Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 16, 2018

Survey data point to Japan's economy gaining strength after disappointing Q1 GDP

- GDP falls 0.2% q/q in first quarter after 0.1% gain in the previous quarter

- Flat private consumption growth, falling investment spending and slower export growth all acts as drags on economic activity

- Data may get revised higher, and surveys point to second quarter upturn

The Japanese economy shrank in the first three months of 2018, according to the preliminary estimate of gross domestic product, but survey data suggest the economy is continuing to expand, and that growth could accelerate in the second quarter.

Disappointing start to 2018

The first estimate of gross domestic product from Japan's Cabinet Office showed the economy contracting 0.2% in the first quarter of 2018, signalling an end to a two-year period of growth.

The disappointing news was compounded by a downward revision to growth in the closing quarter of last year to just 0.1%.

In annual terms, real GDP in the first quarter was 1.0% higher than a year ago, its slowest year-on-year growth rate since the second quarter of 2016.

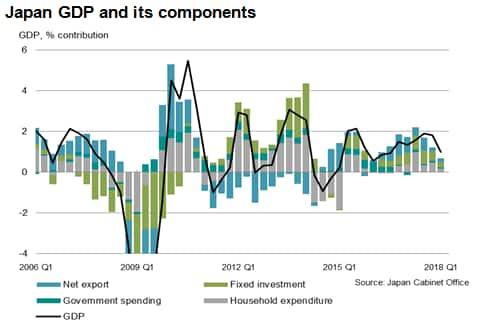

Key drags on the economy were flat private spending and a quarterly decline of 0.3% in domestic investment. A slowdown in export growth also weighed on economic activity, suggesting the appreciation of the yen in the first quarter has affected export competitiveness. The yen gained 6% against the US dollar in the three months to March.

Brighter future?

In the first instance, it's important to bear in mind that Japan's GDP data are notorious for being revised after initial estimates. The fact that the first quarter decline contrasted with ongoing (albeit slower) expansion indicated by survey data hints at the official data being revised slightly higher at the second reading (8th June).

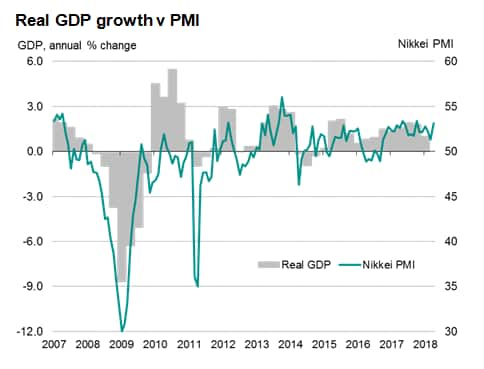

Furthermore, recent Nikkei PMI surveys, conducted by IHS Markit, point to economic growth picking up at the start of the second quarter. The surveys exhibit a 73% correlation with the annual % change in real GDP, acting with a lead.. The surveys also provide evidence of domestic demand taking a larger role in driving economic expansion. In particular, service sector business activity rose in April at the strongest rate since last October, suggesting private consumption has accelerated.

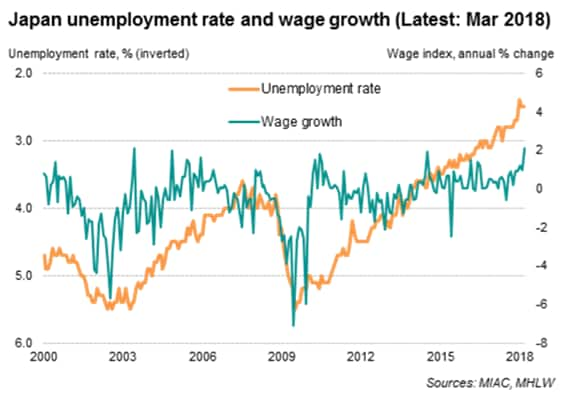

Tight labour market conditions and rising wage growth also support further household spending growth. The unemployment rate is at a 24-year low, while growth in average earnings rose to the fastest for nearly 15 years during March. Works related to the 2020 Tokyo Olympics may also boost economic activity.

Stronger domestic demand could help offset the loss of growth momentum seen in the external market. The PMI’s gauge for export sales registered the weakest growth in the current expansion trend during April, in line with slower global economic growth, suggesting that Japan’s economy may not benefit as much from export demand as it did in 2017.

Monetary policy

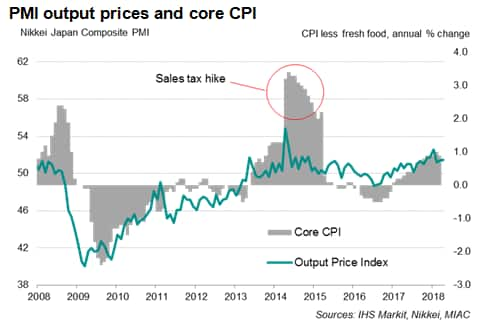

The latest GDP data diminish the odds of the Bank of Japan considering dialing back its monetary stimulus this year. Already, the BOJ has struggled to boost inflationary pressure despite aggressive easing, with Governor Kuroda attributing the low inflation environment to the deflationary mind-set of the Japanese consumer.

While the March wage data were encouraging, it’s widely anticipated that it will require a prolonged period of sustained pay growth for Japanese consumers to increase spending.

We’ll know more next week about economic activity in the second quarter with the publication of flash manufacturing Nikkei PMI data for May, but the likelihood is that the first quarter’s contraction will prove temporary. As such, the survey data suggest there is no need for policy to be loosened to help the economy, as current settings are sufficient to keep economic growth on a steady momentum.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-point-to-japans-economy-gaining-strength-after-disappointing-q1-gdp.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-point-to-japans-economy-gaining-strength-after-disappointing-q1-gdp.html&text=Survey+data+point+to+Japan%27s+economy+gaining+strength+after+disappointing+Q1+GDP+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-point-to-japans-economy-gaining-strength-after-disappointing-q1-gdp.html","enabled":true},{"name":"email","url":"?subject=Survey data point to Japan's economy gaining strength after disappointing Q1 GDP | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-point-to-japans-economy-gaining-strength-after-disappointing-q1-gdp.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Survey+data+point+to+Japan%27s+economy+gaining+strength+after+disappointing+Q1+GDP+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-point-to-japans-economy-gaining-strength-after-disappointing-q1-gdp.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}