Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 15, 2018

PMI signals headwind to aluminium prices

- Aluminium prices rise to 79-month high…

- …amid supply shortage fears

- Aluminium users PMI subdued at 51.9 in April, indicating softening demand

Survey data indicate that manufacturers have been building safety stocks of aluminium, but also suggest that subdued demand growth at aluminium-using firms worldwide presents a downside risk for prices.

Rallied by fundamentals or speculation?

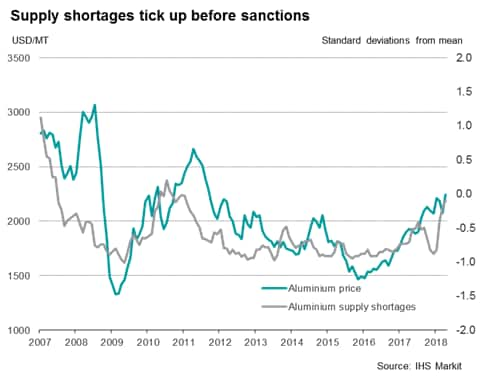

Aluminium markets underwent turmoil at the start of the second quarter. Fears of worsening supply shortages following Rusal sanctions pushed the price of the light metal to its highest in over six-and-a-half years at $2245/MT during April. Shortages of aluminium accelerated throughout April, reaching an 87-month high.

As with any traded commodity, the price of aluminium has been partly driven by speculation. However, demand continues to provide a headwind for prices.

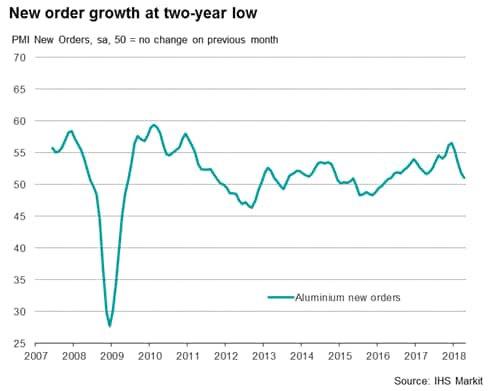

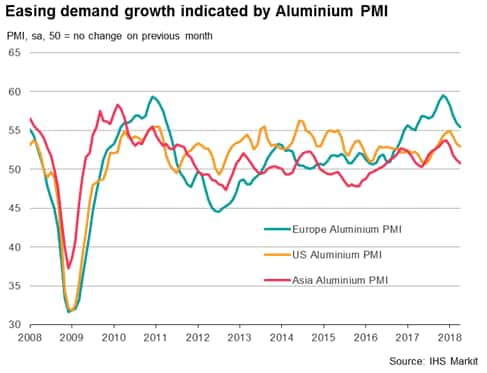

Demand growth for the light metal has lost impetus from the strong expansion seen at the end of last year. The IHS Markit Aluminium PMI fell to its lowest in almost a year at 51.9 in April. The slowdown was driven by softer output and new order improvements at aluminium-intensive manufacturers worldwide, with the latter dropping to a two-year low.

At the regional level, aluminium using firms in Asia - a key driver for aluminium prices - registered the most notable slowdown in growth in April. Whilst expansions were generally stronger in the US and Europe, the survey data in these regions also indicated a loss of growth momentum.

Sanctions add to already elevated shortages

Sanctions on Rusal threaten to remove 6% of aluminium supply from the global market . Notably, incidences of aluminium supply shortages at manufacturers worldwide ticked up before the threat of sanctions, thereby validating fears around future scarcity of the light metal.

Furthermore, supply shortage data collected by IHS Markit and published in the monthly Price & Supply Monitor report signalled the worst degree of aluminium availability in 87 months during April. That said, the recent loosening in sanctions will allow more time for markets to adjust, with countries such as China potentially filling the supply gap with their surpluses.

In response to Rusal sanctions, stockpiles of aluminium built up at a marked pace in LME warehouses in the middle of April. Anecdotal evidence suggested that Rusal brands of aluminium were being dumped onto the LME. This build-up was immediately followed by accelerated buying by manufacturers, which aimed to increase their inventories in speculation of future price hikes and supply shortages. The finding was corroborated by aluminium PMI data, which showed that stocks of purchases growth accelerated in April, extending the longest phase of accumulation in seven years.

Future outlook

Whilst there is evidence of both fundamental and speculative pricing influence on the supply side, demand growth for the light metal remains weak in key markets. Furthermore, tightening monetary policy in the US and a stronger dollar will likely keep aluminium prices in check.

PMI data provide guide to metals demand fundamentals

Using data from our survey panels across Asia, Europe and the US, IHS Markit produce data tracking trends at copper, aluminium and steel intensive goods producers. Data cover indexes for output, new orders, new export orders, input purchasing, stock holdings, prices, vendor delivery times and employment.

The aluminium PMI data are derived from monthly information provided by around 1500 aluminium users across the world.

For further information on commodities PMI data, please contact economics@ihsmarkit.com

Sam Teague, Economist, IHS Markit

Tel: +44 1491 461 018

Email: sam.teague@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-headwind-to-aluminium-prices.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-headwind-to-aluminium-prices.html&text=PMI+signals+headwind+to+aluminium+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-headwind-to-aluminium-prices.html","enabled":true},{"name":"email","url":"?subject=PMI signals headwind to aluminium prices | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-headwind-to-aluminium-prices.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+signals+headwind+to+aluminium+prices+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-signals-headwind-to-aluminium-prices.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}