Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 24, 2020

Dry Bulk Trade: Impact of 'phase-one' trade agreement

On 15 January 2020, President Trump and Chinese Vice Premier He signed the highly anticipated "phase-one" trade agreement between the US and China.

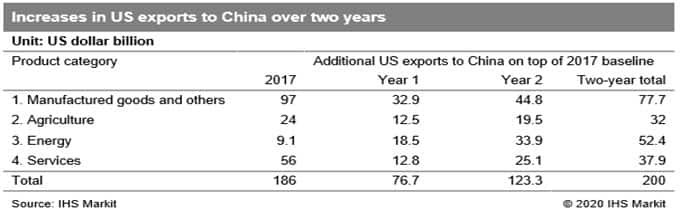

China agreed to purchase, over two years, $200 billion of goods.

- $162.4 billion of goods ($32B in agriculture, $52.4B in energy, $77.7B in manufacturing) above the 2017 level ($130B).

- $37.9 billion in services from US companies over the two years, above the 2017 level ($56B).

After the Phase One trade deal, much of the focus in the dry market is now on China's agricultural and energy purchase commitments built into the deal.

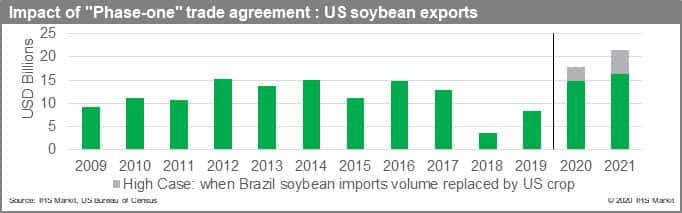

For agriculture, China has committed to buying additional purchases of US agriculture products, $32 billion over two years, which specified $12.5 billion above the 2017 baseline of $24 billion for a total of $36.5 billion in 2020.

The deal did not specify the exact amount of each commodity, but the historical market share of soybean indicates China will meet the commitments with a significantly larger purchase of soybean: according to IHS Markit Global Trade Atlas, China bought $12 billion US dollars of soybean (31.6 million tonnes), a half of the total agricultural product purchase from the US in 2017.

After the deal, IHS Markit increased its forecast of China's 2019/20 imports to 91 million tonnes and raised its 2020/21 China soybean import forecast to 95 million tonnes.

However, owing to the development of African swine fever, China has a limited soybean demand growth, which may lead China to reduce Brazilian soybean purchases to keep the US-China phase one commitments in 2020-21.

Source: IHS Markit Global Trade Atlas

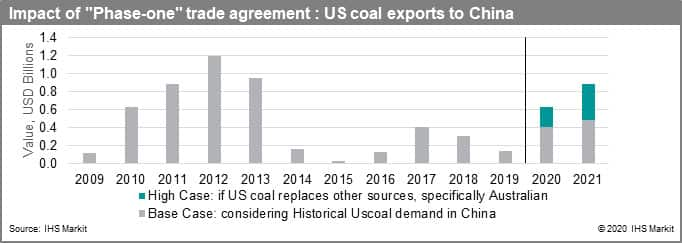

For energy, China will also purchase at least $52.4 billion in energy over the two years, from a baseline of $9.1 billion in 2017.

In our view, even though crude oil imports will play a major role for China to achieve the pledged target of energy imports in the "phase-one" trade deal, coal can also play some role to meet the commitment. After the deal, IHS Markit expects incremental US coal exports, mostly coking coal, to China to be around 3-5 MMt each year during 2020-21, adding at most $600 million of incremental trade value.

However, US coal exports to China is not expected to jump significantly in the coming months as the lack of cost competitiveness in the Chinese market will limit the scale of incremental thermal US coal imports.

We expect that China will first opt to cut imports of similar quality coal from other countries, specifically, Australian or Mongolian to make room for more US coking coal.

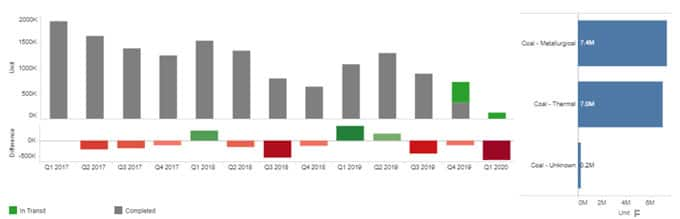

According to IHS Markit Commodities at Sea, the US exported more coking coal than thermal coal to China over the last three years, and this trend is expected to continue in the next two years.

US coking and thermal coal exports to China

Source: IHS Markit Commodities at Sea

There is still a high potential risk, as the deal size looks quite ambitious and China may not make the sizeable purchases until November 2020 (US presidential election) when there will be a clear view of who is going to take office.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-impact-of-phaseone-trade-agreement.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-impact-of-phaseone-trade-agreement.html&text=Dry+Bulk+Trade%3a+Impact+of+%27phase-one%27+trade+agreement+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-impact-of-phaseone-trade-agreement.html","enabled":true},{"name":"email","url":"?subject=Dry Bulk Trade: Impact of 'phase-one' trade agreement | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-impact-of-phaseone-trade-agreement.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dry+Bulk+Trade%3a+Impact+of+%27phase-one%27+trade+agreement+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-impact-of-phaseone-trade-agreement.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}