Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 27, 2018

Economic Review: Week of 30 July 2018

- US Fed, Bank of Japan, Bank of England policy meetings, plus rate decisions in India and Brazil

- Worldwide manufacturing and services PMI reports

- US labour market update

- Eurozone GDP

A busy week sees important central bank meetings in the US, Japan and the UK, as well as India and Brazil. Major data releases include the worldwide PMI data for both manufacturing and services, rounding off with the US employment report, which includes non-farm payrolls and employee earnings.

Policymaking in focus

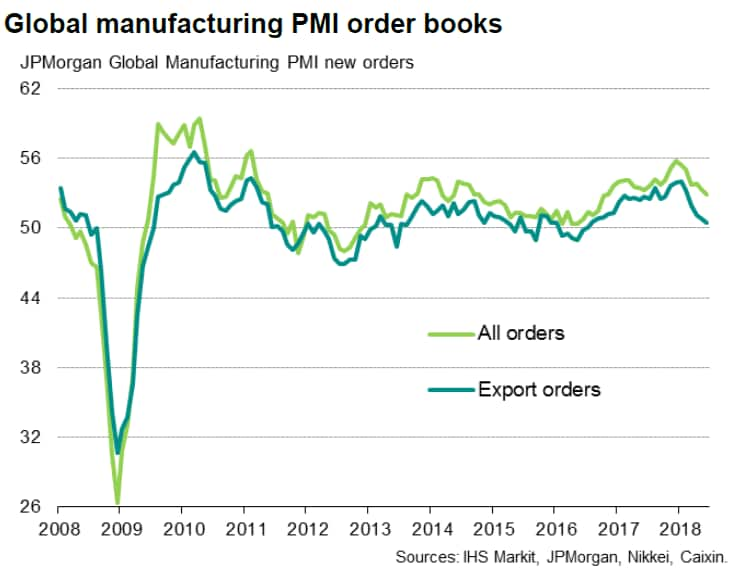

Policymakers in the US, Japan and the UK meet amid intensifying concerns about the potential damaging impact of trade wars. While US interest rates are not expected to rise again, having been hiked recently in June, a quarter point base rate rise by the Bank of England is widely anticipated and the Bank of Japan is showing signs of unease at the extent to which its policy tools are distorting markets.

US surveys and employment report to help guide policy

While no policy change is expected at the US Federal Reserve, the accompanying statement will be scoured for clues as to the pace of future tightening, with at least two more rate hikes generally expected in 2018. Price gauges have spiked higher since the last meeting, including flash PMI price indices for July, and the economy is benefitting from robust domestic demand. However, there are concerns that the outlook has clouded due to trade wars, and that rising short term interest rates are causing the yield curve to invert, often considered a leading indicator of recession.

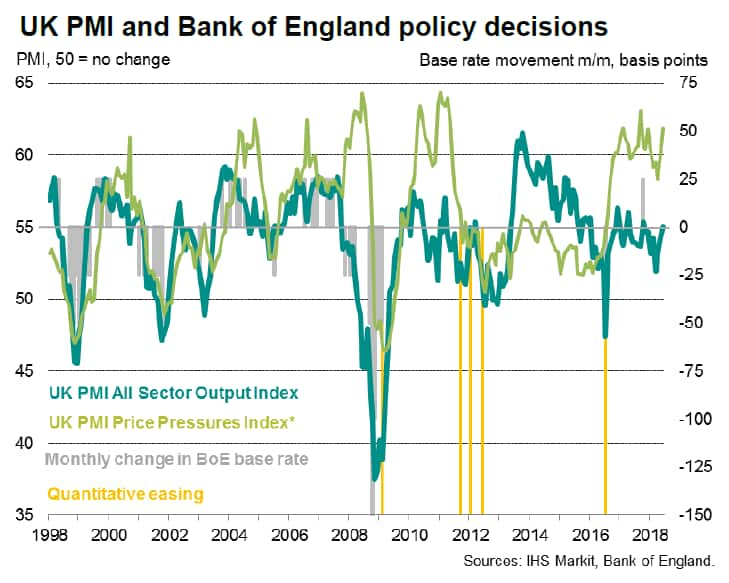

Bank of England interest rate decision

In the UK, the economy has shown signs of rebounding in the second quarter, playing into the hands of the hawks on the Bank of England's Monetary Policy Committee. Private sector regular pay growth has also edged up to 2.9% and households are showing signs of greater optimism. However, a rate hike is by no means a done deal, as total pay growth and consumer spending remain lacklustre, inflation has eased and Brexit uncertainties pose risks to future growth. Updated PMI numbers will provide insight into the extent to which the second quarter rebound has sustained momentum going into the final half of the year, and will be an important test for gauging appetite for future rate hikes.

Bond market eyes BoJ meeting

In Japan, speculation has intensified that the central bank is looking to adjust policy, and in particular it's Yield Curve Control, which had artificially supressed bond yields to the extent that policymakers are growing concerned about the functioning of the market. However, inflation remains firmly below target and recent Nikkei PMI data highlighted growing stress from trade frictions in the manufacturing sector.

Eurozone second quarter growth update

With the ECB eyeing a tapering of its asset purchases later this year, a clutch of data releases will be parsed to judge whether intentions will remain on track. Second quarter GDP is expected to match the 0.4% rise seen in the first quarter, but final PMI numbers for manufacturing and services could play a more important role in determining future growth trends. Other euro area data releases include retail sales, GDP data for Italy and Spain, as well as inflation numbers for Germany, France and Italy.

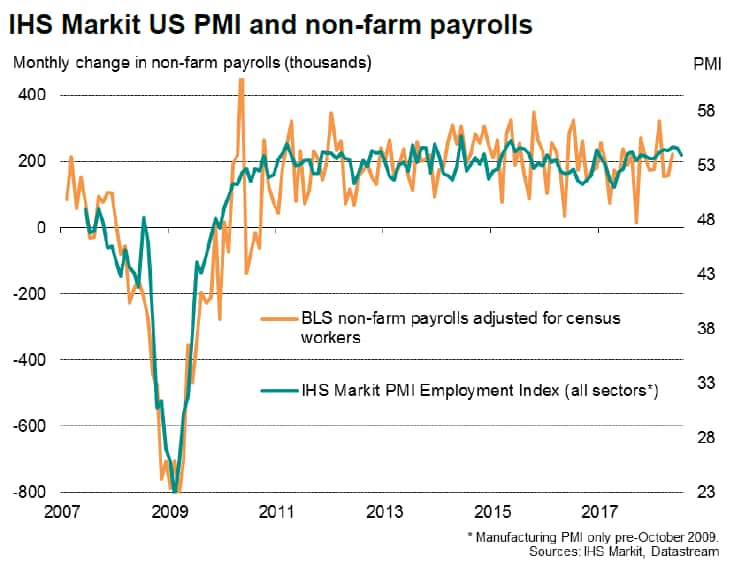

In addition to updated US survey data from the IHS Markit PMIs and the ISM, the week sees the US employment report, which will add colour to the hiring and employee earnings picture. The PMI employment index suggests the labour market remains in good health, indicative of non-farm payrolls rising by just over 200,000, which would add to the hawkish outlook for US interest rates.

Download the report for a full diary of key economic releases.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-review-week-of-30-july-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-review-week-of-30-july-2018.html&text=Economic+Review%3a+Week+of+30+July+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-review-week-of-30-july-2018.html","enabled":true},{"name":"email","url":"?subject=Economic Review: Week of 30 July 2018 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-review-week-of-30-july-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+Review%3a+Week+of+30+July+2018+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-review-week-of-30-july-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}