Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 04, 2018

Muted PMI leaves global economy in lower gear

- Global PMI signals economic growth stuck in lower gear after subdued April rebound

- Hiring and order book growth remain solid

- US closes the gap with eurozone, also sees highest price pressures

After a brief spell of excitement at the start of the year, PMI survey data indicate that global economic growth has settled into a lower (but still robust) pace in recent months. Growth trends also appear to be changing, with the US showing increasing signs of driving the global expansion while European growth cools.

Price pressures also remain elevated, with the US seeing the steepest rate of increase of the largest developed economies.

Steady growth and buoyant hiring

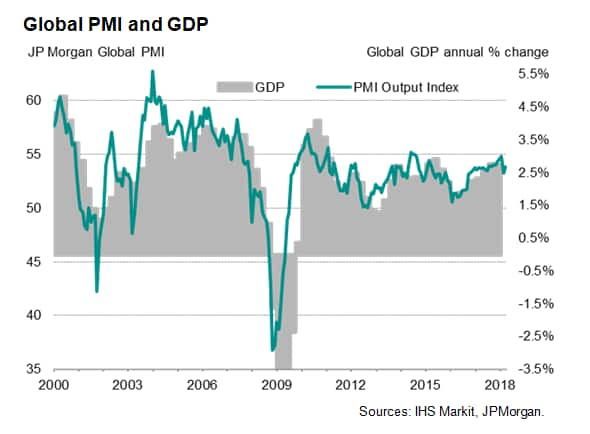

At 53.8 in April, the headline JPMorgan Global Composite PMI, compiled by IHS Markit, failed to regain even half of the 1.5 point drop seen in March, leaving the rate of growth lower than recorded earlier in the year. The rate of increase was nevertheless in line with the average over 2017. As such, the PMI is consistent with global GDP rising at a reasonably solid annual rate of just over 2.5% (at market exchange rates) at the start of the second quarter.

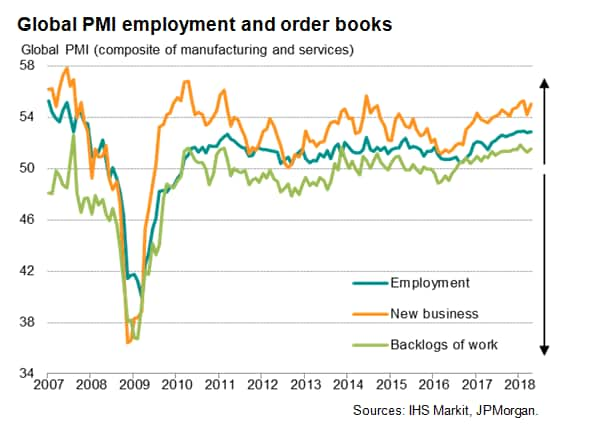

Encouragingly, new business inflows picked up pace again, albeit also slightly below recent peaks, leading to a further increase in backlogs of work. Global employment growth was meanwhile the joint-highest seen over the past decade as firms expanded capacity to meet fuller order books.

The strength of new order growth and job creation at the global level further highlights the robust health of the global economy, even if the overall pace of expansion has slowed since earlier in the year.

It should also be noted that at least some of the slowdown was in part attributable to supply side constraints, including skill shortages and delivery delays for certain inputs, in turn reflecting the recent surge in demand for both employees and raw materials.

Suppliers' delivery times showed the highest incidence of worldwide supply chain delays for seven years.

US closes gap with eurozone

Muted rebounds were seen in both manufacturing and services, and likewise in the headline PMI readings for developed and emerging markets. However, the drivers of growth have changed in recent months.

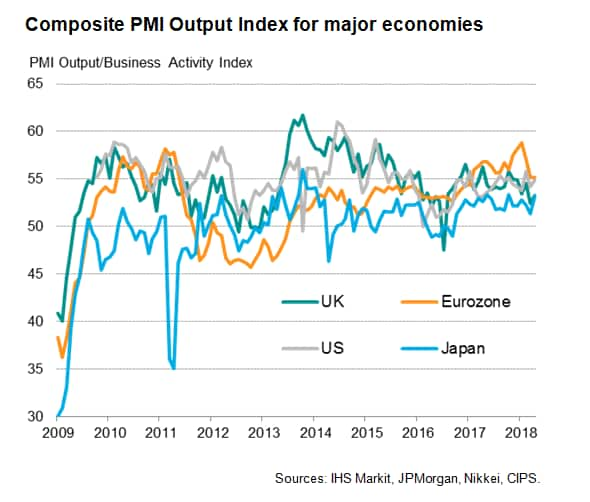

In the developed world, slower growth in the eurozone compared to earlier in the year means the US has closed the gap on the single currency area. The IHS Markit US surveys showed growth accelerated slightly in April while the eurozone has seen growth slacken off from strong rates at the turn of the year.

The UK and Japan continued to lag behind, with the UK seeing growth fade to the second-lowest since the Brexit vote. While relatively weak, the Nikkei PMI nevertheless showed Japan enjoying its strongest expansion for six months.

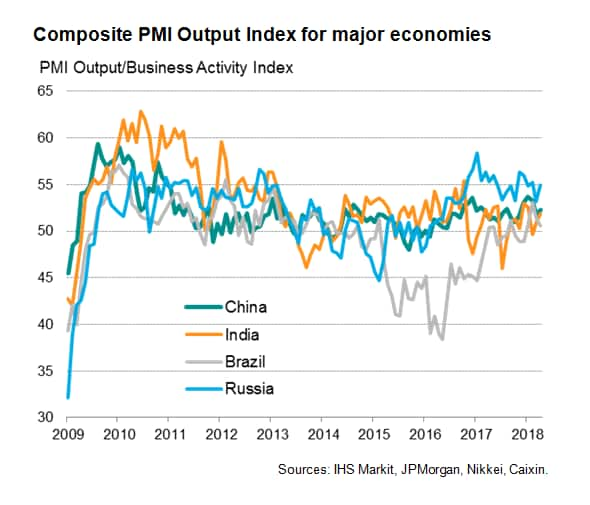

In the emerging markets, growth ticked higher in Russia, China and India to provide welcome news that economic growth has started on a solid footing at the start of the second quarter in all three cases. However, rates of expansion remained below peaks seen at the turn of the year, due in part to weakened export performances. Brazil meanwhile saw growth slide to a four-month low, but the survey data continue to indicate on-going economic recovery.

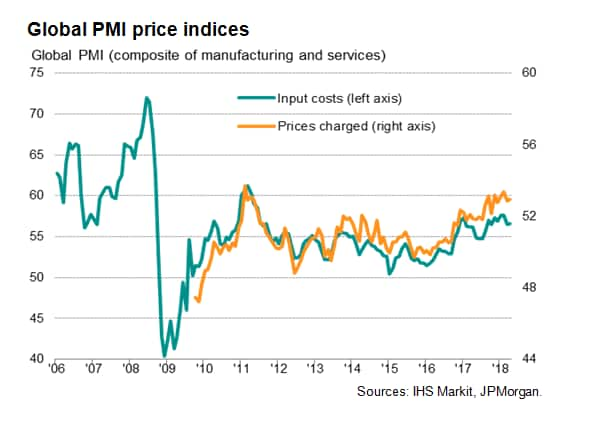

Price pressures pick up, led by the US

The global upturn was once again accompanied by rising price pressures, in the form of both higher costs and increased selling prices for goods and services. The latter has dipped since earlier in 2018 but is notable in that it remains among the highest seen over the past seven years.

For the first time since 2015, the US reported the highest rate of selling price inflation of the four largest developed economies. Inflation measures meanwhile cooled in both the eurozone and UK but remained elevated. Prices showed a more modest increase in Japan, though the rate of increase remained relatively strong by recent years' standards.

Data suggest US Fed is only major central bank on course for further tightening

The accelerating pace of growth signalled in the IHS Markit US surveys and accompanying rise in price pressures adds to expectations that the Fed will hike interest rates at least another two times in 2018.

The slowdown in the UK PMI surveys was meanwhile a key contributor to analysts' revised expectations that the Bank of England will hold off on any imminent further tightening of policy.

In Japan, the PMI data added to signs that the economy remains on a steady growth path, but price pressures remain modest relative to the Bank of Japan's target. Similarly, in the eurozone, the drop in the PMI surveys adds a note of caution to the ECB's outlook for the region, especially with input cost price pressures failing to feed through to core inflation.

May's PMI data will therefore provide important updates as to whether growth has continued to cool in the eurozone and UK, and whether the US is forging ahead.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-global-pmi-leaves-global-economy-in-lower-gear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-global-pmi-leaves-global-economy-in-lower-gear.html&text=Muted+PMI+leaves+global+economy+in+lower+gear+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-global-pmi-leaves-global-economy-in-lower-gear.html","enabled":true},{"name":"email","url":"?subject=Muted PMI leaves global economy in lower gear | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-global-pmi-leaves-global-economy-in-lower-gear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Muted+PMI+leaves+global+economy+in+lower+gear+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmuted-global-pmi-leaves-global-economy-in-lower-gear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}