Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2026

Global manufacturing PMI starts 2026 on stronger note, but cost growth hits three-year high

Global manufacturing business conditions improved at a modest but increased pace at the start of 2026, with an especially encouraging rise in the numbers of economies reporting higher production. Total worldwide output growth was the joint-sharpest since June 2024.

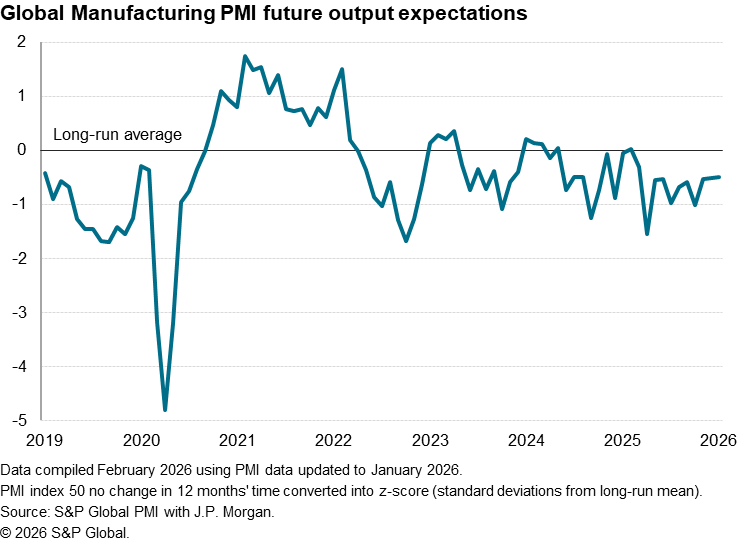

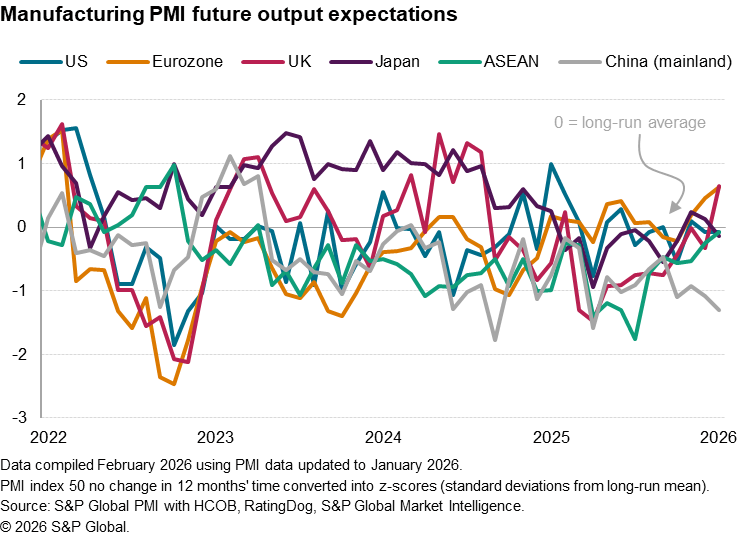

Looking ahead, manufacturing optimism has proven resilient in the face of heightened geopolitical uncertainty at the start of the year, notably in Europe, albeit remaining very subdued by historical standards.

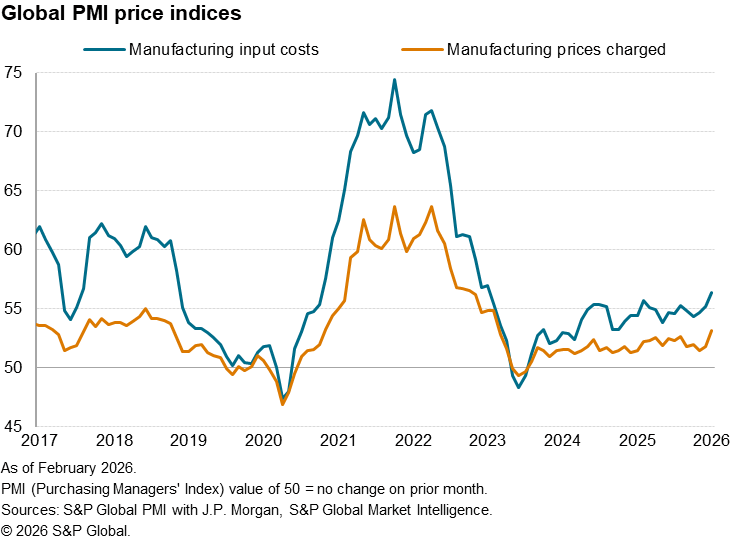

One area of concern to monitor going forward is the recent rise in industrial input prices, notably for metals and energy, itself often driven by geopolitical worries, which has led to the steepest rise in global goods prices for three years.

Manufacturing starts 2026 on solid footing

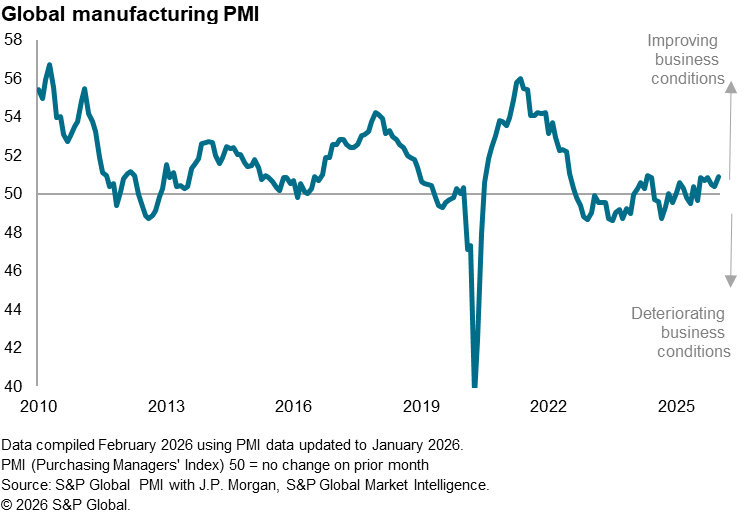

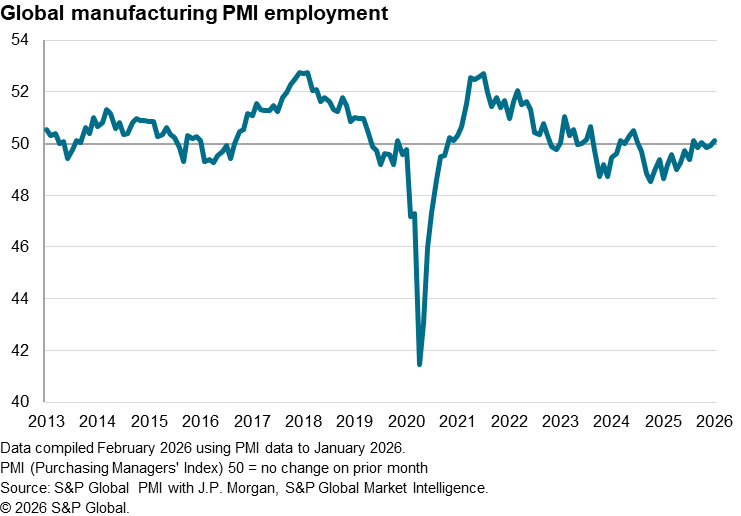

Global manufacturing got off to a modest but encouraging start to 2026, according to PMI data sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence. The headline global manufacturing PMI rose from 50.4 to a three-month high of 50.9, signalling a sustained, albeit subdued, improvement of business conditions for a sixth straight month.

Although the index remains only modestly in expansion territory (i.e. above the 50.0 no change level), the ongoing resilience of the manufacturing sector in the face of heightened geopolitical tensions at the start of 2026 is itself encouraging. Some of the PMI's sub-indices also helped fuel some tentative optimism about the start of the year.

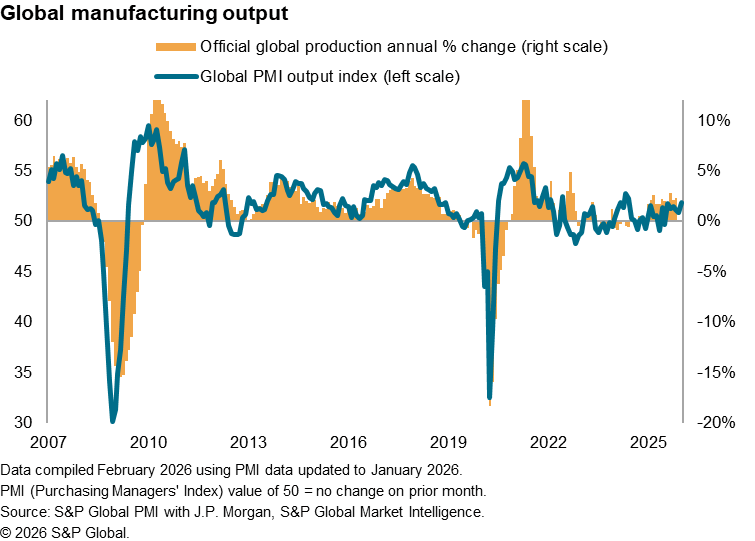

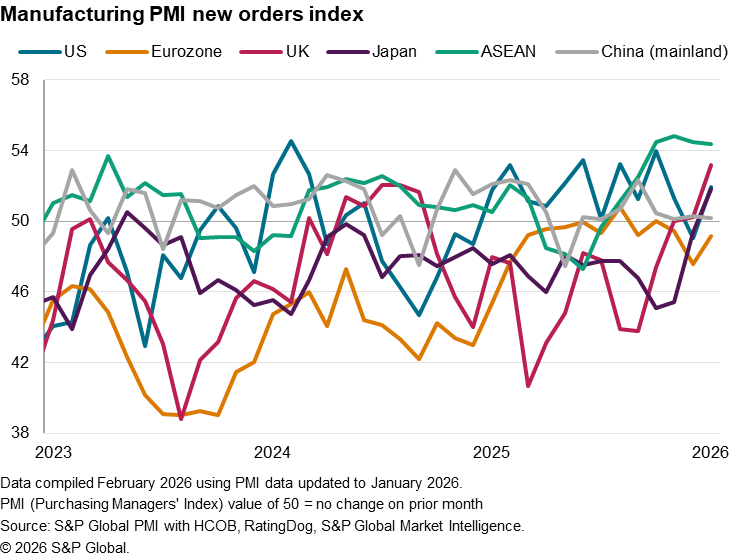

In particular, the PMI's output index, measuring global factory production growth, started 2026 at its joint-highest since June 2024, matched by August 2025. New orders also edged higher at the fastest rate since February of last year, helped in part by a near-steadying of global export orders.

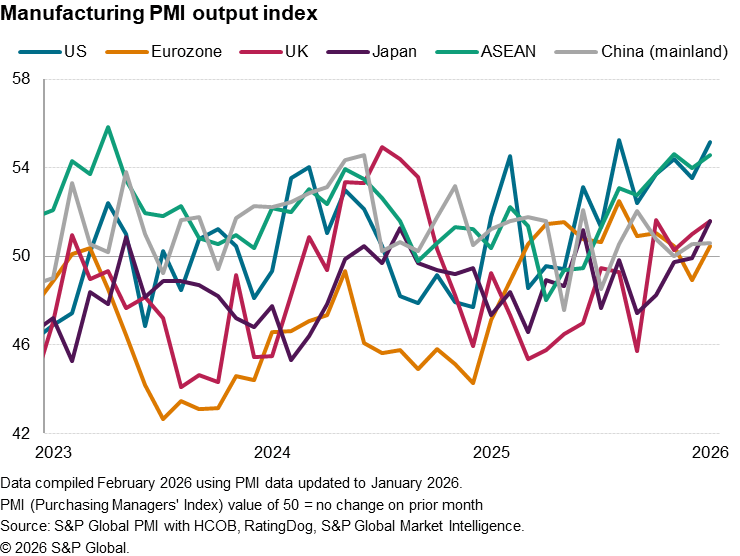

US and ASEAN lead upturn

Looking further into output trends, especially strong gains were seen in India, the US and the ASEAN economies, the latter led by Vietnam. While the Indian expansion follows a general pattern of robust growth in recent years, the US expansion was notable in having not been bettered since March 2022 and the ASEAN increase was the joint-highest since April 2023.

There were other highs also worth noting: output growth in Japan hit a 45-month high, while an 11-month high was seen in Taiwan and South Korea's upturn was the joint-strongest in 17 months, accompanied by a modest sustained upturn in mainland China. In Europe, the UK's expansion was the fastest in 16 months, accompanied by a return to growth in the eurozone.

Even Canada, hard hit by US trade policy, reported a marginal return of production growth for the first time in a year. Australia meanwhile reported one of its best gains seen over the past three years.

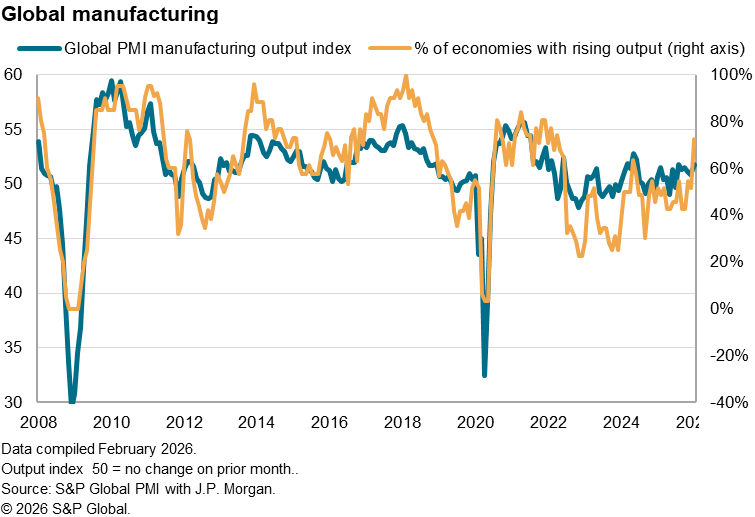

Areas of stress persist, however, including strong downturns in Mexico and Brazil, widely blamed by producers on US tariffs, and in parts of Europe. But nearly three quarters of all economies surveyed reported rising output in January, up from just over half at the end of last year.

Outlook for 2026

Whether this improvement sets the scene for a better performance for manufacturing in 2026 compared to 2025, which saw the global PMI manufacturing output index average just 50.8, is uncertain.

In Europe, increased fiscal spending is anticipated to be a key driver of improved manufacturing performance, benefitting defense-related manufacturers in particular. Interest rates have also fallen in many economies, notably in the US and Europe, in theory helping to stimulate consumer demand and investment. Financial markets gains are also helping via a wealth effect.

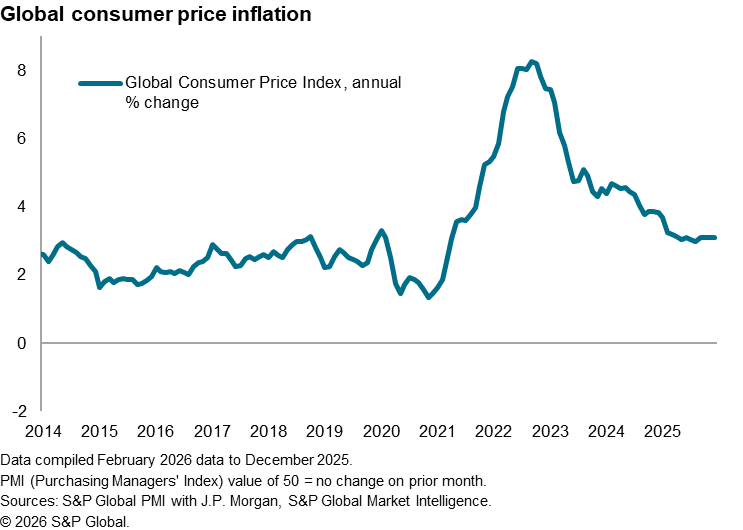

Cost of living pressures have meanwhile eased in many economies compared to this time last year. Global consumer price inflation was running at 3.1% last December, down from 3.7% at the end of 2024 and 4.5% at the end of 2023.

Companies are also adapting to a 'new normal' of uncertainty, building supply chain resilience and diversifying into new markets. Although US tariffs remain a potential headwind to trade growth, we are seeing companies in economies such as mainland China, Canada and across Southeast Asia report new export trading opportunities as companies diversify away from US markets.

Hence business confidence regarding the year-ahead outlook in the manufacturing economy nudged higher globally in January, reaching a ten-month high. However, despite this improvement, confidence remains well below its long run average, principally reflecting heightened uncertainty over the geopolitical environment.

This uncertainty discourages business spending, hiring and investment, dampening any optimism about manufacturing growth in 2026.

Below-par confidence is evident in the US, mainland China, India, Japan and even on average across the ASEAN economy, albeit the latter showing signs of returning to norms, having picked up markedly since last April's US tariff announcements.

However, perhaps most encouraging is the above-par sentiment being witnessed in Europe, potentially signaling a shift in in the global pattern of manufacturing growth over the coming year towards a part of the world that may be reviving after several years of struggle.

Keeping an eye on prices

One further aspect of the manufacturing environment to monitor is prices. Although lower manufacturing price growth helped to reduce consumer price inflation over prior post-pandemic years, 2026 starts with the steepest growth of producer price costs for three years, feeding through to the largest rise in factory gate selling prices for nearly three years.

Even if the US is excluded, which has seen PMI respondents report higher price growth due to import tariffs, global producer input price growth is likewise up to a pace not beaten over the past three years.

Some of this cost growth reflects geopolitics, which have led to a sharp rise in metals prices during January, notably for copper and steel, as well as energy, all of which are key inputs and have the potential to feed through to higher consumer price inflation (in turn dampening interest rate cut expectations) or squeezed profit margins. While this price growth is not yet at a worrying level by historical standards, further increases could become more concerning for the outlook and need to be monitored alongside any accompanying supply chain stress.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-starts-2026-on-stronger-note-feb26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-starts-2026-on-stronger-note-feb26.html&text=Global+manufacturing+PMI+starts+2026+on+stronger+note%2c+but+cost+growth+hits+three-year+high+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-starts-2026-on-stronger-note-feb26.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI starts 2026 on stronger note, but cost growth hits three-year high | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-starts-2026-on-stronger-note-feb26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+starts+2026+on+stronger+note%2c+but+cost+growth+hits+three-year+high+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-starts-2026-on-stronger-note-feb26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}