Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 16, 2018

Service sector helps keep Russian economy growing as manufacturing fades

- PMI surveys signal stronger service sector growth compared to manufacturing expansion

- Business activity across monitored sub-sectors increases steeply

- Industrial production rises at weaker pace towards the middle of 2018

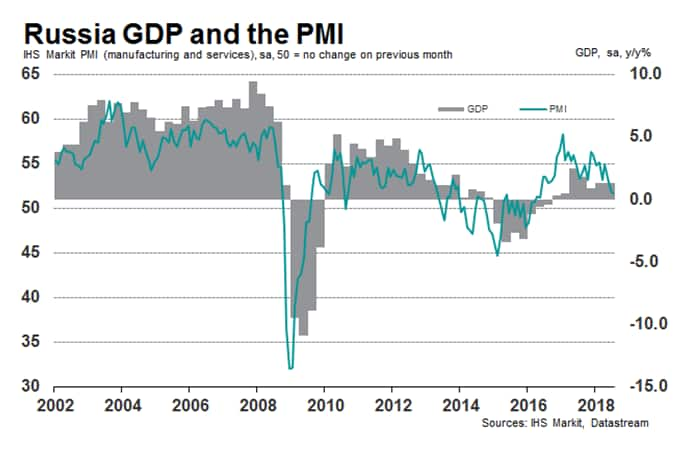

The recent football World Cup in Russia has provided a boost to the Russian economy, with fans from all over the globe descending on host cities to watch their national team. The service sector saw the greatest impact, according to IHS Markit's survey data, with business activity and new orders expanding strongly in the event's build-up. However, the survey data have also signalled the re-emergence of weaker underlying domestic demand conditions, with panellists linking this to a softer pace of economic expansion.

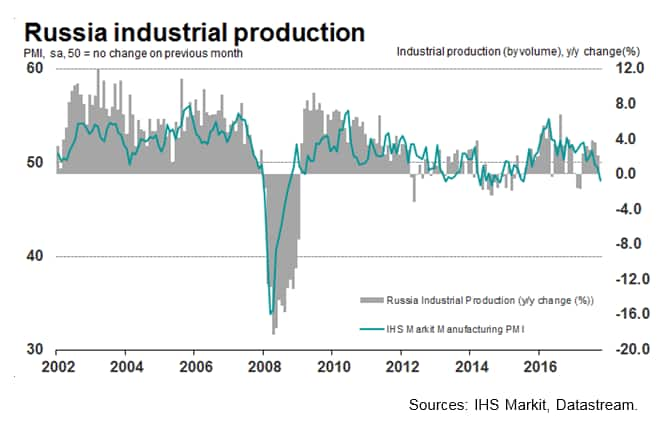

Manufacturers in particular have not fared well, with industrial production growth easing throughout the second quarter. Weaker official data was corroborated by a third successive deterioration in the health of the sector in July, as indicated by the IHS Markit Russia Manufacturing PMI. The latest dip in overall performance was exacerbated by a second consecutive monthly fall in new orders.

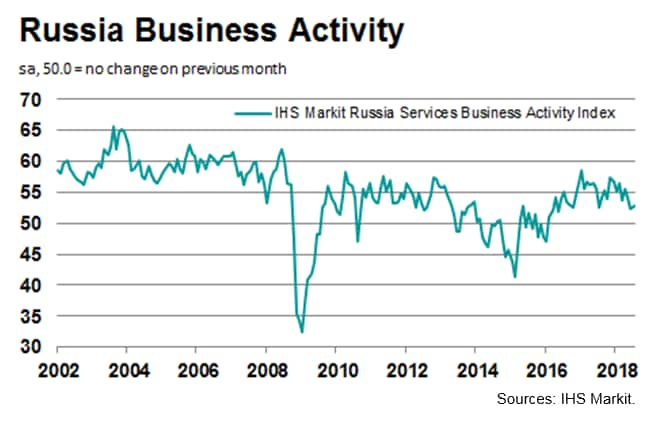

Strong growth across services sub-sectors

Despite the July PMI surveys recording the first monthly deterioration in manufacturing performance since April 2016, a rise in service sector activity during the month helped the Russia Composite PMI Output Index signal a moderate rise in overall activity. However, the increase was the weakest for 26 months.

At the sub-sector level, growth in Transport & Storage companies was particularly strong and drove the overall services upturn.

In each of the monitored services sub-sectors (which include Transport & Storage, Consumer Services, Information & Communication, Finance & Insurance and Real Estate & Business Services) expansions were largely solid throughout the second quarter and at the start of the third quarter. Following a boost to new orders during June, all sub-sectors reported an increase in new business in July. The fastest expansions were registered by firms in Transport & Storage and Finance & Insurance.

That said, the rate of new business growth softened across the Finance & Insurance and Real Estate & Business Services segments in July. The latter registered the most notable change following the World Cup, with the pace of expansion easing for the third successive month.

Manufacturing sector fails to keep pace

In manufacturing, the picture has been less buoyant. Recent subdued trends in underlying domestic and foreign demand for Russian manufactured goods have weighed down on growth, with the issue exacerbated by April's sanctions. Metal producers have been particularly hard hit, with consumer goods producers also reporting a solid fall in output since May. The effects of this issue are expected to wane over the second half of the year however, with IHS Markit forecasting industrial production to grow 3.9% in 2018, easing to 2.9% in 2019.

Proposed policy changes

That said, the service sector will not be without its challenges over the coming year as new VAT rules come into force. The current proposal for the change will raise the sales tax from 18% to 20% on January 1st 2019. Consequently, inflation expectations have been revised up for 2019, with many expecting a halt on interest rate cuts as the tax hike is forecast to push inflation above the 4.0% target.

Meanwhile, a controversial proposed increase in the retirement age could impact part-time workers and investment in on-the-job training in the medium-term if phased in. July data signalled the second successive month of job shedding across both the manufacturing and service sector, despite a solid rise in services new business. In an already challenging labour market where redundancies have increased, and firms prioritise more efficient business processes, candidates will face greater pressure to stay fit and skilled. However, a rise in the retirement age could lead to greater economic growth and increase the level of government investment in healthcare and education.

Forthcoming economic data releases:

- September 3rd: IHS Markit Russia Manufacturing PMI (August)

- September 5th: IHS Markit Russia Services PMI (August)

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Sian Jones, Economist, IHS Markit

Tel: +65 44 1491 461017

sian.jones@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-helps-keep-russian-economy-growing-160818.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-helps-keep-russian-economy-growing-160818.html&text=Service+sector+helps+keep+Russian+economy+growing+as+manufacturing+fades+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-helps-keep-russian-economy-growing-160818.html","enabled":true},{"name":"email","url":"?subject=Service sector helps keep Russian economy growing as manufacturing fades | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-helps-keep-russian-economy-growing-160818.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Service+sector+helps+keep+Russian+economy+growing+as+manufacturing+fades+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fservice-sector-helps-keep-russian-economy-growing-160818.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}