Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 11, 2019

Higher nickel prices are here to stay

Nickel markets have been roiled by the announcement that the Indonesian government would bring forward a ban on nickel ore exports from 2022 to January 2020. Rumors had been swirling since July that the Indonesian government would bring forward a ban on nickel ore exports from 2022. Nickel prices on both the London Metal Exchange (LME) and Shanghai Futures Exchange (SHFE) increased sharply throughout July and August, prior to the official announcement on August 30. The LME nickel spot price jumped by 14% in two trading days following the announcement to settle at $18,622/metric on Monday, 2 September. The LME nickel price has since moderated back below $18,000/metric ton but remains at its highest level since 2014 and sits 56% higher than June's monthly price average of $11,967/metric ton.

Indonesia is a major supplier of nickel ores and concentrates to the global market, accounting for 27% of global mined production in 2018. The Indonesian government initially implemented a ban on unprocessed ore exports in 2014 to incentivize investment in local processing capacity. While a significant amount of refining capacity, primarily financed by Chinese investors, has been built in Indonesia since 2014, China remains the largest source of refined nickel.

Indonesia was previously the largest provider of nickel ore imports for China's domestic nickel refineries. The output, in turn, is used as feedstock for China's sizable stainless steel industry. Imports of nickel ore from the Philippines into China increased in 2014 after the initial Indonesian export ban was put in place. While Chinese imports of nickel ore from Indonesia picked up following Indonesia's ban suspension in 2017, the Philippines remains the dominant source of nickel ore for China. Looking at the next 12-24 months, China's reduced reliance on Indonesian nickel ore suggests less price disruption this time compared with the first ban in 2014.

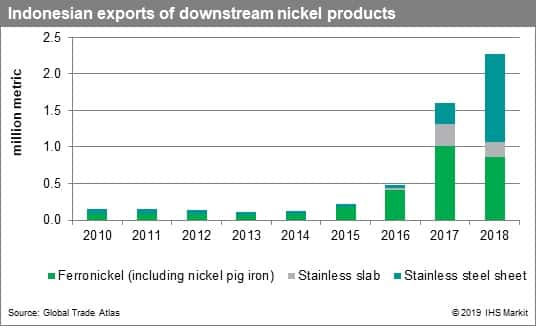

While Indonesia will no longer export nickel ore as of January 2020, it continues to export increasing amounts of nickel pig iron, stainless steel slab, and stainless steel sheet abroad, where China is a main customer. Thus, while Indonesian nickel ore exports will fall, higher exports of higher-value-added downstream nickel products will offset the loss—exactly the Indonesian government's aim.

Given the two-month run-up in prices during July and August over speculation around the Indonesian export ban, our view is the disruption to supply has already been priced-in with little upside risk at this point. Weak demand growth across all major markets along with elevated stainless steel inventories will also act as a headwind.

Bottom line: IHS Markit anticipates the LME nickel price will move moderately lower over the near term once the short covering is completed. We view $15,400/metric ton as a new floor for LME nickel prices and forecast prices to move back down toward this level by year-end.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-nickel-prices-are-here-to-stay.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-nickel-prices-are-here-to-stay.html&text=Higher+nickel+prices+are+here+to+stay+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-nickel-prices-are-here-to-stay.html","enabled":true},{"name":"email","url":"?subject=Higher nickel prices are here to stay | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-nickel-prices-are-here-to-stay.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Higher+nickel+prices+are+here+to+stay+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-nickel-prices-are-here-to-stay.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}