Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2018

Eurozone settles into lower gear

- Flash PMI unchanged in April, signals slowest expansion since start of 2017

- Surveys still indicative of solid c0.6% GDP growth

- Softer rises in new orders and export sales, plus lower optimism, suggests growth could weaken in May

The eurozone economy remained stuck in a lower gear in April, with business activity expanding at a rate unchanged in March, which had in turn been the slowest since the start of 2017.

The IHS Markit Eurozone PMI held steady at 55.2 in April, according to flash survey data, which are based on an early-cut of approximately 80% of final responses. The unchanged reading indicated the joint-weakest expansion of business output since the start of 2017, but remained well above the average of 53.8 seen over the past five years.

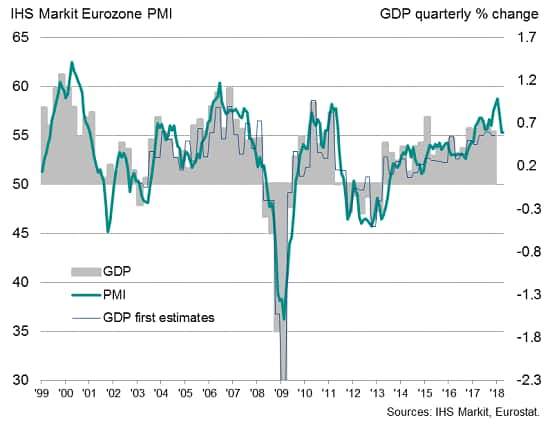

While the survey data indicate that growth has downshifted markedly since the peak at the start of the year, importantly the rate of expansion still remains impressively robust, and not just by eurozone standards. The April data are running at a level broadly consistent with eurozone GDP growth of 0.6% at the start of the second quarter.

Eurozone PMI v GDP estimates

The decline in the PMI from January's high is neither surprising nor alarming: such strong growth as that seen at the start of the year rarely persists for long, as supply fails to keep up with demand. With the PMI data for recent months registering record numbers of delivery delays for inputs to factories, as well as reports of growing skill shortages, output is clearly being constrained. In France, strikes were also reported to have disrupted growth in April, and may continue to do so in coming months.

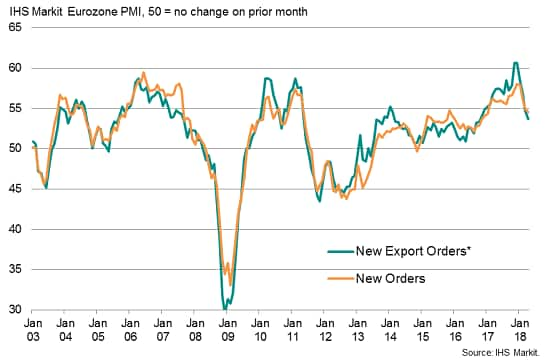

However, it's also clear that underlying demand has weakened, in part due to exports being hit by the stronger euro. Factories reported the smallest gains in both total goods orders and export orders for a year-and-a-half during April. New business inflows in the service sector meanwhile slipped to an eight-month low, adding to signs of a broad-based waning of demand growth both at home and in export markets.

With companies' future expectations having slipped to the lowest since last year, growth may well slow in coming months.

Eurozone PMI future expectations

Eurozone PMI new orders

Rebounds in France and Germany contrast with slower growth in rest of region

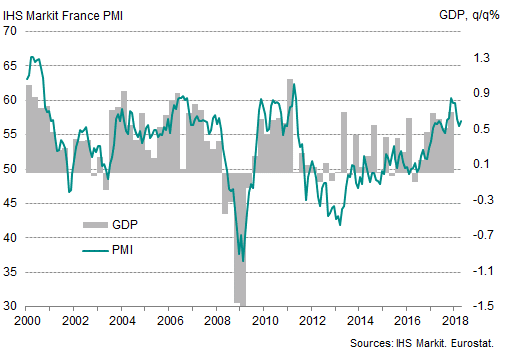

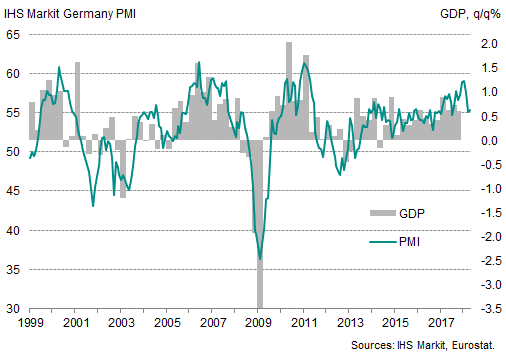

By country, growth picked up slightly in both France and Germany, but in both cases failed to recover to February's levels. France's expansion was consequently the second-weakest in the past eight months while Germany's was the second-lowest in nine months. While manufacturing acted as the main drag in France, it was the service sector that lagged behind in Germany.

Despite the disappointingly modest rebounds, growth in both France and Germany remains robust by historical standards, consistent with GDP rising at a quarterly rate of approximately 0.6% and 0.5% respectively at the start of the second quarter.

Elsewhere, growth slowed to an 18-month low, with both manufacturing and services recording weaker expansions.

France PMI v GDP

Germany PMI v GDP

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-settles-into-lower-gear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-settles-into-lower-gear.html&text=Eurozone+settles+into+lower+gear+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-settles-into-lower-gear.html","enabled":true},{"name":"email","url":"?subject=Eurozone settles into lower gear | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-settles-into-lower-gear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+settles+into+lower+gear+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-settles-into-lower-gear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}