Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2018

UK GDP data add to signs of economy's renewed weakness after strong summer

- GDP rises 0.1% in October, three-month growth rate slows to 0.4% from 0.6%

- More timely business surveys hint at stalling economy in November

- Brexit holds key to business outlook

The underlying pace of economic growth slowed at the start of the fourth quarter, according to the latest official data. The numbers come on the heels of more up-to-date survey evidence which suggests the economy is approaching stall speed and could even contract as we move into 2019 unless demand revives.

Gross domestic product (GDP) rose 0.1% in October, according to the Office for National Statistics (ONS), in line with expectations. While the increase was an improvement on the flat picture seen in the prior two months, the more important three-month growth rate slowed to 0.4%, down from a strong 0.6% expansion seen in the three months to September.

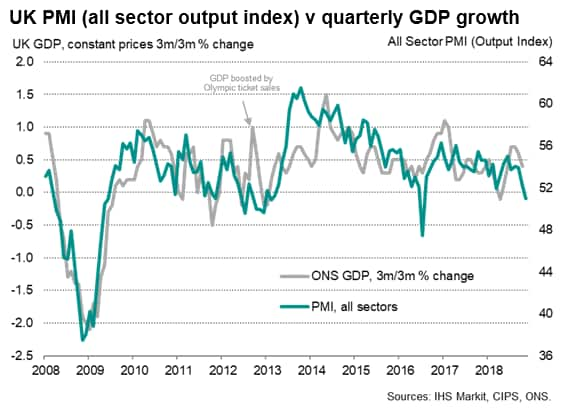

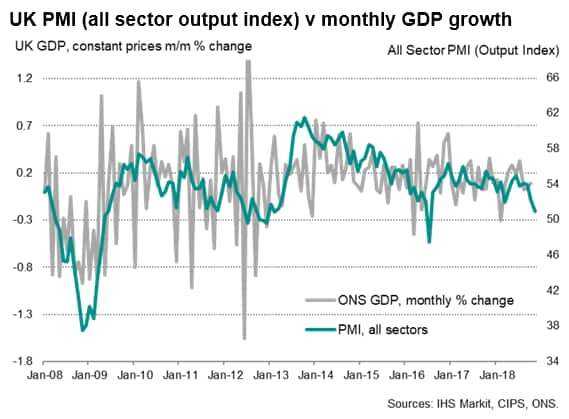

This easing in the underlying pace of growth is in line with the evidence from business surveys such as the IHS Markit/CIPS PMI, the latest data from which indicated that the economy stalled in November. With the survey's forward-looking gauges such as inflows of new work and business sentiment also deteriorating, modest growth of just 0.1% is indicated for the fourth quarter, with an increased risk of the economy contracting as we head into 2019 unless demand perks up in coming months.

Slower growth of spending and investment is no surprise and is a rational response to intensifying Brexit uncertainty, which has been exacerbated by a broader global economic slowdown, especially in the eurozone.

The outlook for growth therefore very much depends on Brexit developments over the coming days, weeks and months, and the surrounding uncertainty makes forecasting extremely difficult. However, the widely-expected slowing of the economy in the lead-up to the UK's separation from the EU is now clearly evident, leaving the big question of whether the economy will bounce back alongside a smooth Brexit process or slide into decline.

Weaker industry and trade picture

In the detail, industrial production fell 0.6% in October, of which manufacturing output was down 0.9%. Construction industry output meanwhile fell 0.2%, leaving the service sector as the only major part of the economy to expand at the start of the fourth quarter, though even here the 0.2% expansion was only modest.

Meanwhile, the goods trade deficit widened in October, adding to the gloomier economic picture. Exports fell 1.8% during the month, down 0.1% in the latest three months versus the prior three months, while imports rose 3.8%, up 2.2% in the latest three months.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-gdp-data-add-to-signs-of-economys-renewed-weakness-181210.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-gdp-data-add-to-signs-of-economys-renewed-weakness-181210.html&text=UK+GDP+data+add+to+signs+of+economy%27s+renewed+weakness+after+strong+summer+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-gdp-data-add-to-signs-of-economys-renewed-weakness-181210.html","enabled":true},{"name":"email","url":"?subject=UK GDP data add to signs of economy's renewed weakness after strong summer | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-gdp-data-add-to-signs-of-economys-renewed-weakness-181210.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+GDP+data+add+to+signs+of+economy%27s+renewed+weakness+after+strong+summer+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-gdp-data-add-to-signs-of-economys-renewed-weakness-181210.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}