Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 16, 2018

US manufacturing growth trend slips in July, in line with PMI survey

- Manufacturing output rises 0.3% in July

- But the three-month growth rate has cooled since April, in line with IHS Markit's PMI

- Some evidence slowdown could be temporary

Manufacturing continued to expand in July, but the underlying trend has shown signs of weakening compared to earlier in the year.

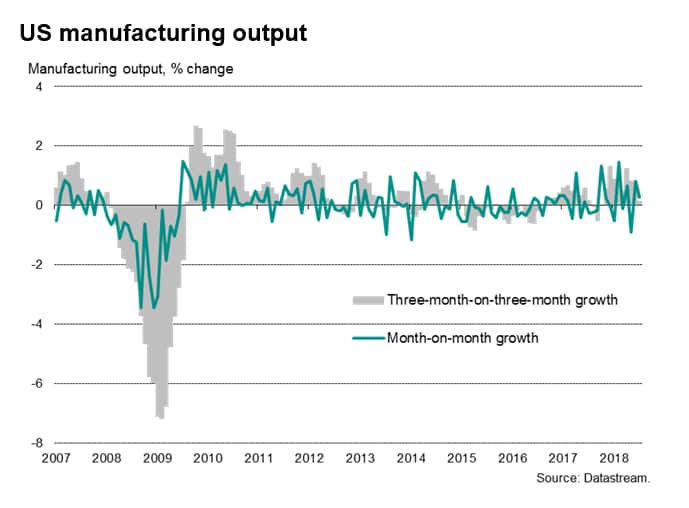

Official data showed manufacturing output up 0.3% in July, just above the 0.2% average seen over the past year-and-a-half since the start of 2017. However, some caution is warranted, as the monthly data are volatile and a comparison of growth in the latest three months hints at a slowdown in the rate of expansion.

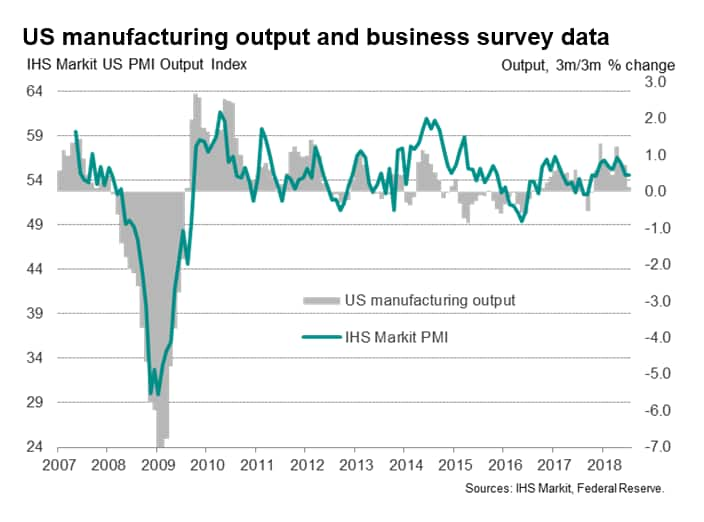

Such a slowdown would be consistent with the IHS Markit PMI survey data, which signalled the weakest rise in manufacturing output for eight months in July.

Slower growth trend

The 0.3% increase in factory output in July came on the heels of a 0.8% rise in June, but the data have been choppy, making signals hard to read. For example, output had fallen 0.9% in May. To see a better picture of the underlying production trend, we compare output in the latest three months against the prior three months. This three-month average had picked up earlier in the year, peaking at 1.2% in April, which had been the strongest gain since the first quarter of 2012. However, the three-month growth rate has since cooled, down to 0.7% in the second quarter and 0.1% in July, which is its lowest since last October.

Survey data insights

The strong output growth during the second quarter was anticipated in advance by IHS Markit's PMI survey data, with the survey's Output Index averaging 55.7 in the three months to June. A regression-based model shows this index level to be historically consistent with quarterly output growth of just under 0.6%.

The manufacturing PMI Output Index exhibits an 89% correlation with the official measure of factory output. However, as it is published before the official numbers, the PMI acts as a useful advance guide.

Disappointingly, the PMI Output Index has slipped lower in recent months, dropping to 54.5 in July, a level historically consistent with a quarterly output growth rate of just over 0.2%. Like the official three-month growth rate, the PMI Output Index has fallen steadily since peaking in April.

Looking in more detail, the survey also showed that new orders growth continued to outstrip that of output. This suggests that firms may seek to boost production again in August to cater to the increased inflows of new business. Anecdotal evidence suggested the rise was due to the acquisition of new clients and favourable domestic demand conditions. That said, the overall rate of growth of order books in the last two months has been the weakest since November of last year, with foreign demand falling fractionally for the second successive month.

Some of the production weakness could also be attributed to difficulties in sourcing sufficient quantities of inputs. The PMI survey showed suppliers' lead-times lengthening to the great extent seen in the near-10-year history of the survey.

Insights into whether the July slowdown will prove temporary, possibly the result of delivery delays, will be provided by next week's flash PMI numbers for August, which will be published on 23rd August. The flash release will also include service sector PMI numbers alongside the manufacturing indices.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-growth-trend-slips-in-july-160818.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-growth-trend-slips-in-july-160818.html&text=US+manufacturing+growth+trend+slips+in+July%2c+in+line+with+PMI+survey+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-growth-trend-slips-in-july-160818.html","enabled":true},{"name":"email","url":"?subject=US manufacturing growth trend slips in July, in line with PMI survey | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-growth-trend-slips-in-july-160818.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+growth+trend+slips+in+July%2c+in+line+with+PMI+survey+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-growth-trend-slips-in-july-160818.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}