Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 12, 2019

Softer growth of Malaysian industrial output points to slower GDP expansion

- Industrial production growth almost halves in February (1.7%) from January (3.2%)

- Manufacturing production also rises at a slower pace

- Nikkei PMI highlight deteriorating factory trend but also report a brightening outlook

Official data brought more news of a growth slowdown in the Malaysian economy, with signs that a combination of a weaker external environment and easing domestic demand is weighing on economic activity.

Industrial output growth eases sharply

According to official statistics, industrial production grew 1.7% compared to a year ago in February, down from 3.2% in January. The latest growth was among the weakest since 2015, but broadly in line with economists' expectations.

Factory output growth was largely supported by the manufacturing and electricity generation sectors, while mining production contracted by 5%, marking a second straight month of decline. Manufacturing output growth nonetheless eased to 3.7%.

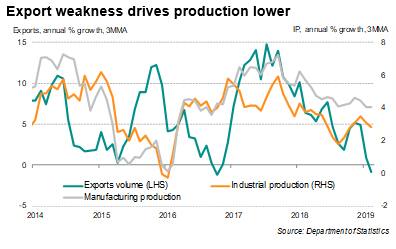

The average of the first two months of the year for factory output provided a clear look at the underlying trend for industry. At 2.5% so far in the first quarter of 2019, growth is down from 3.5% in the final three months of 2018. The expansion of manufacturing output at 3.9% so far this year was the softest since the third quarter of 2016, painting a picture of weakening expansion in the manufacturing sector.

Slower growth in first quarter

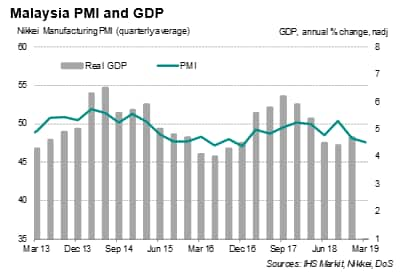

The weakening trend seen in the industrial production data add further to evidence that the Malaysian economy could grow at a slower pace this year. IHS Markit forecasts full-year GDP growth of 4.4% for 2019, down from 4.7% in 2018.

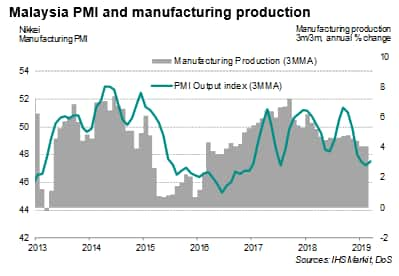

The official data followed survey data which showed Malaysian manufacturing companies reporting increasing headwinds on current business activity in March. The Nikkei PMI, compiled by IHS Markit, indicated that several key survey gauges, including manufacturing output, fell at the end of March.

However, when compared against official measures, the PMI is still broadly indicative of the economy growing at an annual rate of 4.0-4.5%, with manufacturing output increasing at an annual pace of just under 4%. (Note that, as with many other fast-growing economies, the PMI indices in Malaysia have to drop much further below 50 to signal either a contracting manufacturing sector or a decline in GDP.)

The poor manufacturing survey results partly reflected a deteriorating export trend, which is consistent with current global trade developments.

Brighter outlook

The PMI survey data also bring some encouraging signs for the Malaysian economy, adding to hopes that the recent slowdown in manufacturing will start to ease in coming months. The March survey found companies had become more optimistic about the year ahead, with expectations of future output growth rising to the highest for nearly a year. Gauges of purchasing and inventories also came off recent lows, suggesting companies are starting to plan for improved demand in the coming months.

Central bank policy

While there is increasing talk in Malaysia of a rate cut, consistent with a broad shift in central banks' policy stance across the world, we think that conditions need to worsen substantially to warrant policy easing. We continue to hold the view that Bank Negara Malaysia will leave monetary policy on hold throughout 2019.

Nonetheless, the outlook remains uncertain amid trade frictions and weak global demand. Therefore, a close monitoring of economic data in the months ahead, PMI surveys in particular, given their timely release, is crucial.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsofter-growth-of-malaysian-industrial-output-points-to-slower-gdp-expansion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsofter-growth-of-malaysian-industrial-output-points-to-slower-gdp-expansion.html&text=Softer+growth+of+Malaysian+industrial+output+points+to+slower+GDP+expansion+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsofter-growth-of-malaysian-industrial-output-points-to-slower-gdp-expansion.html","enabled":true},{"name":"email","url":"?subject=Softer growth of Malaysian industrial output points to slower GDP expansion | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsofter-growth-of-malaysian-industrial-output-points-to-slower-gdp-expansion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Softer+growth+of+Malaysian+industrial+output+points+to+slower+GDP+expansion+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsofter-growth-of-malaysian-industrial-output-points-to-slower-gdp-expansion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}