Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 01, 2022

US manufacturing reports steepening output loss, but supply chain delays and price pressures ease

The seasonally adjusted S&P Global US Manufacturing Purchasing Managers' Index™ (PMI™) posted 51.5 in August, down from 52.2 in July to the lowest since July 2020.

We look beyond the survey's headline index to provide more color on the health of US manufacturing, with is undergoing a period of falling demand, inflation and ongoing supply constraints, which are driving output lower and leading to a greater reluctance to invest in machinery and labor.

More positively, supply chain delays moderated in August, and price pressures fell to the lowest for one and a half years.

Output down for second straight month

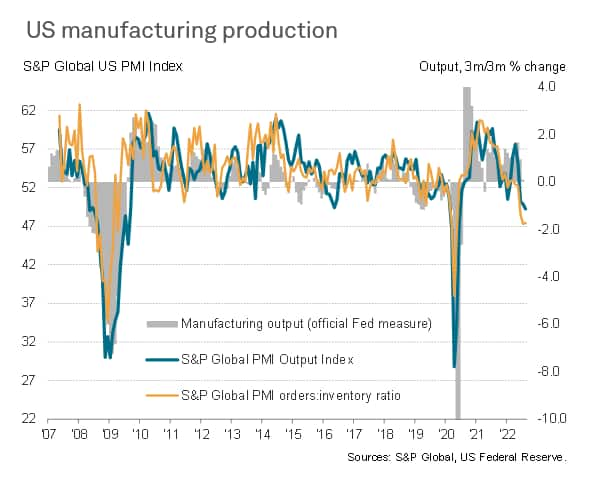

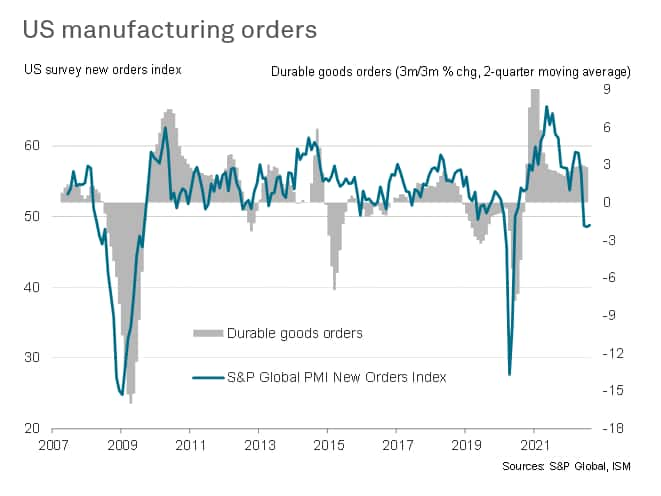

The PMI survey's Output Index showed US factory production having dropped for a second month running in August, with the New Orders Index meanwhile indicating that demand for goods has now fallen for three straight months.

Barring the initial pandemic lockdown months, this is the steepest downturn in US manufacturing signalled by the PMI since the global financial crisis in 2009. Forward-looking indicators such as the orders-inventory ratio suggest that the downturn has further to run.

Companies blamed a variety of factors for the deterioration in demand, including the ongoing impact of soaring inflation, supply constraints, rising interest rates and growing uncertainty about the economic outlook.

Reluctance to invest and expand

Worryingly, the sharpest drop in demand was recorded for business equipment and machinery, which points to falling investment spending and heightened risk aversion. At 44.7, the New Orders Index for producers of investment goods such as plant and machinery was the lowest since comparable data were first available in late-2009, excluding the first pandemic lockdown months of early-2020.

Similarly, payroll growth slowed close to stalling, reflecting a growing reticence to expand workforce numbers in the face of the deteriorating demand environment. August's Employment Index was the second-lowest for just over two years and, at 51.1, well below the average of 53.0 seen so far during the recovery.

Supply delays moderate

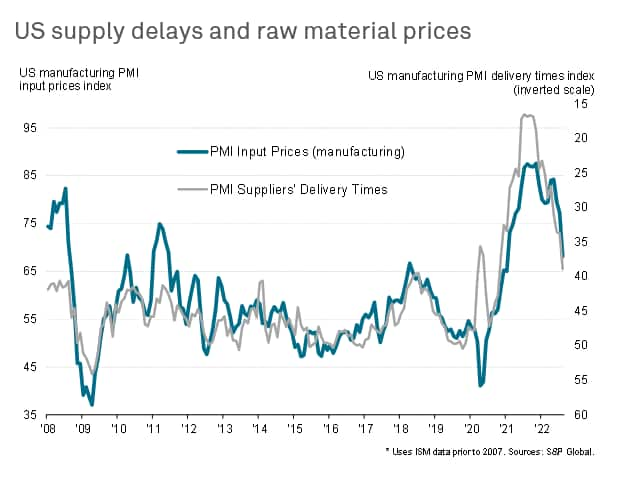

Falling demand for raw materials has, however, taken pressure off supply chains and helped shift some of the pricing power away from sellers towards buyers.

Although vendor performance deteriorated again in August as transportation and logistics issues remained evident, the lengthening of average supplier lead times was the smallest since October 2020.

With supply constraints having acted as a major cause of higher prices during the pandemic, this easing of supply delays has led to a commensurate cooling of price pressures. Average input costs paid by producers rose in August at the slowest rate since January 2021, reflecting this partial shift in pricing power away from sellers towards buyers.

Inflationary pressures ease

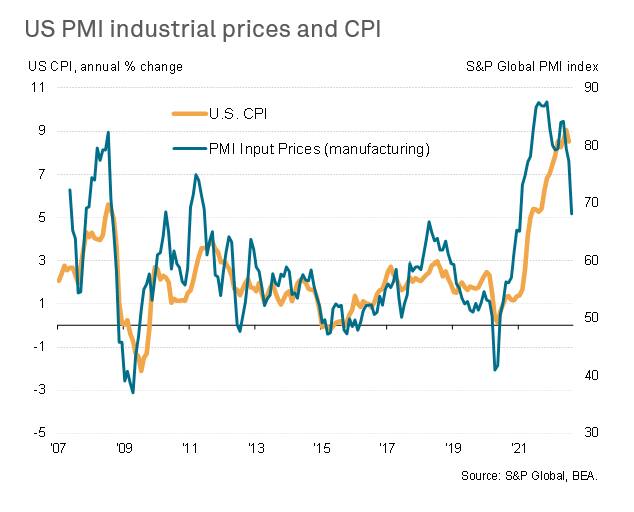

Although still elevated by historical standards, the survey's inflation gauges measuring both input costs and selling prices are now at their lowest for one and a half years, which should help to bring consumer price inflation down in the coming months.

The manufacturing PMI's Input Cost Index, for example, exhibits an 86% correlation with the annual change of consumer prices in the US, with the PMI acting with a lead of two months.

Clearly, the inflation outlook will also depend on service sector inflation rates and the volatile energy market in particular, but the feeding through of lower supply-related cost pressures in manufacturing undoubtedly bodes well for the inflation outlook in coming months.

S&P Global US Manufacturing PMI press release

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-reports-steepening-output-loss-but-supply-chain-delays-and-price-pressures-ease-Sept22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-reports-steepening-output-loss-but-supply-chain-delays-and-price-pressures-ease-Sept22.html&text=US+manufacturing+reports+steepening+output+loss%2c+but+supply+chain+delays+and+price+pressures+ease+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-reports-steepening-output-loss-but-supply-chain-delays-and-price-pressures-ease-Sept22.html","enabled":true},{"name":"email","url":"?subject=US manufacturing reports steepening output loss, but supply chain delays and price pressures ease | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-reports-steepening-output-loss-but-supply-chain-delays-and-price-pressures-ease-Sept22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+reports+steepening+output+loss%2c+but+supply+chain+delays+and+price+pressures+ease+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-reports-steepening-output-loss-but-supply-chain-delays-and-price-pressures-ease-Sept22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}