Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 03, 2018

Muted UK PMI rebound indicates tepid economic growth at start of second quarter

- 'All-sector' PMI shows muted rebound in April, index at third-lowest since EU referendum

- Employment growth slows as businesses cite weaker demand growth and uncertain outlook

- Price pressures cool

Business activity picked up only modestly in April after being disrupted by heavy snowfall in March, according to the latest PMI data, indicating that the rate of economic growth remained subdued at the start of the second quarter.

The April survey also brought signs that jobs growth has slowed and inflationary pressures have eased, suggesting that policymakers will back away from any imminent hiking of interest rates. Any further slowing will also raise questions as to whether the November rate hike may have been ill-timed.

Muted rebound from snow-hit March

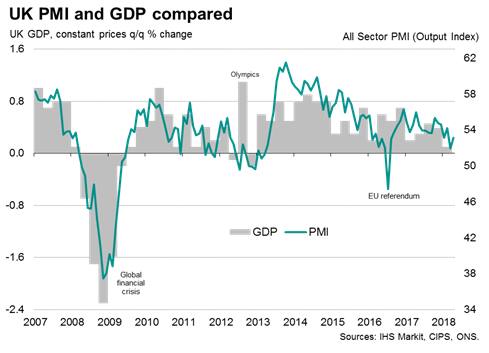

The expansion signalled by the April IHS Markit/CIPS PMI surveys was the third-weakest since the immediate fall-out from the 2016 Brexit vote. At 53.2, the 'all-sector' output index failed to recover the ground lost in March, when the PMI sank to 51.9 from 54.2 in February, underscoring how the economy has slowed since late last year.

While anecdotal evidence collected from surveyed companies indicated that the weak PMI numbers in March were in part attributable to business being disrupted by heavy snowfall, no such adverse factors were reported in April. The surveys have instead indicated that sales, investment and hiring are being hit by uncertainty about the economic outlook as well as sluggish domestic demand, notably among consumers.

The latest index reading is historically consistent with the economy growing at a quarterly rate of around 0.2% at the start of the second quarter.

The sluggish start to the second quarter comes after disappointing first quarter economic growth, initially estimated by the Office for National Statistics at just 0.1%. The PMI had indicated an expansion of 0.3%.

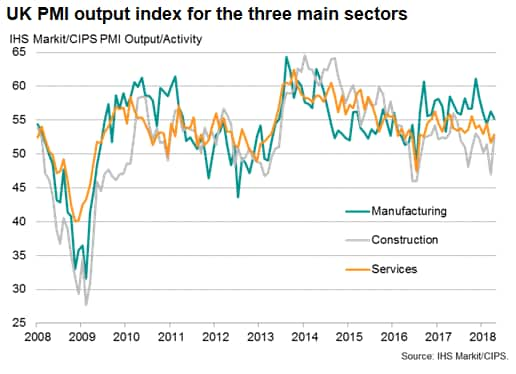

The strongest rebound was seen in the construction sector, which saw the largest monthly output rise since November after a sharp decline in March. Services growth also accelerated but, after March's low, was the second-weakest seen for over one-and-a-half years. Within services, the worst performances were again seen in consumer-facing parts of the economy, notably hotels and restaurants. The strongest expansion was seen in financial services. Manufacturing meanwhile lost momentum, with output rising at the second-slowest rate for just over a year.

Business expectations about the year ahead also recovered during April, rising to a three-month high on the back of improved outlooks in services and construction. Manufacturing optimism waned, however, dropping to a five-month low.

Jobs growth hit by subdued order books

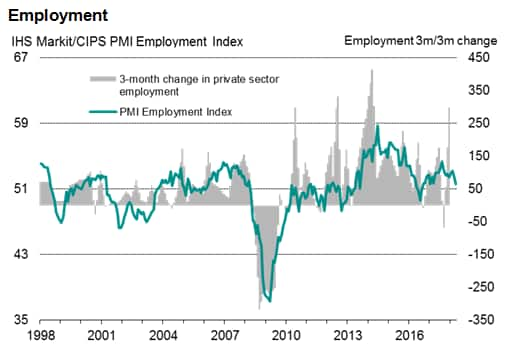

Despite the rebounds in current and expected output, job creation slipped to the lowest since January 2017, weakening across the board as businesses scaled back expansion plans.

The slippage in employment growth in part reflected a renewed drop in order book backlogs in both manufacturing and services, which indicated that existing capacity was more than sufficient to cope with current inflows of work. While new business inflows picked up slightly from March's 20-month low, the rise was the second-weakest since the slump in demand seen in the aftermath of the Brexit vote.

Cooling price pressures

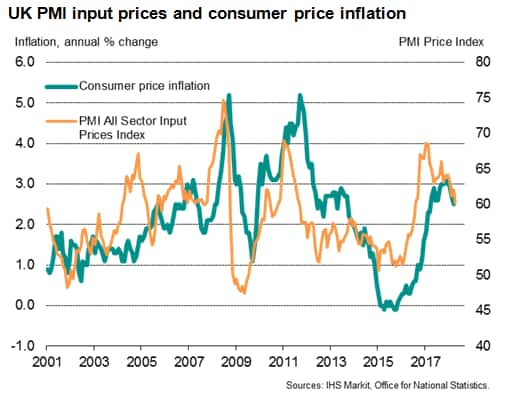

The surveys also indicate how price pressures have continued to cool, albeit with the rates of increase remaining elevated by historical standards. Average input costs showed the smallest rise since July 2016, while selling prices rose at the weakest rate for eight months. Both measures have eased markedly since the highs of late last year, but the still-elevated readings suggest that the downward trajectory of consumer price inflation may prove only gradual, especially with the recent rise in oil prices likely to exert upward pressure in coming months. However, the signal from the PMI surveys is that core price pressures are cooling amid sluggish demand and the waning impact of the weakened pound.

Looser policy bias signalled

Two of the Bank of England's nine Monetary Policy Committee members voted for higher interest rates at the April policy meeting, raising the odds of policy being tightened at the May meeting to a near certainty at one point. However, since then disappointing GDP numbers, weaker than expected inflation data and relatively subdued survey indicators for April have fuelled expectations that the Bank will pull-back from hiking. The lack of rebound in the services survey will further add to expectations that the MPC will take its finger firmly off the rate hike trigger.

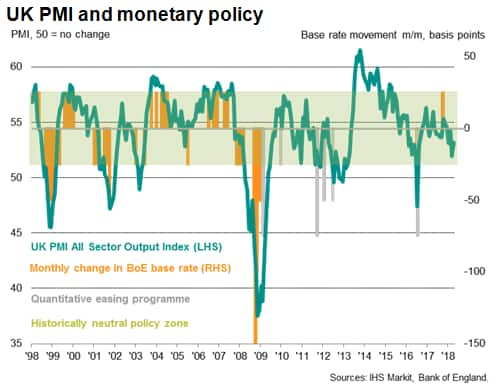

Historical comparisons with monetary policy decisions in fact suggest that the current all-sector PMI reading is more consistent with an easing rather than tightening bias, though is not yet low enough to be in territory normally associated with interest rates being cut.

The speed with which the economy appears to have slowed and inflation cooled so far this year also raises questions regarding the November rate hike, which had been the first in a decade. As we noted at the time, that first rate hike since the global financial crisis was unusual, given the weakness of growth being signalled by the surveys. The all-sector PMI stood at 55.3 with an average of just 54.2 in the most recent three months. Previous interest rates hikes (since 1999) had only occurred when the all-sector PMI had been above 56.5.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-uk-pmi-rebound-indicates-tepid-economic-growth-at-start-of-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-uk-pmi-rebound-indicates-tepid-economic-growth-at-start-of-second-quarter.html&text=Muted+UK+PMI+rebound+indicates+tepid+economic+growth+at+start+of+second+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-uk-pmi-rebound-indicates-tepid-economic-growth-at-start-of-second-quarter.html","enabled":true},{"name":"email","url":"?subject=Muted UK PMI rebound indicates tepid economic growth at start of second quarter | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-uk-pmi-rebound-indicates-tepid-economic-growth-at-start-of-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Muted+UK+PMI+rebound+indicates+tepid+economic+growth+at+start+of+second+quarter+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-uk-pmi-rebound-indicates-tepid-economic-growth-at-start-of-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}