Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2018

UK PMI surveys show economy growing at slowest rate for nearly 18 months

- PMI surveys signal weakest expansion of business activity since August 2016

- Growth slows in all three main business sectors

- Output price inflation cools further but holds close to decade-high

- Business optimism lifts higher

The pace of UK economic growth slowed sharply at the start of the year as January saw a triple-whammy of weaker PMI™ surveys. Hiring remained robust, however, and business confidence continued to perk up from recent lows. Price pressures meanwhile remained elevated, and held close to a decade-high despite cooling to a three-month low.

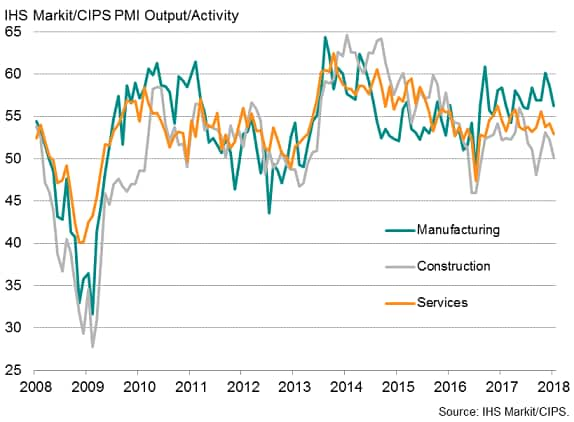

UK PMI output index for the three main sectors

Steady fourth quarter growth

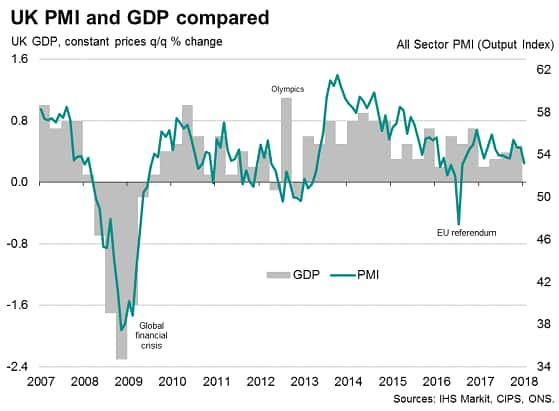

The ‘all-sector’ IHS Markit/CIPS PMI Output Index fell to 53.2 in January, its lowest since August 2016 and down from readings of 54.7 in both December and November. While the fourth quarter PMI readings were historically consistent with the economy growing at a quarterly rate of 0.4-0.5% (actual GDP growth is initially estimated at 0.5%), the January reading signals a growth rate of just under 0.3%.

Output trends deteriorated in all three major business sectors of the economy in January.

The best performance continued to be seen in manufacturing, where export gains helped drive further robust output growth. However, weakened domestic demand meant the overall rate of expansion in new orders slipped to the lowest since last June.

Service sector expansion meanwhile weakened to a 16-month low, reflecting a marked waning of growth in demand for business services and in consumer-facing sectors such as hotels and restaurants in recent months. Demand for transport and communication services is also now in decline and is near-stagnant for computing and IT services. The most resilient performance is being seen in financial services.

Construction remained the weakest link, with output growth more or less grinding to a halt after the modest improvement seen at the end of last year. A renewed decline in house building accompanied lacklustre commercial building and civil engineering sectors.

Mixed outlook

Forward-looking indicators were mixed. Inflows of new business showed the smallest monthly rise since August 2016, suggesting output growth could weaken further in February. However, expectations about companies’ business activity levels in a year’s time struck a ten-month high amid brighter outlooks in all three sectors.

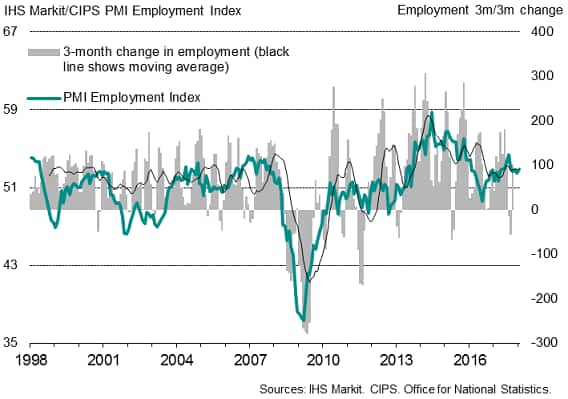

Hiring picked up slightly from December’s nine-month low as companies signalled the strongest upturn in payrolls since last September. Job creation was led by manufacturers and, to a lesser extent, service providers. Construction employment meanwhile showed the smallest gain in the current 18-month sequence of expansion. The resulting overall rise in employment was broadly in line with the average seen last year.

Employment

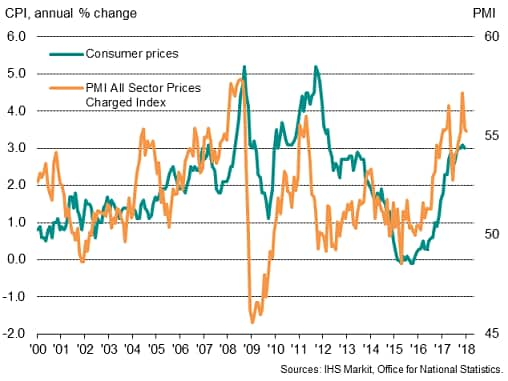

Inflationary pressures ease further

Price pressures cooled slightly alongside the slowing of the economy.

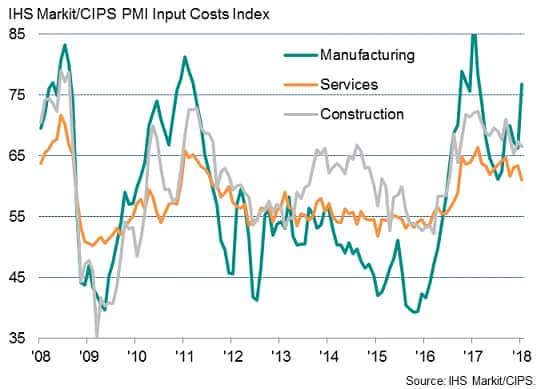

Average input costs rose at the weakest rate for three months, remaining elevated but well below the peaks seen early last year. Manufacturing input cost inflation remained especially high, linked in part to higher oil prices, which rose to the highest for over three years during the month. Service sector cost inflation, which is less affected by global commodity prices, meanwhile eased to a 16-month low.

Average prices charged for goods and services also rose at a marked pace again as firms sought to pass higher costs on to customers, though likewise showed the smallest rise for three months.

Input costs

UK PMI prices charged and inflation

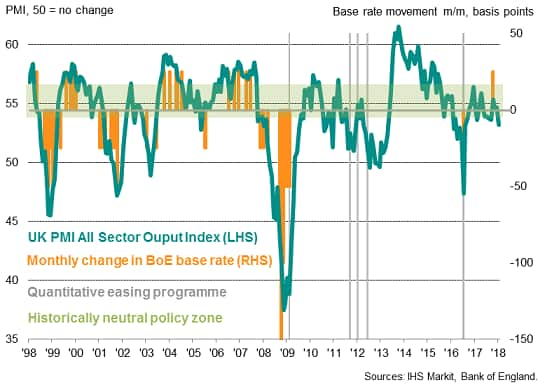

Dovish policy signal

The January decline pushes the all-sector PMI down into dovish territory as far as Bank of England monetary policy is concerned, historically consistent with a loosening bias. As such, the data cast doubts on any imminent rise in interest rates. Since 1999, interest rates have not been raised when the all-sector PMI has been below 56.5, with the sole exception of last November’s hike to 0.5% (when the latest PMI reading had been 55.4).

UK PMI and monetary policy

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-surveys-economy-growing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-surveys-economy-growing.html&text=UK+PMI+surveys+show+economy+growing+at+slowest+rate+for+nearly+18+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-surveys-economy-growing.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys show economy growing at slowest rate for nearly 18 months&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-surveys-economy-growing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+show+economy+growing+at+slowest+rate+for+nearly+18+months http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-surveys-economy-growing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}