Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 05, 2020

Daily Global Market Summary - 5 October 2020

Equity markets closed higher across the globe alongside other risk assets, as further improvement in US presidential candidate Joe Biden's poll numbers in key battleground states may be potentially dampening some of the uncertainty going into next month's presidential election. Brent/WTI closed sharply higher, but prices still remain below this summer's peak levels. European government bonds closed modestly lower and 10yr US government bonds had their worst day since mid-March on the switch to a risk-on sentiment. iTraxx and CDX indices closed tighter across IG and high yield. The US dollar closed lower, while gold and silver were higher on the day.

Americas

- President Trump left Walter Reed National Military Medical Center with a cautious prognosis Monday after three days of treatment for COVID-19, returning to a White House roiled by the spread of the contagion among his top aides a month before he seeks re-election. (WSJ)

- US equity markets closed sharply higher today; Russell 2000 +2.8%, Nasdaq +2.3%, S&P 500 +1.8%, and DJIA +1.7%.

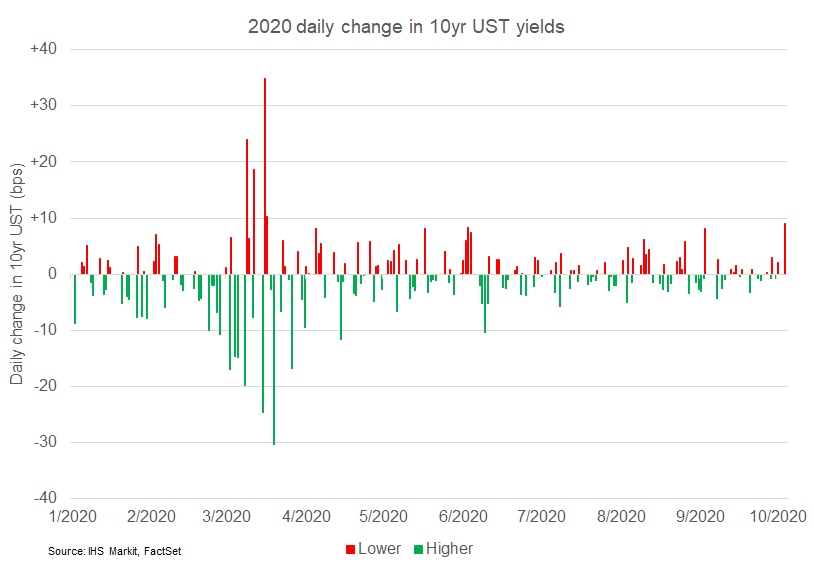

- 10yr US govt bonds closed +9bps/0.79% yield and 30yr bonds

+10bps/1.59% yield. Today is the fifth largest selloff (based on

increase in yield) in 10yr bonds this year and the most since 18

March when 10s closed +10bps.

- CDX-NAIG closed -3bps/57bps and CDX-NAHY -17bps/388bps.

- DXY US dollar index closed -0.5%/93.40.

- Gold closed +0.7%/$1,920 per ounce and silver +2.2%/$24.56 per ounce.

- Crude oil closed +5.9%/$39.22 per barrel, which is 9.6% below this summer's peak level.

- The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 54.6 in September, down slightly from 55.0 in August, but matching the earlier released 'flash' estimate. The solid rise in business activity was commonly linked to stronger demand conditions. The rate of growth was the second-fastest since March 2019 and solid overall despite softening from that seen in August. In line with greater new business inflows, firms increased their workforce numbers in September. The rate of job creation was strong overall and the second-quickest since February 2019, as many firms stated that insufficient capacity to process new orders had driven hiring. At the same time, backlogs of work rose for the third month running and at a solid pace. (IHS Markit Economist Chris Williamson)

- Tesla has announced its global production and delivery figures for the third quarter, with 139,300 vehicles delivered and 145,036 vehicles produced. In its brief statement, Tesla also reported that its new-vehicle inventory declined further during the period, "as we continue to improve our delivery efficiency". Of the totals, Tesla delivered a combined 15,200 Model S and Model X vehicles and produced 16,992 units. The combined total of Model 3 and Model Y vehicles delivered was 124,100 units, with 128,044 units produced. Tesla provided only a snapshot of its deliveries and production in the third quarter and did not break down the figures by country or region. Further details will come with the company's reporting of its third-quarter financial results later this month. The production and delivery figures represent a sharp increase from third quarter 2019, as production at Tesla's Chinese factory is being ramped up and sales of the Model Y have begun. In the second quarter of 2020, Tesla delivered 90,650 vehicles and produced 82,272 vehicles, although the figures were affected by COVID-19 pandemic-related shutdowns. Tesla's current growth is a result of increased production capacity and additional model lines. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Caterpillar has signed an agreement to acquire the Oil & Gas Division (Weir Oil & Gas) of the Weir Group, a Scotland-based global engineering business. Headquartered near Fort Worth, Texas, Weir Oil & Gas produces a full line of pumps, flow iron, consumable parts, wellhead and pressure control products that are serviced via an extensive global network of service centers located near customer operations. The acquisition will expand Caterpillar's offerings in the well service industry. Caterpillar will combine Weir Oil & Gas's pressure pumping and pressure control portfolio with its engines and transmissions business. The purchase price of USD405 million is to be paid in cash at closing. The acquisition requires approval by Weir shareholders and is subject to review by various regulatory authorities as well as customary closing conditions. The transaction includes more than 40 Weir Oil & Gas manufacturing and services locations and approximately 2,000 employees. In February 2020, the Weir Group announced its intention to sell the Oil & Gas division to become a pure play mining technology provider. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Uber's logistics arm, Uber Freight, has raised USD500 million in funding from private equity firm Greenbriar Equity Group, reports Reuters. The company will use the infused capital to scale its logistics platform and increase product innovation. Uber Freight is valued at USD3.3 billion on a post-money basis and will see Michael Weiss and Jill Raker, managing partners of Greenbriar, joining its board. Uber Freight was launched in May 2017 as a service that matches truckers with companies needing cargo to be shipped across the United States. In 2018, Uber announced that it would spin off its long-haul trucking business, Uber Freight, into a standalone business unit (see United States: 8 August 2018: Uber spins off freight business, co-founder returns to lead new entity). In 2019, Uber Freight announced its expansion into Europe and that it was moving its headquarters to Chicago (US), with plans to nearly double the unit's workforce. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US Canola Association has asked the Environmental Protection Agency (EPA) to approve the oilseed as a source of renewable fuel, which could feed an expected surge in demand for raw material from processing plants being developed. In March, the group submitted a pathway petition to EPA to add canola renewable diesel as an eligible renewable fuel standards product, said Tom Hance, Washington Representative for the US Canola Association. The petition is not yet publicly available and is under EPA review, according to Hance. If approved, demand for the oilseed—and potentially its price—could rise and spur more imports from Canada. It could double the amount of Canada's crop that goes into fuel production, according to the Canola Council of Canada. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- The agrochemical market in Brazil for "product on the ground" was flat during the first half of the year, inching up barely 0.2% to $6,040 million, the crop protection industry trade association, Sindiveg reports. The data does not reflect the total number of products sold, as some of these products are not actually used by growers, the association explains. The cumulative area treated (PAT) with various agrochemicals rose by 6% to 643.2 million ha. PAT calculates the volume use by treated area. It was up by 7.3% in the first three months of this year. Insecticides accounted for 36% of the surveyed agrochemicals, fungicides some 33% and herbicides, 22%. Soybeans accounted for almost a third of the treated area (33%) at 224.9 million ha, compared with 32% during last year's first six months. Maize constituted some 29% of the treated area (28% in the same period last year) at 200.2 million ha, and cotton 18% (19%). The next major crops included sugarcane, wheat, fruits and vegetables, beans, coffee and citrus fruits. The Sindiveg reports increased use of fungicides and insecticides on the three main crops. Fungicide application rose on soybeans to control anthracnose, target leaf spot (Corynespora cassiicola) and Asian soybean rust (Phakopsora pachyrhizi). Insecticide applications on the crop were up for the control of stink bugs (Pentatomidae spp). The use of fungicides was up on maize to combat leaf diseases and rust, and applications of insecticides rose for the control of stink bugs and leafhoppers (Dalbulus maidis). Applications of fungicides were also up for grey mildew (Ramularia aréola) control on cotton, and that of insecticides for the control of boll weevils (Anthonomus grandis) on the crop. The association says that pest and disease pressure was greater than ever in the first half of this year. On soybeans, it stressed the particular challenges of Asian soybean rust, while noting that stink bugs were the principal pest. Sourgrass (Digitaria insularis) and flaxleaf (Conyza bonariensis) provided the main weed concerns for the crop, which demanded different modes of action to control them. (IHS Markit Crop Science's Robert Birkett)

- Colombian bank Banco GNB Sudameris cancelled on 1 October a

planned bond sale and repurchase of its 2022 notes. The institution

- the seventh-largest bank by assets in Colombia - withdrew a

tender offer announced on 18 September to repurchase its 7.5%

subordinated notes due in 2022 and refinance this with a new

10-year bond with a target yield in the mid-to-high 8% area. A

report by Latin Finance cited a source who commented that few

bondholders had wished to redeem the existing debt, and reports

stated that investors had demanded a coupon of over 9%. (IHS Markit

Banking Risk's Alejandro Duran-Carrete and Brian Lawson)

- The high yields reportedly sought on the bank's debt appear atypical versus other recent bank issuances in other regions and are also considerably higher than on the largest (top three) Colombian banks.

- Investor sentiment towards emerging-market risk has been mixed

in recent weeks, amid concerns over the evolution of the COVID-19

pandemic and the potential trajectory of the global economy.

- At sovereign level, Bahrain and Egypt have enjoyed clear market success despite facing elements of debt or external stress. However, GNB Sudameris is one of three Latin American borrowers that have withdrawn bond sales recently.

- Brazilian oil and gas firm Petro Rio withdrew its planned USD450-million five-year deal, citing oil market uncertainties and recent price volatility. In a CVM filing statement on 17 September, it described conditions as "unfavorable".

- On 2 October, Brazilian outsourcing company Atento also withdrew a planned bond sale and repurchase of existing debt, planning to review the situation again "once market conditions stabilize".

- The market's price sensitivity to GNB does not appear credit-driven. GNB does not display significantly greater risk than the overall Colombian banking sector.

- In July, GNB Colombia had a non-performing loan (NPL) ratio of 1.2% versus the sector average of 3.2%. Moreover, its profitability, as measured by the return on assets (ROA) ratio, stood at 0.79% versus 0.83% for the sector. GNB's capitalisation as measured by the capital-adequacy ratio and Tier 1 ratio stood at healthy levels of 19.7% and 11.6%, respectively, compared with the 15.5% and 11.2% average for Colombian banks.

- Colombian sovereign debt appears supportive of banking-sector credit fundamentals. IHS Markit economists have highlighted recently that Colombian sovereign debt is likely to retain an investment grade rating and should not face substantial funding issues.

- President Nicolás Maduro will introduce the "anti-blockade" bill in the week starting on 5 October at the National Constituent Assembly; the bill grants the government powers to change property ownership, as well as the management of state-owned companies and mixed companies (joint ventures). The draft legislation would permit more foreign direct investment in Venezuela's strategic economic sectors, including in the oil sector, where key projects are currently controlled by the national oil company Petróleos de Venezuela (PDVSA). The Hydrocarbons Law mandates that PDVSA controls 50.1% of shares and that the operation of oil projects with foreign companies is capped at 49.9%. The bill also allows expropriated companies to be returned to their original owners or privatized. The pro-government National Constituent Assembly is the de facto legislature in Venezuela as the internationally recognized opposition-controlled national assembly is deemed as null and void by Maduro and the Supreme Court. The anti-blockade bill is very likely to become effective this week, as soon as it is approved by the National Constituent Assembly, attracting interest from Russian, Chinese, and Iranian state-owned companies, and Turkish and Indian investors, to control 100% of shares and operations in oil projects. These investors would also be interested in assuming control of key mining and other industries that were subject to expropriations. The bill is unlikely, however, to attract interest from established Western companies over fears of breaching US sanctions, and President Maduro's government lacks the capacity to provide guarantees for investors and resume the business operations of expropriated assets. (IHS Markit Country Risk's Diego Moya-Ocampos)

- According to the Central Bank of Honduras (Banco Central de

Honduras: BCH), the Honduran economy contracted by 18.5% year on

year (y/y) in the second quarter of 2020, driven by contractions in

all major sectors of the economy. Based on this significant GDP

contraction and expectations of a slow recovery, IHS Markit is

likely to revise down its 2020 GDP forecast during the November

forecasting round. (IHS Markit Economist Lindsay Jagla)

- Recently published data by the BCH show that second-quarter GDP declined by 18.5% y/y. In quarterly terms, the economy contracted by 17.6%, after declining by 2.2% in the first quarter this year.

- The spread of the coronavirus disease 2019 (COVID-19) virus and subsequent social-distancing measures have paralyzed the economy, lowering internal and external demands. Global economic contraction - especially in the United States - has lowered demand for Honduran exports, which declined by 41.7% quarter on quarter (q/q), and contributed to a 13.2% decline in investment.

- A combination of lower disposable income, stricter curfews and restrictions, and fewer remittances contributed to low internal demand. This, in turn affected consumption, which fell by 14.1%, as well as imports, which dropped by 31.3%.

- Nearly all economic sectors contracted in the second quarter, but the overall decline was driven by q/q contractions in manufacturing (-30.8%); retail, hotels, and restaurants (-29.3%); financial services (-9.8%); construction (-50.1%); and transportation and storage services (-37.4%). Measures to combat the COVID-19 virus have resulted in restrictions that halted the tourism industry, prevented companies and factories from operating at full capacity, and generally slowed all economic activity.

- The only sectors that gained quarterly growth were utilities (+0.5%), communications (+0.1%), and public administration and defense (+0.2%); however, these had no significant impact on the final GDP figure.

- The country's second-quarter data were in line with our expectations that this quarter would be the worst for Honduras this year because of strict social-distancing measures and economic shutdown, domestically and abroad. We expect Honduras to mark quarterly improvements starting in the third quarter, but the country will still face significant overall GDP contraction in 2020.

Europe/Middle East/Africa

- European equity markets closed higher; Spain +1.2%, Italy/Germany +1.1%, France +1.0%, and UK +0.7%.

- 10yr European govt bonds closed lower across the region; UK +4bps, Germany/Spain +3bps, France +2bps, and Italy +1bp.

- iTraxx-Europe closed -1bp/57bps and iTraxx-Xover -8bps/333bps.

- Brent crude closed +5.1%/$41.29 per barrel.

- The eurozone's economic recovery ground almost to a halt in September, as a renewed fall in service sector activity countered faster manufacturing growth. The IHS Markit Composite PMI output index, a GDP-weighted average of the manufacturing and service sector survey gauges, fell from 51.9 in August to 50.4, signalling only a mild increase in business activity. While the survey continues to indicate that the economy rebounded strongly over the third quarter as a whole, thanks to a strong surge at the start of the quarter (after business activity contracted sharply during the height of the Covid-19 pandemic in the second quarter), the rebound lost almost all of its momentum as the third quarter progressed. As such, the survey indicates an increased risk of the economy sliding back into contraction in the fourth quarter. Our baseline forecast is for the eurozone economy to continue to grow in the fourth quarter, but with the eurozone economy having already almost stalled in September, the chances of a renewed downturn in the fourth quarter have clearly risen. Much will depend on whether second waves of virus infections can be controlled, and whether social distancing restrictions can therefore be loosened to allow service sector activity to pick up again. Governments will also need to be vigilant in providing timely support to sustain recoveries, alongside increasingly accommodative monetary policy. In terms of the latter, inflationary pressures remained low in September, keeping the door open for loose policy. Average prices charged for goods and services fell for a seventh straight month in September, according to the PMI survey, with the rate of deflation gathering pace again after easing in the prior four months. Expectations have risen for more asset purchases to be sanctioned by the ECB's governing council by the end of the year, and any further deterioration of the PMI numbers as we head into the fourth quarter will add further weight to calls for more stimulus. (IHS Markit Economist Chris Williamson)

- Tesla has agreed a deal to buy the German company, ATW Automation, which assembles battery modules for the automotive industry, according to a Bloomberg report. ATW is a subsidiary of Canadian ATS Automation Tooling Systems Inc. On 25 September, ATS announced that that certain assets and employees at one of its Germany-based units would be sold and transferred to a third party, without disclosing the name of the company. German publications The European and WirtschaftsKurier first reported the planned acquisition, although neither ATS or Tesla have confirmed it. ATW, based in western Germany, has about 120 employees and has completed more than 20 battery production lines for international automakers. Given Tesla's investment in a new plant site in Brandenburg which is near the site of Berlin's new airport, such an acquisition would make a great deal of strategic sense. (IHS Markit AutoIntelligence's Tim Urquhart)

- Passenger car registrations in the UK have fallen by 4.4% year

on year (y/y) during the important high-volume month of September.

According to the Society of Motor Manufacturers and Traders (SMMT),

demand has fallen from 343,255 units to 328,041 units. (IHS Markit

AutoIntelligence's Ian Fletcher)

- This makes it the weakest 'new plate' September ever, according to trade association. There were declines across all customer types. Private demand dipped by 1.1% y/y to 161,363 units, while fleet registrations contracted by 5.8% y/y to 159,081 units. Registrations by business customers also dropped by 31.9% y/y to 7,597 units.

- Fuel-type data during September also highlighted shifts in consumer preference. Gasoline (petrol)-engine passenger car registrations dropped by 20.9% y/y to 176,532 units, and diesel plummeted by 38.4% y/y to 46,996 units.

- The shift is partly explained by mild-hybrid (MHEV) becoming a more prevalent technology, with diesel MHEVs having increased 66.4% y/y to 13,484 units and gasoline MHEVs expanding by 422.1% y/y to 30,382 units.

- Other customers are making a more conscious move in the direction of alternative powertrain technologies. Traditional hybrids have risen 55.8% y/y to 26,344 units, and an even bigger percentage increase has gone to plug-in hybrids (PHEVs) which jumped 138,6% y/y to 12,400 units.

- Battery electric vehicles (BEVs) have also risen by 184.3% y/y to 21,903 units. Nevertheless, the collective market share of these three types remains in single figures.

- Ford was again the leading brand in September with volumes of 28,252 units, although this was a decline of 13.1% y/y.

- Second place in the brand chart last month was Volkswagen (VW) with 27,328 units registered, which was a leap of 39.2% y/y.

- It was a mixed month for the German premium brands, which occupied the following three positions. Mercedes led the way in terms of registrations, with its 23,522 units taking it to third. Another faller this month was BMW in fifth which registered 21,225 units, a fall of 23.7% y/y; none of its models entered the top-10 chart this month. Audi split the two brands; due to its low base of comparison a year ago, its registrations surged by 71.8% y/y to 21,893 units, although none of its vehicles appeared in the top-10 model chart either.

- Looking forward, IHS Markit passenger car registrations will suffer a huge drop during 2020, with demand expected to have fallen by 26.9% y/y to 1.69 million. Although we expect volumes will start to move towards earlier levels during 2021, this will only stand at around 2.02 million units, well below the 2.31 million units recorded in 2019, which itself was well below a previous peak recorded in the middle of the previous decade. This is also based upon the UK finally reaching an agreement with the EU on a trade deal and the expectation that there will be no restrictions placed on movement.

- Italy's national statistical office (ISTAT) reports that the

impact of the COVID-19-virus pandemic was more severe on the

economy during the second quarter of 2020 than initially reported.

The national lockdown and the social-distancing measures mothballed

the hotel and restaurant, and the travel and transport sectors, and

recreational, cultural, and personal services from 11 March. ISTAT

estimates that the Italian economy slumped by 13.0% quarter on

quarter (q/q) in the second quarter, revised from the previously

reported drops of 12.8% q/q in the second release and 12.4% q/q in

the first estimate. (IHS Markit Economist Raj Badiani)

- In annual terms, the economy contracted by 18.0% year on year (y/y) and 5.6% y/y in the second and first quarters, respectively.

- This is in line with our second-quarter assessment prior to the official releases when we estimated that real GDP shrank by 13.0% q/q and 17.8% year on year (y/y).

- In addition, it implies that Italy remained in technical recession (defined as two successive quarters of q/q decline) during the second quarter after it contracted by 5.5% q/q in early 2020 and 0.2% q/q in the fourth quarter of 2019.

- A breakdown by expenditure reveals that domestic demand subtracted 9.6 percentage points from the GDP change between the first and second quarters, with private consumption and fixed investment each representing drags of 6.8 and 2.9 percentage points, respectively.

- Net exports also made a negative contribution of 2.3 percentage point, with exports falling more sharply than imports.

- A change in inventories was also a drag on the second-quarter GDP change, signifying a subtraction of 1.2 percentage point.

- Consumer spending bore the brunt of tumbling Italian activity during the second quarter. Specifically, it contracted by 11.4% q/q and was 17.3% smaller than a year earlier in the second quarter.

- In addition, the household economy endured a sharp fall in its gross disposable income in real terms, which fell by 5.8% q/q.

- With the national lockdown curtailing the ability of households to spend, the personal savings ratio rose to a record 18.6% of disposable income in the second quarter, up from 13.3% in the first quarter.

- Meanwhile, fixed investment fell acutely, at 16.2% q/q and 22.6% y/y in the second quarter, with spending on machinery and equipment, dwellings and residential structures heavily curtailed.

- Third-quarter growth stood at an estimated 6.6% q/q, but some high-frequency data hinted at a loss of momentum after initial surge in activity.

- Atlantique Offshore Energy has commenced fabrication of the electrical substations for the Fécamp wind farm, offshore France. First steel cut took place on 30 September 2020 at Chantiers de l'Atlantique's shipyard in Saint-Nazaire, France. At the start of the year, a consortium formed by Enbridge, EDF Renewables and wdp Offshore granted Atlantique Offshore Energy, GE Grid Solutions and SDI a contract to supply the wind farm's substations. Atlantique Offshore Energy is in charge of designing, manufacturing and commissioning the topside and jacket foundation, GE Grid Solutions is in charge of designing, manufacturing and commissioning high and medium voltage electrical equipment and protection control systems, while SDI will carry out the transport and installation. Delivery of the substation is scheduled for 2022. The Fécamp wind farm will comprise 71 Siemens Gamesa 7 MW turbines, located between 13 and 22km off the northwest of France. Commissioning of the 500 MW project is scheduled for 2023. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- Construction of Equinor's Hywind Tampen offshore floating wind farm in Norway has commenced. The wind project will provide power to the Snorre and Gullfaks projects via 11 x 8MW wind turbines with a total capacity of 88 MW. The wind turbines are anticipated to meet about 35% of the annual power demand of the projects' five platforms, Snorre A and B and Gullfaks A, B and C. The wind farm will be located between the Snorre and Gullfaks platforms in water depths of 260 to 300 m, 140 km from shore. The project aims to reduce Co2 emissions by more than 200,000 metric tons per year by reducing the use of gas turbines on the fields. Total investment will be close to NOK 5 billion (USD 486 million). (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- Sales in the Turkish passenger car and light commercial vehicle

(LCV) markets increased by 115.8% year on year (y/y) to 90,619

units in September, according to data released by the Automotive

Distributors Association (Otomotiv Distribütörleri Derneği: ODD).

(IHS Markit AutoIntelligence's Nitin Budhiraja)

- Of this total, passenger vehicle sales were up by 101.9% y/y to 71,296 units during the month, while LCV sales stood at 19,323 units, up by 189.1% y/y.

- The country's light-vehicle market posted a year-to-date (YTD) increase of 75.5% y/y to 493,621 units, comprising 388,690 passenger vehicles, up by 70.0% y/y, and 104,931 LCVs, up by 99.2% y/y.

- In the YTD, C-segment vehicles accounted for 63.2% of total passenger vehicle sales in Turkey, with sedans being the most preferred vehicle type, accounting for 43.9%.

- In the LCV segment, vans accounted for 76.8% of total sales in the YTD, followed by light trucks at 11.0%.

- The significant y/y sales growth in Turkey during September can be attributed to the low base of comparison and easing of lockdown restrictions.

Asia-Pacific

- APAC equity markets closed higher across the region; Australia +2.6%, Hong Kong +1.3%, south Korea +1.3%, Japan +1.2%, and India +0.7%.

- Honda has announced that it has decided to withdraw from the FIA Formula One (F1) world championship as an engine supplier at the end of the 2021 season, according to a company statement. This means that the OEM will conclude its supply contracts with the Red Bull and Alpha Tauri Formula One teams to provide engines at the end of next season. Instead the company will refocus the resources committed to its Formula One engine program, including some of its brightest and focused engineers and designers on battery electric vehicles (BEVs) and fuel cell development. In its statement Honda said, "Toward this end, Honda needs to funnel its corporate resources in research and development into the areas of future power unit and energy technologies, including fuel cell vehicle (FCV) and battery EV (BEV) technologies, which will be the core of carbon-free technologies. As a part of this move, in April of this year, Honda created a new center called Innovative Research Excellence, Power Unit & Energy. Honda will allocate its energy management and fuel technologies as well as knowledge amassed through F1 activities to this area of power unit and energy technologies and take initiatives while focusing on the future realization of carbon neutrality. Toward this end, Honda made the decision to conclude its participation in F1." While the decision took the F1 community by surprise, and not least Red Bull Racing and Red Bull's second team Alpha Tauri, which currently have contracts to run Honda engines and which were working on the assumption that this would be a long-term relationship, it is not as surprising to anyone who understands the current dominant dynamics of the global automotive industry. The industry is facing unprecedented cost pressures, with the twin tests of the move towards electrification and increasing investment in digital architectures including the move towards autonomous vehicle technology, all the while facing the threat of potential industry disruptors from the tech industry who are sitting on huge cash piles, something traditional OEMs do not have access to. (IHS Markit AutoIntelligence's Tim Urquhart)

- Ramboll has been contracted by China Steel Power Corporation to design the jacket foundation for the Zhong Neng offshore windfarm in Taiwan. The 300MW project is 20km off the west coast of Changhua County. The project is co-developed by China Steel Corporation (CSC) and Copenhagen Infrastructure Partners (CIP) and is scheduled for completion in 2024. Ramboll will provide the conceptual, FEED, and detailed designs for the primary and secondary structure of the jacket foundations, piles, and transition pieces, among other things. Ramboll also provided the engineering for CIP's Chang Fang and Xidao offshore wind farms' jacket foundations. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- New vehicle sales in Australia decreased by 21.8% year on year

(y/y) to 68,985 units during September, according to data from the

Federal Chamber of Automotive Industries (FCAI). (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- The sport utility vehicle (SUV) segment posted a sales decline of 22.0% y/y to 32,647 units, while passenger car sales fell steeply to 17,720 units, down by 28.8% y/y.

- In September, sales of light commercial vehicles (LCVs) totaled 15,772 units, down by 13.6% y/y, while heavy commercial vehicle (HCV) sales were 2,846 units, down 10.2% y/y.

- During the month, Toyota was the best-selling brand with sales of 12,936 units. In second place was Mazda with sales of 7,000 units, followed by Hyundai with 5,273 units, Kia with 5,092units, and Ford with 4,816 units.

- The top-selling vehicle was the Ford Ranger with sales of 3,726 units, Toyota Hilux (3,610 units), Toyota RAV 4 (2,433) and Hyundai i30 (1,786 units).

- The state of Victoria, which is currently under Stage 4 Restrictions, recorded a 57.7% y/y decrease in sales to 10,447 units last month.

- FCAI chief executive Tony Weber anticipates, the industry to see an increasingly positive trend as barriers to purchase are eased and consumer confidence returns.

- On a year-to-date (YTD) basis, sales were down by 20.5% y/y to 644,891 units.

- Although the Australian new vehicle sales in September improved compared to August, it is are still under pressure due to market forces. It seemed as if the COVID-19 pandemic was under control and fading away in Australia until early June, but there was another wave of fresh cases towards the end of the month, which led to some states reimposing restrictions on gatherings.

- Petrofac has been awarded a FEED contract for the Infinite Blue Energy Group's (IBE) Arrowsmith Hydrogen Project in Australia. Petrofac's scope of work includes reviewing the conceptual work carried out on the project to date and the execution of the FEED study. This will be undertaken by Petrofac's teams in Perth, Australia and Woking, England. Located in Western Australia, the Arrowsmith Hydrogen Project is expected to commence production by the end of 2022 and will generate 25 tons of green hydrogen per day from water, solar and wind. The contract represents a significant strategic step in Petrofac's continued expansion into renewable energy and quickly follows its recently announced award for the Acorn Carbon Capture and Storage (CCS) and hydrogen project in the United Kingdom. (IHS Markit Upstream Costs and Technology's William Cunningham)

- The global electric vehicle (EV) sales of Hyundai Motor Group,

including affiliate Kia, increased 25% year on year (y/y) to around

60,707 units during January-July, reports the Yonhap News Agency,

citing data released by the Korea Automotive Technology Institute.

This means the South Korean automotive group emerged as the world's

fourth-largest player in terms of global EV sales during the

period. (IHS Markit AutoIntelligence's Jamal Amir)

- Tesla topped the list by selling 191,971 units over the seven-month period, up 4% y/y, trailed by Renault-Nissan with 86,189 units, down 5% y/y.

- Volkswagen followed in third place with EV sales of 75,228 units, more than double y/y over the period.

- China-based BYD chased Hyundai Motor Group by selling 42,340 units during the period, although its EV sales plunged 63% y/y.

- The report also highlights that Hyundai Motor Group became the top player in the fuel-cell electric vehicle (FCEV) segment in January-July by selling 2,879 units, up nearly 60% y/y.

- Toyota followed in the rankings by selling 439 FCEVs during the period, up 71% y/y. The surge in Hyundai Motor Group's global EV sales reflects the growing demand for such vehicles globally.

- Various governments around the world are preparing to phase out the use of gasoline (petrol)- and diesel-powered vehicles in their fight against pollution and are providing incentives to increase the adoption of alternative-powertrain vehicles. Hyundai Motor Group aims to become a global leader in the field of electrified mobility. It aims to capture 10% of the global EV market by selling 1 million EVs by 2025. In a bid to achieve this goal, the automaker intends to invest more in future mobility and introduce more EV models.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-october-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-october-2020.html&text=Daily+Global+Market+Summary+-+5+October+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-october-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 5 October 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-october-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+5+October+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-5-october-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}