Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 10, 2024

Three storms, three shortages: Supply chains wrestle to react to storms

While primarily human tragedies, hurricanes also provide significant challenges for supply chains. The 2024 storm season, in both the Pacific and Atlantic basins, has proven far worse than prior years in terms of the magnitude of storms' impacts.

In 2025, there will be the emergence of a La Niña weather system, which is currently expected to be less severe than normal, but could nonetheless lead to a heavier hurricane season in the US Atlantic and wetter conditions in Asia.

Looking further ahead, climate change science suggests hurricane-type storms will become more frequent, more extreme and less predictable.

Logistics networks prove resilient

Port closures on a localized basis and the resulting supply chain disruptions are an almost annual event, shown by Hurricane Irma in 2017, Hurricanes Florence and Willa in 2018, Hurricane Dorian in 2019, Hurricane Laura in 2020, Hurricane Ida in 2021, Hurricane Ian in 2022 and Hurricanes Idalia (east coast) and Hilary (west coast) in 2023.

All resulted in significant port closures and inland disruptions. Ports typically only remain closed for a few days, but recovery — including normalization of onward distribution — can take two to three weeks to achieve, while the most extreme events can cause weeks of disruptions, as shown by Hurricane Sandy in 2012.

The impact is most typically felt by ports in the Gulf Coast including Houston and New Orleans, although closures further up the southeast coast (Charleston and Savannah) and even the northeast are not unknown.

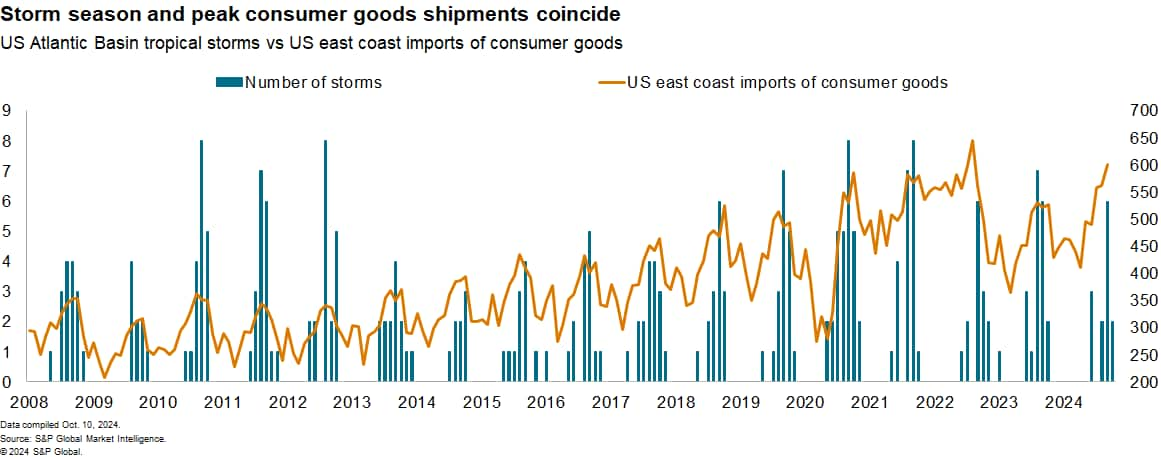

The disruptions can be particularly challenging for consumer goods (both durables and food) and other seasonal imports, which typically peak in August through October, Market Intelligence data shows. Extensive challenges can also be presented for agricultural and energy exports, which are also seasonal for harvest and winter demand reasons.

While ports may reopen swiftly, flooding and power outages can cause extensive damage to inland supply chains which can take weeks or even months to recover from. The three major storms on the Atlantic and Gulf seaboards in 2024 have resulted in three distinct challenges.

Beryl imperils chemicals supplies

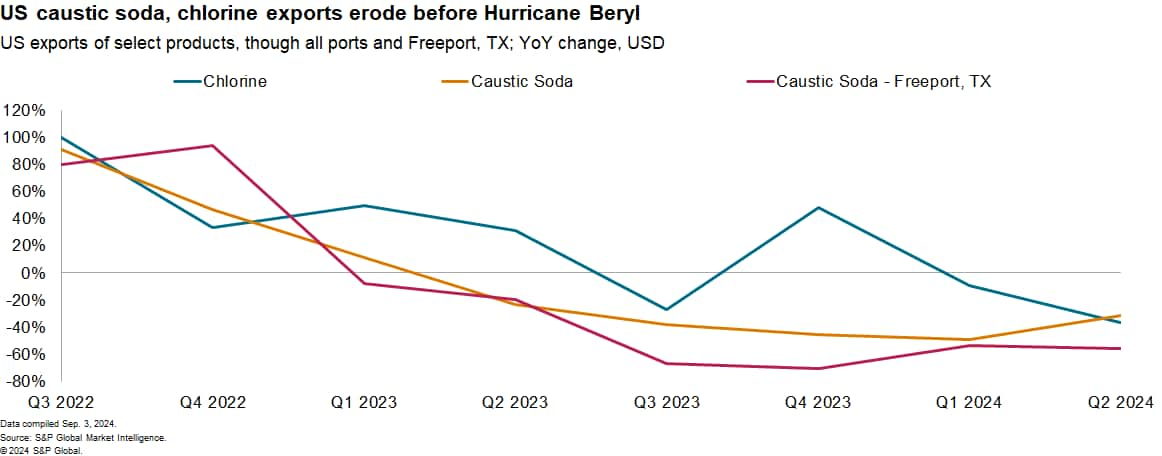

Production of caustic soda and chlorine at facilities in Freeport, Texas, were offline for six weeks following Hurricane Beryl, leading major producers to declare force majeure and suspend shipments. While damage to the facilities was not major, the clean-up process and restart of operations took an extended period.

Exports had already been in decline before the July 10 outage. Market intelligence data shows that US dollar exports of caustic soda and chlorine fell by 31.4% year over year and 37.0% year over year in the second quarter. This was amplified at the port in Freeport, Texas, where exports of aqueous caustic soda were down by 55.8% year over year in the same period.

The impact of the hurricane and production shutdowns in the third quarter will likely affect exports, with Freeport Texas responsible for 13.1% of aqueous caustic soda exports from the US in the second quarter. This is down from a high of 37.7% of US exports of that commodity in the second quarter of 2018.

Helene causes problems for medical supply chains

Hurricane Helene, which made landfall at Perry, Florida, in the US on Sept. 26 as a Category 4 storm, may prove to be one of the costliest on record in the US as a result of high levels of flood damage. The hurricane was somewhat atypical in its geographic scale and resulting level of rainfall which has caused damage to inland supply chain infrastructure.

Norfolk Southern Corp.'s rail networks across Georgia to West Virginia have been interrupted by flood damage, adding to disruptions resulting from the East Coast port strike which started on Oct. 1 and lasted for three days.

Factories and mines can take longer to recover, either because of direct damage to facilities or due to displacement of staff. Helene has caused both types of challenges for sectors as diverse as high-quality quartz production (used in semiconductor manufacturing) and medical supplies manufacturing in North Carolina.

The latter includes the closure of a plant operated by Baxter International Inc., which is the largest site in the US for the production of dialysis and other intravenous solutions. Reopening the plant may be compromised by local bridge damage, potentially requiring alternative sourcing including imports.

In the short term, the plant's damage may be covered by additional imports. Market Intelligence data shows US seaborne imports of intravenous medical products increased by 10.4% year over year in the third quarter of 2024, but were still 12.2% below their pandemic-era high.

In the longer term, it could lead to a revisiting of government healthcare materials supply chain strategies which had previously been enhanced following the COVID-19 pandemic.

Milton reveals power grid problems

Hurricane Milton has caused extensive flooding and damage to power grids in the Tampa Bay area of Florida, US. Initial reports indicated over three million homes and commercial operations experienced power cuts.

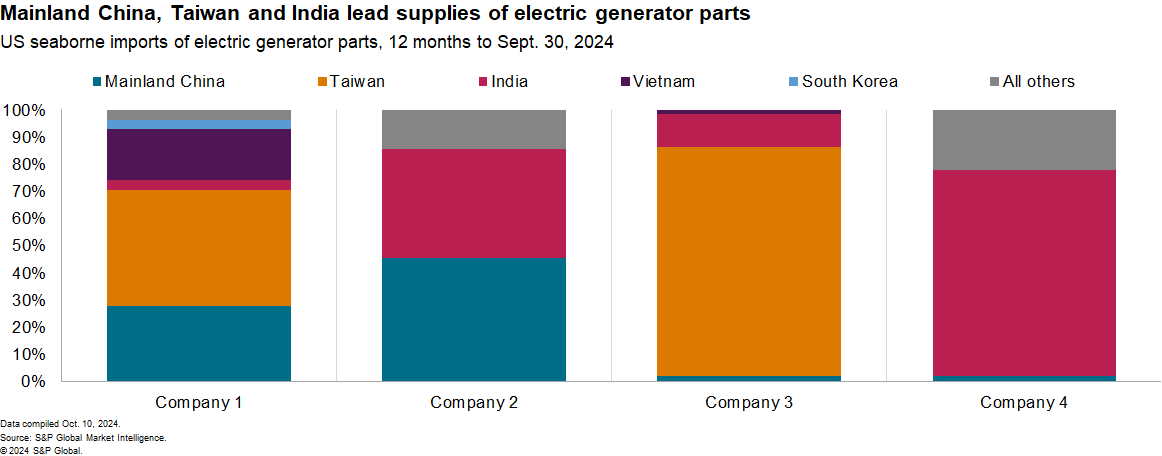

Coming rapidly on the heels of Hurricanes Helene and Beryl, demand for domestic power generators - both to provide supplies to Helene-affected areas and preparatory purchases for Milton - has meant some domestic backup generators have largely sold out according to reports.

It could take several weeks at least for generator producers to rebuild their inventories given the length of their supply chain which, in common with many electrical equipment systems, stretch deeply into Asia. Market Intelligence data shows 40% of the electric generator parts imported by four large US manufacturers of generators were sourced from Taiwan, with a further 20% from mainland China and 19% from India.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-storms-three-shortages-supply-chains-react-to-storms.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-storms-three-shortages-supply-chains-react-to-storms.html&text=Three+storms%2c+three+shortages%3a+Supply+chains+wrestle+to+react+to+storms+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-storms-three-shortages-supply-chains-react-to-storms.html","enabled":true},{"name":"email","url":"?subject=Three storms, three shortages: Supply chains wrestle to react to storms | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-storms-three-shortages-supply-chains-react-to-storms.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Three+storms%2c+three+shortages%3a+Supply+chains+wrestle+to+react+to+storms+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthree-storms-three-shortages-supply-chains-react-to-storms.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}