the other hand, Brazil and Canada recorded the steepest downturns in goods trade midway through the fourth quarter. In Brazil, the pace at which external orders fell was the sharpest since June, with tariffs impact being especially widely reported upon orders from the US. Likewise for Canadian manufacturers, tariffs reportedly dampened new export orders from the US resulting in a tenth successive monthly reduction in overall export orders.

Solid declines in new export orders were also seen for the UK, Russia and Japan, while more modest contractions were noted for the US and the EU. Finally, South Korean goods exports near-stabilised in November.

Access the global PMI press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-stabilises-in-november-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-stabilises-in-november-Dec25.html&text=Global+trade+stabilises+in+November+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-stabilises-in-november-Dec25.html","enabled":true},{"name":"email","url":"?subject=Global trade stabilises in November | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-stabilises-in-november-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+stabilises+in+November+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-stabilises-in-november-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}