Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 01, 2023

Global factory output returns to growth amid China's reopening and supply chain improvements

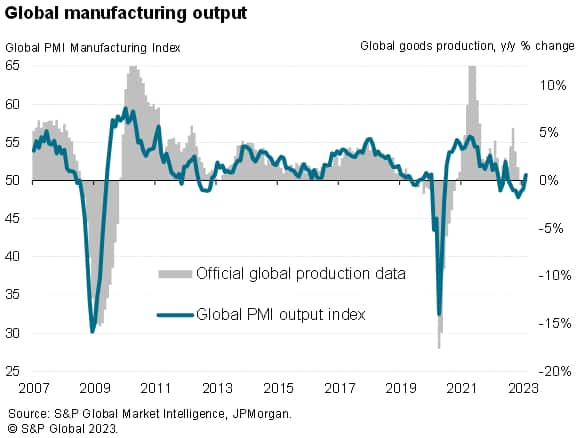

Global manufacturing output returned to growth in February after six months of decline, according to the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global.

The improvement was driven by Asia and coincided with the reopening of the economy of mainland China after the easing of COVID-19 restrictions. Supply constraints eased, with delivery times improving in February to the greatest extent since 2009, facilitating higher output. Demand for both consumer goods and investment goods also revived. Inventory reduction policies meanwhile remained a drag on growth, though even here there were signs of the drag easing.

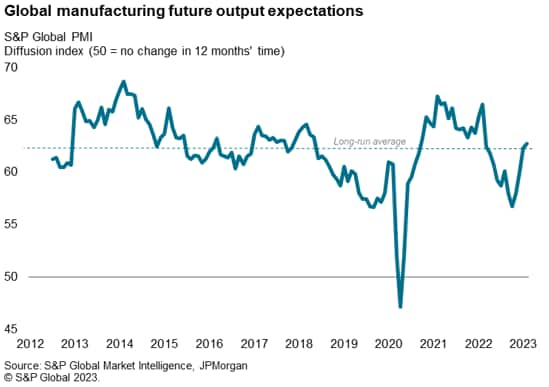

Looking ahead, business confidence moved above its longer run average in February, boding well for the recent improvement in output growth to gain traction in March.

Global factory output returns to growth

Global manufacturing rose in February for the first time in seven months, according to the latest PMI surveys compiled by S&P Global. At 50.8, the JPMorgan Global Manufacturing PMI Output Index rose above the 50.0 threshold which separates contraction from expansion for the first time since last July, hitting its highest since last June. Although still indicating only a modest increase in production, the output index has now risen for three successive months from a low in November which, barring COVID-19 lockdown months, had been the weakest reading since 2009.

Asia leads the revival

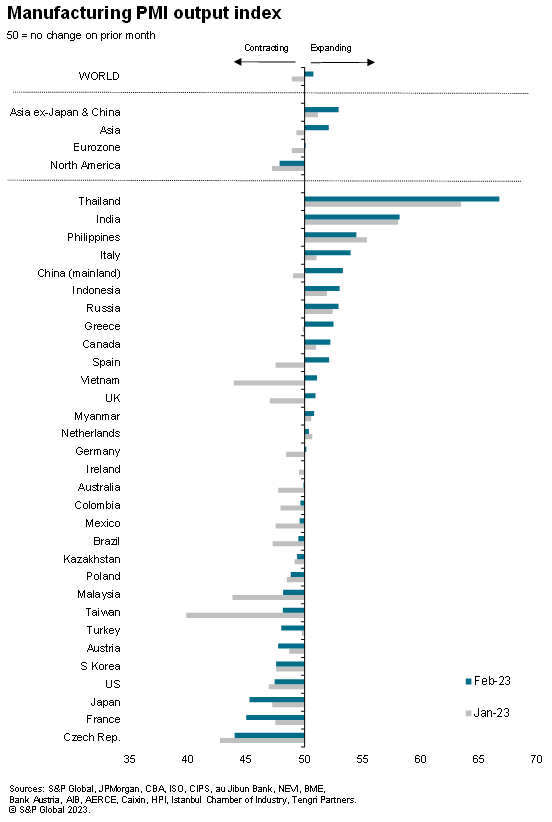

The strongest expansion was recorded in Asia, with global output growth led by Thailand, India and the Philippines for a second successive month. Indonesia also enjoyed a solid expansion while both mainland China and Vietnam returned to growth.

Taiwan meanwhile saw the biggest monthly rise in its output index of all economies monitored, albeit remaining in decline alongside Japan, Malaysia and South Korea, underscoring the ongoing divergent picture of manufacturing trends in Asia. The region as a whole nevertheless returned to growth for the first time in six months.

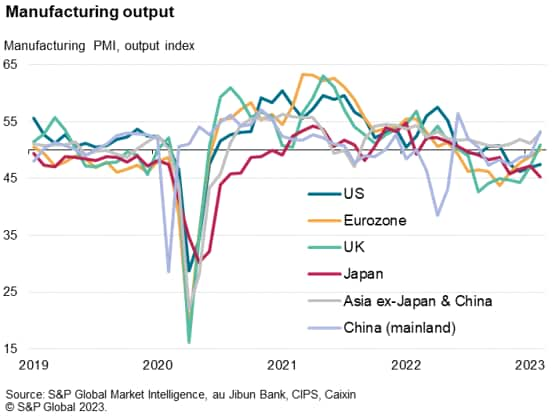

At the other end of the scale, the weakest region in February was North America, where production fell for a fourth straight month, the rate of decline easing only moderately but registering one of the worst performances recorded out of lockdowns since the global financial crisis. Despite seeing some cooling of its downturn, the US sat at fourth from the bottom of the global rankings. More encouragingly, output growth gathered some momentum in Canada, and Mexico reported only a marginal contraction.

Signs of manufacturing downturns ending were also evident in Europe. The Eurozone stabilised after contracting for eight months with a marginal increase in production during February, and a modest expansion was seen in the UK for the first time in eight months.

Central and eastern Europe remained under pressure due to the proximity of the Ukraine war, however, with the Czech Republic reporting the steepest decline of all countries monitored.

Supply chains improve to greatest extent since 2009

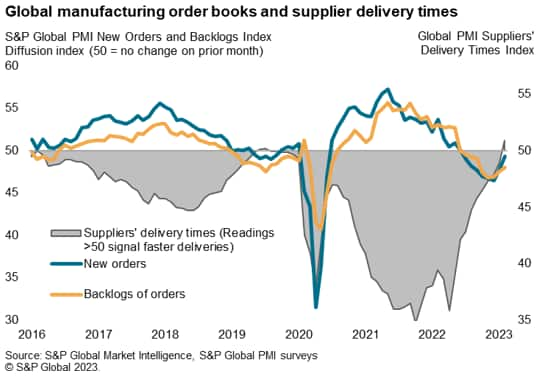

Facilitating the return to growth of output was an easing of supply chain constraints, which had severely restrained production during much of the pandemic and led to rising backlogs of work. In February, in contrast, average supplier delivery times shortened for the first time since July 2019, quickening to a degree not seen since June 2009. These improved delivery schedules have permitted higher production, notably in the US, Europe and of course in mainland China, following the easing of COVID-19 restrictions.

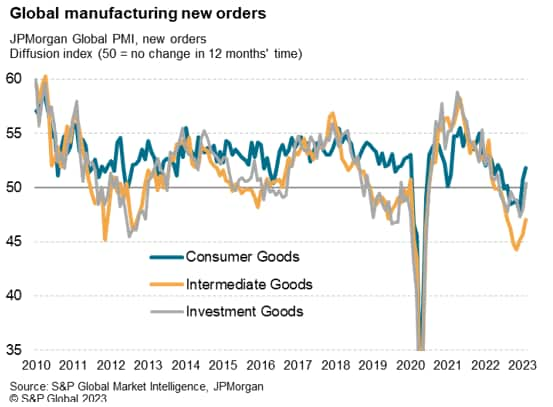

Less encouraging was the continued decline in new orders recorded globally in February, hinting at persistent weak demand, though the rate of decline did ease to the slowest in the recent eight-month downturn thanks to a robust gain in new orders for consumer goods and a more muted rise in demand for investment goods, such as machinery and equipment.

Inventory drag

The biggest drag remained that of falling demand for intermediate goods, which are manufactured goods supplied to other factories as inputs. Examples include car tyres, batteries, steel fabrications etc.

This drop in intermediate goods demand in turn partly reflected ongoing efforts by factories to reduce inventories. Globally, purchases of inputs fell for a seventh straight month in February, allowing inventories of inputs to fall for a fourth month running. Stocks of finished goods likewise fell, largely fueled by deliberate cost-cutting inventory reduction policies. The good news, however, was that both the rate of decline of input buying and inventory reduction eased during the month, hinting at an easing drag from the inventory cycle.

Brighter outlook

This nascent shift away from destocking, as well as the reduced overall downturn in new orders and lift in output, could also be traced to a further uptick in business confidence about the year ahead. Output expectations in fact rose for a fourth successive month. The rise pushed sentiment above the survey's long-run average for the first time since last March, albeit gaining much less ground than the rise seen in January, when sentiment had been buoyed by the news of China's reopening. The further upturn in confidence nevertheless bodes well for the manufacturing upturn to gain some additional momentum in March.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-returns-to-growth-amid-chinas-reopening-and-supply-chain-improvements-February2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-returns-to-growth-amid-chinas-reopening-and-supply-chain-improvements-February2023.html&text=Global+factory+output+returns+to+growth+amid+China%27s+reopening+and+supply+chain+improvements+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-returns-to-growth-amid-chinas-reopening-and-supply-chain-improvements-February2023.html","enabled":true},{"name":"email","url":"?subject=Global factory output returns to growth amid China's reopening and supply chain improvements | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-returns-to-growth-amid-chinas-reopening-and-supply-chain-improvements-February2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factory+output+returns+to+growth+amid+China%27s+reopening+and+supply+chain+improvements+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-returns-to-growth-amid-chinas-reopening-and-supply-chain-improvements-February2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}