Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 11, 2019

Jamaica to exit IMF agreement with above-average growth

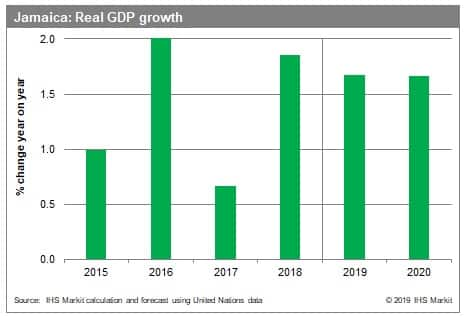

- Since cooperation with the IMF began in 2016, Jamaica has reduced its debt-to-GDP ratio to 94%, versus a peak of 135% in 2013, and achieved 1.9% growth in 2018, versus an average of 0.7% in the five preceding years.

- The Director General of the Planning Institute of Jamaica, Wayne Henry highlighted the importance of maintaining macroeconomic policy stability as a safeguard against slower global growth.

- IHS Markit forecasts growth to slow moderately to 1.7% growth in 2019 due to weaker external support. First-quarter 2019 growth averaged 1.7% year on year, supported by improving business conditions, rising consumer confidence, and strong growth in the tourism, construction, and mining sectors. Downside risks are related to global trade uncertainty, which threatens to reduce tourism and financial flows, or lower aluminium prices.

Domestically, there is also a risk of contract instability in the aluminium sector. There is a possibility for environmental disputes in the Cockpit Country boundaries, which are backed by the main opposition People's National Party (PNP). Furthermore, the USD360-million aluminium refinery in St Elizabeth, owned by Chinese company JISCO, faces labor-strike risks and subsequent operational disruptions over dismissals in July 2019, as well as contract reviews over its financial stability.

The IMF SBA officially ends in September 2019, however, the government plans to continue working with IMF teams until 2021. The government of President Andrew Holness is committed to continuing the Economic Reform Program. Next steps include increasing central bank independence, establishing an inflation target, developing a natural disaster financing framework, and creating an independent fiscal council to oversee the goal of reducing the debt-to-GDP ratio from 94% to 60% by 2026 (as mandated by the Fiscal Responsibility Law, adopted in 2010 and revised in 2014).

Fiscal stability will depend on the government's ability to maintain a sustainable public-sector wage bill, which makes up the second greatest allocation component in the fiscal year (FY) 2019/20 budget. In 2018, the government signed a wage agreement (applicable for 2017-2021), for a gradual 16% increase over the four-year period with unions, who represent 95% of all public-sector employees. IHS Markit expects annual inflation to be unchanged in 2019 at 3.7%, but gradually to increase to 4.4% in 2021 due to a supportive monetary policy that will boost domestic demand. Higher inflation will increase the risk of unions demanding higher wage increases, in turn threatening the feasibility of the government's fiscal targets by increasing public spending.

Furthermore, should the government dismiss public-sector workers to downsize the sector, the risk of labor strikes would increase. A mitigating risk factor for the sustainability of government finances would be the continued privatization of energy and tourism projects, freeing up government funds by engaging the private sector in funding key projects. Recent successful privatizations include Norman Manley International Airport, the Kingston Container Terminal, and the Wigton Wind Farm.

We expect several additional public-private partnerships to take place in the short term through the Development Bank of Jamaica.

Tax changes likely to be narrow and project-specific ahead of 2021 elections. To consolidate its popularity ahead of the general elections in 2021, the ruling Jamaica Labor Party (JLP) government is likely to introduce only very limited and project-specific taxes so as to seek to generally promote new business in Jamaica. For example, the government said in July that it would be likely to impose fees on Airbnb (and not on Airbnb property operators), for which it has signed a memorandum of understanding that includes co-operation to promote and protect the tourism sector.

Indicators of changing risk environment

Increasing risk

- Successful legal campaigning by NGOS and opposition leaders resulting in contract alterations or cancellations of mining projects within contested Cockpit Country boundaries, raising risks of mining-sector downturn.

- Unsustainable spending on social security or infrastructure projects, or on the public-sector wage bill due to higher wage demands caused by higher than expected inflation, resulting in a higher likelihood of tax increases after the elections in 2021.

- Fall in global aluminium prices undermining export earnings and hindering achievement of fiscal policy targets.

Decreasing risk

- September leadership contests generate divisions within the opposition party, making it less likely to co-ordinate campaigns against mining in the contested Cockpit Country boundaries, reducing the risk of state contract alteration and economic instability.

- Rising global aluminium prices improve government revenues, reducing the need for government spending cuts or increased taxes.

- Confirmation of successful tenders for the privatization of previously state-owned assets, increasing probability of economic diversification and stabilized growth by increasing financing for important infrastructure projects.

Posted 11 September 2019

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjamaica-to-exit-imf-agreement-with-aboveaverage-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjamaica-to-exit-imf-agreement-with-aboveaverage-growth.html&text=Jamaica+to+exit+IMF+agreement+with+above-average+growth+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjamaica-to-exit-imf-agreement-with-aboveaverage-growth.html","enabled":true},{"name":"email","url":"?subject=Jamaica to exit IMF agreement with above-average growth | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjamaica-to-exit-imf-agreement-with-aboveaverage-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Jamaica+to+exit+IMF+agreement+with+above-average+growth+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjamaica-to-exit-imf-agreement-with-aboveaverage-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}