Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 25, 2018

US Flash PMI surveys point to strong start to third quarter, but prices spike higher

- IHS Markit flash PMI data point to strong GDP and employment rise in July

- Solid domestic demand contrasts with weaker exports

- Survey sees record price hikes

The July flash PMI survey data indicated that the US economy sustained strong growth momentum after what looks to have been a solid second quarter, representing a good start to the second half of 2018.

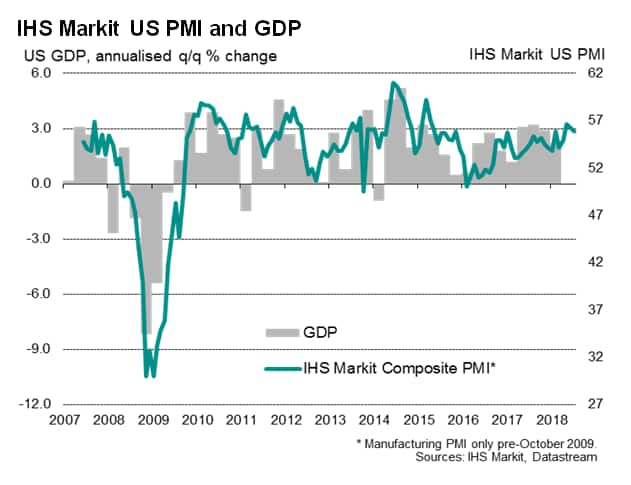

Although down from 56.2 in June, the July flash PMI reading of 55.9 (covering both manufacturing and services) was in line with the average for the second quarter and indicative of the economy growing at an annualised rate of approximately 3%.

The survey has a good track record of predicting GDP, with the noteworthy qualification that the PMI is less volatile in the first half of the year, not suffering the repeated seasonal dips in the first quarter as can be seen in the official GDP numbers. While the PMI indicated a modest start to the year, growth accelerated into the second quarter and has sustained a robust pace in July.

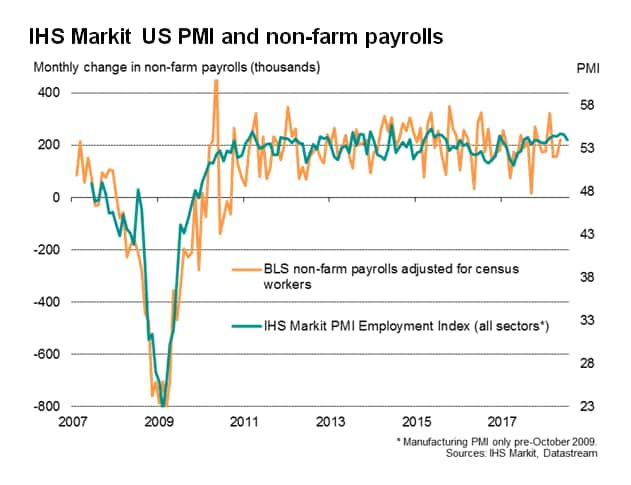

Employment also continued to rise at a solid clip, though the pace of job creation was down slightly compared to prior months. The July flash employment index is nevertheless consistent with another non-farm payroll rise in excess of 200k (read more about how we use the employment index to predict non-farm payrolls here).

Price hikes and trade wars

Buoyant domestic demand has played an important part in driving the recent expansion, helping the service sector maintain particularly impressive growth and helping cushion the goods producing sector from wilting demand in export markets. July saw goods export orders drop, albeit only marginally, for a second successive month.

The weakness of the export trend follows indications that trade frictions have clearly become a major cause of concern, especially among manufacturers, as highlighted in our recent business outlook survey. Some 16% of firms explicitly cited tariffs as a threat to business, with a further 17% reporting worries relating to the impact of rising input costs or raw material prices, often in turn linked to tariffs and trade wars.

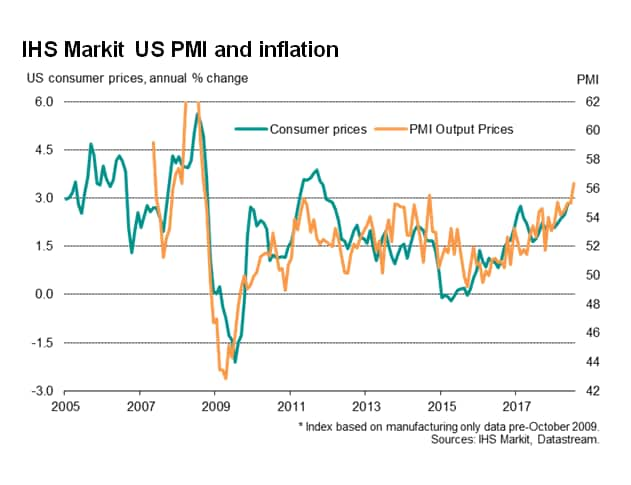

July saw the steepest rise in prices charged for goods and services yet recorded by the surveys as firms passed rising costs on to customers, in turn frequently linked to tariffs. What's more, supply chain delays hit a record high amid rising shortages of key inputs, which is usually a harbinger of further price rises.

Historical comparisons with official consumer price data suggest that the July rise in the PMI survey's output price index is consistent with inflation picking up further at the start of the third quarter, having already reached 2.9% in June.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-surveys-point-to-strong-start-to-third-quarter-but-prices-spike-higher-250718.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-surveys-point-to-strong-start-to-third-quarter-but-prices-spike-higher-250718.html&text=US+Flash+PMI+surveys+point+to+strong+start+to+third+quarter%2c+but+prices+spike+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-surveys-point-to-strong-start-to-third-quarter-but-prices-spike-higher-250718.html","enabled":true},{"name":"email","url":"?subject=US Flash PMI surveys point to strong start to third quarter, but prices spike higher | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-surveys-point-to-strong-start-to-third-quarter-but-prices-spike-higher-250718.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Flash+PMI+surveys+point+to+strong+start+to+third+quarter%2c+but+prices+spike+higher+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-flash-pmi-surveys-point-to-strong-start-to-third-quarter-but-prices-spike-higher-250718.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}