Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 01, 2022

US producers report strong end to first quarter despite Ukraine war impact

US manufacturing growth accelerated in March as robust demand and improving prospects countered the headwinds of soaring cost pressures and the Russia-Ukraine war.

The S&P Global US Manufacturing Purchasing Managers' Index™ (PMI™) posted 58.8 in March, up from 57.3 in February to signals the strongest improvement in the health of the US manufacturing sector since last September.

The details of the survey were even more encouraging than the rising headline number, with output and demand growth on improving trends as supply delays eased, jobs growth accelerated and businesses becoming even more optimistic despite the month seeing the escalation of the Russia-Ukraine war. Price pressures also showed tentative signs of having peaked late last year.

Output and order book growth accelerates

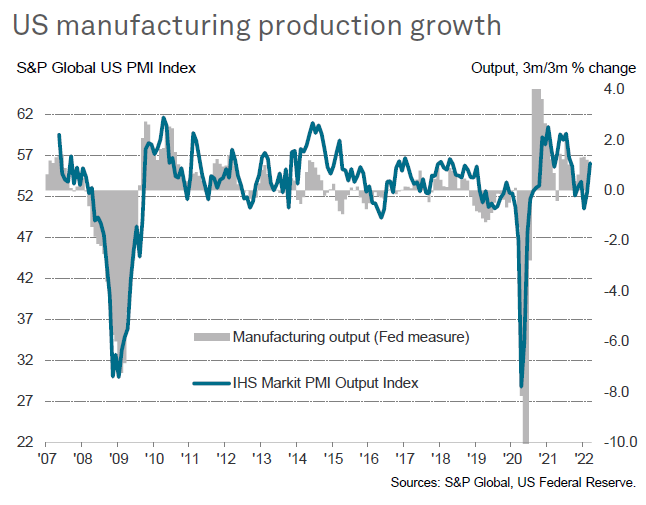

A key driver of the higher PMI was faster growth of production, which rose at a rate not seen since last July. The strengthening production index from the PMI is broadly indicative of robust official manufacturing output growth in excess of 1% on a three-month-on-three-month basis.

Inflows of new business also grew at the strongest rate for six months as customers looked to the further reopening of the economy amid signs that the disruptions from the pandemic continue to fade. Both domestic and export order book growth improved, with new export orders notably rising at the joint-fastest pace for almost a year.

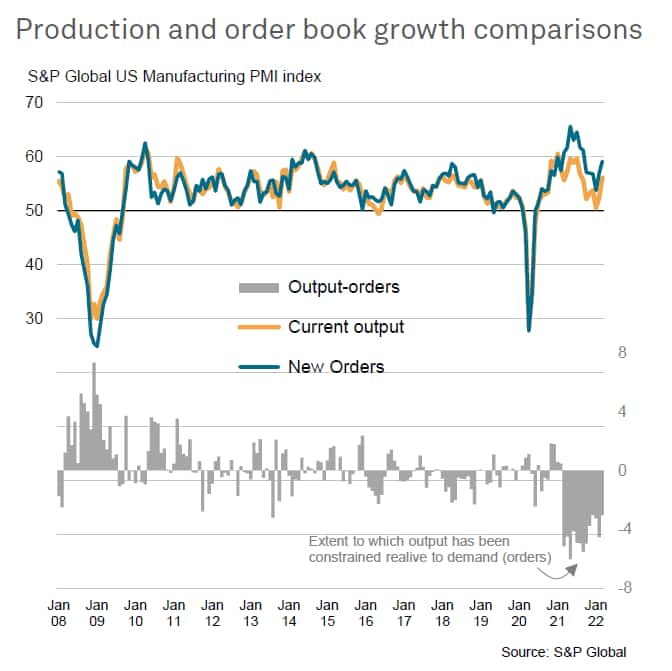

The rise in demand meant new order inflows once again ran ahead of production to suggest that output growth could have been even stronger had it not been for ongoing constraints on production, though notably the output shortfall relative to demand was the joint-smallest seen over the past year.

Supply bottlenecks show further signs of easing

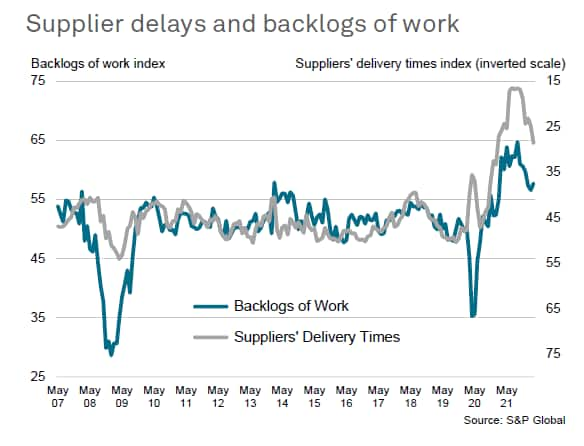

While higher output was encouraged by the upturn in order book growth, it was also facilitated by fewer supply constraints. Separately, even as companies continued to report widespread production constraints due to supply chain bottlenecks, the incidence of such delays is now lower than at any time since January 2021.

Likewise, backlogs of work at manufacturers also grew at a reduced rate comparable to that seen throughout much of 2021, linked to these easing supply constraints as well as jobs growth having improved to an eight-month high as fewer companies reported labor shortages.

Elevated price pressures, but inflation rates are off last year's highs

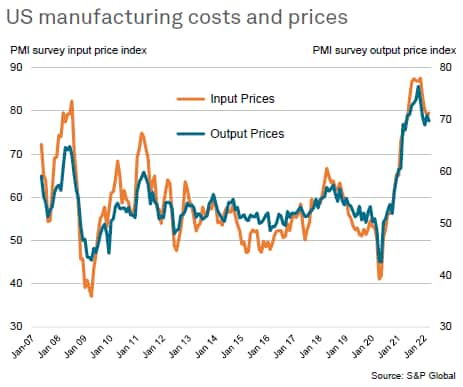

Similarly, although price pressures remained elevated, with surging energy costs pushing firms' costs higher at an increased rate in March, rates of inflation of both input costs and average selling prices have fallen from the record highs seen late last year to hint that US consumer price inflation could likewise soon peak.

Brightening prospects despite Ukraine war

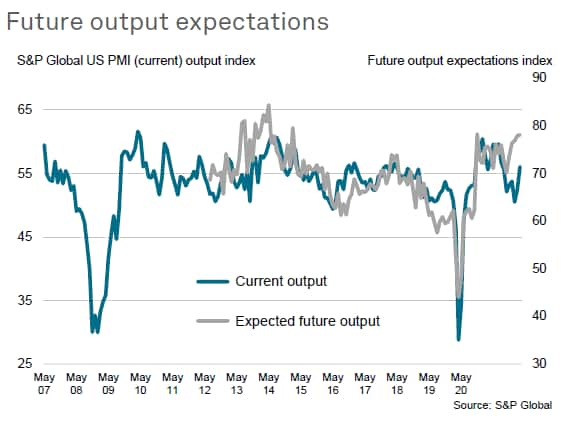

It was especially encouraging to see business optimism about the year ahead improve further in March, despite the new uncertainties, sanctions and geopolitical risks caused by the Ukraine invasion, with optimism among producers now the brightest since late-2020.

Sign up to receive updated commentary in your inbox here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-producers-report-strong-end-to-first-quarter-despite-ukraine-war-impact-apr22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-producers-report-strong-end-to-first-quarter-despite-ukraine-war-impact-apr22.html&text=US+producers+report+strong+end+to+first+quarter+despite+Ukraine+war+impact+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-producers-report-strong-end-to-first-quarter-despite-ukraine-war-impact-apr22.html","enabled":true},{"name":"email","url":"?subject=US producers report strong end to first quarter despite Ukraine war impact | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-producers-report-strong-end-to-first-quarter-despite-ukraine-war-impact-apr22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+producers+report+strong+end+to+first+quarter+despite+Ukraine+war+impact+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-producers-report-strong-end-to-first-quarter-despite-ukraine-war-impact-apr22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}