Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2021

UK Flash PMI close to all-time highs in April as UK lockdowns ease

- Flash UK composite PMI at highest since November 2013

- Service sector and manufacturing expand at marked rates as lockdowns eased and demand revives

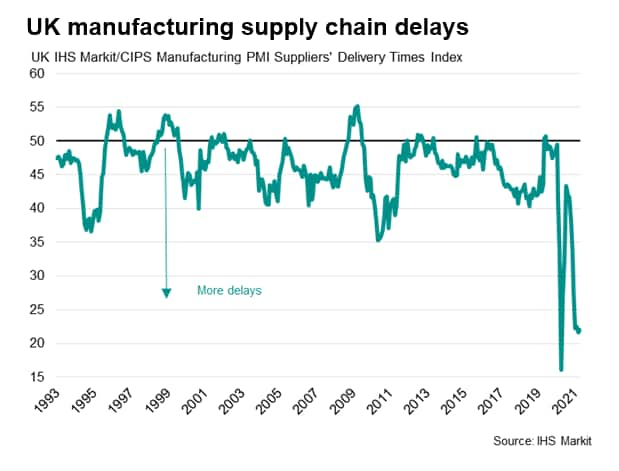

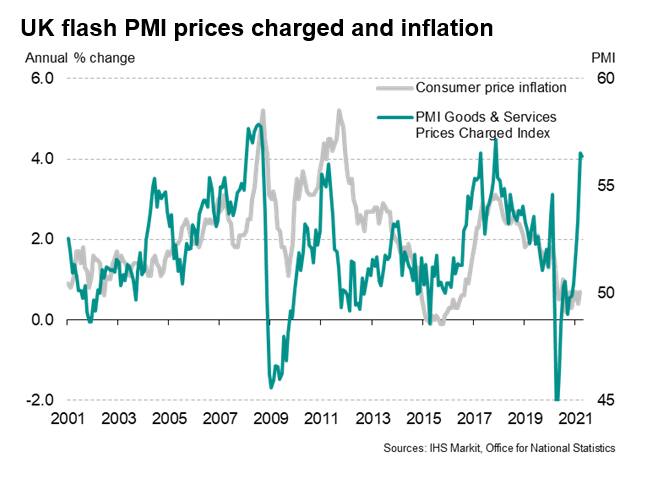

- Prices rise sharply again amid near-record supply delays

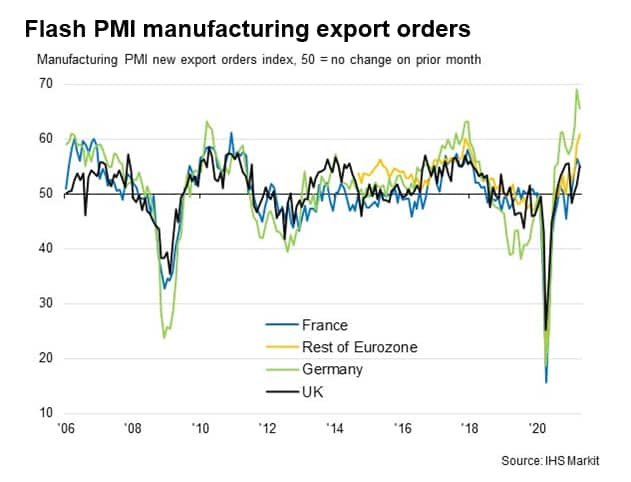

- Exports improve but remain weak compared to the eurozone

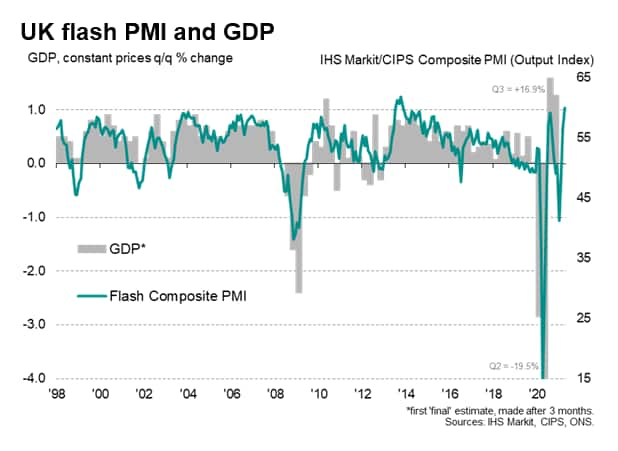

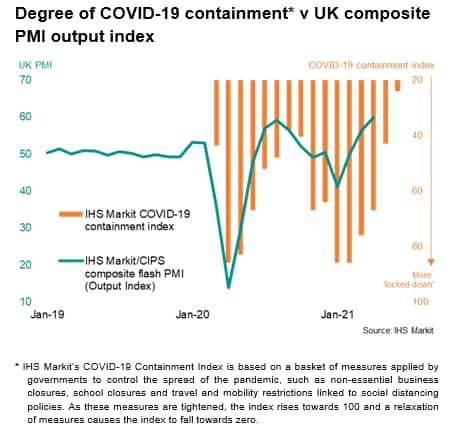

An easing of COVID-19 containment measures in April helped drive the pace of UK economic growth to the best for almost seven and a half years, according to the latest flash PMI data from IHS Markit and CIPS. Jobs growth also accelerated to one of the fastest rates seen over the past six years, as future expectations remained close to March's all-time high. But rising prices are a concern, and export growth remained lacklustre compared to recent trends seen in many other countries.

The headline PMI covering both manufacturing and services rose from 56.4 in March to 60.0 in April, well above expectations of a rise to 58.2. In more than 23 years of PMI history, there has been one spell of faster growth, recorded between August and November 2013.

Resurgent demand as lockdowns ease

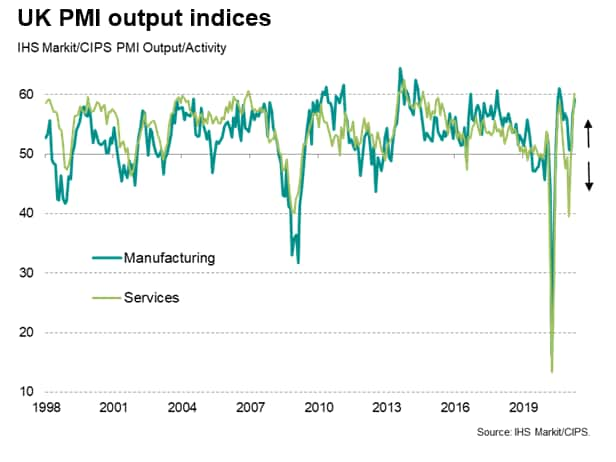

Companies are reporting a surge in demand for both goods and services as the economy opens up from lockdowns and the encouraging vaccine roll-out adds to a brighter outlook. Service activity expanded to the greatest extent since August 2014, while manufacturing production growth accelerated to its fastest for eight months.

Business activity should continue to grow strongly in May and June as lockdown measures are eased further, setting the scene for a bumper second quarter for the economy.

Mechanical engineering leads the factory upturn

Manufacturing trends varied by sector. Best performing was the mechanical engineering sector, linked in part to strong exports, followed by food and drink, despite the latter seeing a marked fall in exports. Especially robust output growth was also recorded for electrical & electronic goods, basic metals goods and chemicals & plastics. Transport (vehicle) producers stood alone in reporting a decline in both production and employment during the month, also reporting a sharp drop in exports, while textiles and clothing manufacturers were notable in reporting only modest growth.

Supply delays were broad based across manufacturing, however, running at near-record levels, but were especially acute in the vehicle manufacturing, electrical & electronics and basic metal industries.

Demand starts to revive for consumer-facing services

While business-to-business services continued to lead the service sector upturn, enjoying the strongest expansion for a second successive month, sharply stronger growth was also recorded for consumer services and financial services.

Although current activity remained subdued in hotels & restaurants, it was a different story for new business inflows into the sector, which jumped to the highest since last August.

Exports rise but remain subdued

While exports returned to growth after three months of decline, the rate of increase remained relatively subdued compared both to domestic orders and export trends seen in many other economies, often linked to post-Brexit trading conditions.

German goods exports, most notably, have been running at a record high in recent months, according to PMI data, leading to the fastest growth of eurozone goods exports on record in March and April, albeit the rate of increase slipping slightly in April due in part to heightened lockdown measures across Europe.

Prices charged for goods rise at steepest rate for a decade

Prices were a second cause for concern. Input costs rose at a rate not seen for over four years, leading to another sharp rise in average prices charged for goods and services. Prices charged at the factory gate for goods jumped especially markedly, rising at a rate not seen for a decade. Companies linked increased prices to higher global prices for many goods, often due to supply shortages, as well as rising import costs linked to Brexit.

Hiring on the rise

Better news came from the job market numbers, with the survey highlighting how the upturn is feeding through to higher employment. With optimism about the year ahead continuing to run close to March's all-time high, firms have been encouraged to take on extra staff at a rate not seen for over three and a half years.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-close-to-alltime-highs-in-april-as-uk-lockdowns-ease-apr21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-close-to-alltime-highs-in-april-as-uk-lockdowns-ease-apr21.html&text=UK+Flash+PMI+close+to+all-time+highs+in+April+as+UK+lockdowns+ease+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-close-to-alltime-highs-in-april-as-uk-lockdowns-ease-apr21.html","enabled":true},{"name":"email","url":"?subject=UK Flash PMI close to all-time highs in April as UK lockdowns ease | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-close-to-alltime-highs-in-april-as-uk-lockdowns-ease-apr21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Flash+PMI+close+to+all-time+highs+in+April+as+UK+lockdowns+ease+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-close-to-alltime-highs-in-april-as-uk-lockdowns-ease-apr21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}