Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 04, 2018

PMI slips to 17-month low as Japan’s economic upturn loses steam

- At 51.3 in March, composite PMI dips to lowest since October 2016

- Stretched supply chains weigh on output growth

- Rising costs continue to push companies to raise selling prices

Growth of Japanese business activity was the slowest since October 2016 at the end of the first quarter, according to the latest Nikkei PMI data, with the rate of expansion slowing for a second successive month. While the overall picture remains positive, the survey sub-indices suggest that economic activity will slow further in coming months.

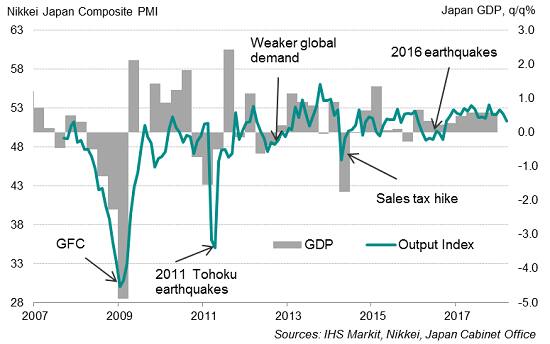

Robust first quarter

The Nikkei Japan Composite PMI™ Output Index slipped from 52.2 in February to 51.3 in March, indicating only a modest rate of improvement in the health of the economy. The latest reading was the weakest for almost one-and-a-half years. Despite the dip in March, the first quarter average PMI reading was relatively robust, indicative of quarterly GDP rising by around 0.4-0.5%.

Japan PMI and economic growth

Broad-based slowdown

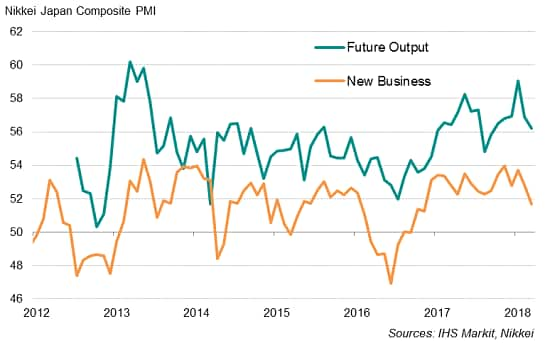

March saw factory output grow at the slowest pace for eight months, while services business activity increased at the weakest rate since October 2016, rising only marginally. The slowdown in business activity growth was accompanied by softer increases in new orders in both sectors. Notably, goods export orders showed the smallest rise for five months.

Measured overall, the composite PMI’s gauge of new orders registered the smallest monthly increase for nearly one-and-a-half years. Confidence about the business outlook in the year ahead meanwhile dipped to a six-month low.

Forward-looking PMI indicators

With the current upturn having now been running for six consecutive quarters (according to the PMI), some cooling of demand is perhaps only to be expected.

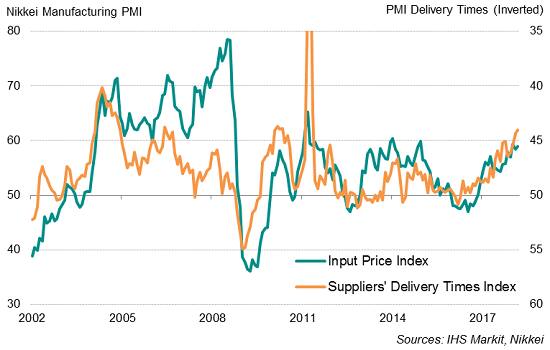

Furthermore, the sustained upturn in demand is taking an increasing toll on supply chains, with delivery times reportedly showing the longest lengthening since the 2011 earthquakes during March. Supply chain delays and global shortages in raw materials could very well weigh on production capabilities in coming months.

Manufacturing supply delays and input prices

Price pressures

One of the side effects of stretched supply chains is increased costs. With demand exceeding supply, pricing power has been increasingly vested in the hands of vendors. As a result, manufacturers continued to face sharp cost increases during March. While easing further from January’s recent peak, overall input cost inflation remained among the highest seen in recent years. Higher prices for food, fuel and industrial metals, such as steel, aluminium and copper, were widely reported. Service providers also pointed to wage inflation as the labour market tightened.

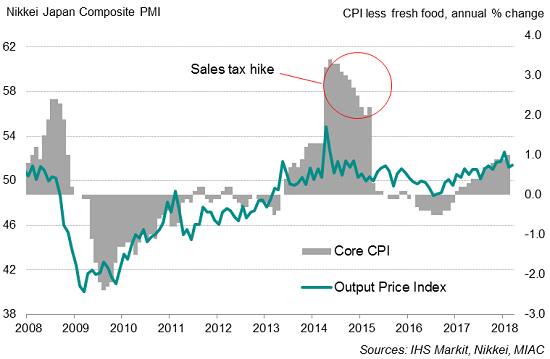

Japan PMI and core inflation

Robust demand conditions enabled companies to raise selling prices to protect margins. The rate of selling price inflation remains well above its historical average, boding well for the Bank of Japan’s efforts to re-inflate the economy. However, the recent appreciation in the yen may dampen imported inflationary forces, which in turn, could make it more difficult for Japan to reach its inflation target.

Recent yen appreciation

Monetary policy

BOJ governor Kuroda said recently that the ‘powerful’ monetary easing will continue until the 2.0% inflation target is met, which he expects to take place next year. Core consumer inflation ticked up to 1.0% in February, still falling short of BOJ’s inflation goal. As such, changes to Japan’s monetary policy are unlikely to be seen any time soon.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fslips-economic-upturn-loses.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fslips-economic-upturn-loses.html&text=PMI+slips+to+17-month+low+as+Japan%e2%80%99s+economic+upturn+loses+steam","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fslips-economic-upturn-loses.html","enabled":true},{"name":"email","url":"?subject=PMI slips to 17-month low as Japan’s economic upturn loses steam&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fslips-economic-upturn-loses.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+slips+to+17-month+low+as+Japan%e2%80%99s+economic+upturn+loses+steam http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fslips-economic-upturn-loses.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}