Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 17, 2020

Daily Global Market Summary - 17 September 2020

Global equity markets closed lower across each region, while US and European benchmark government bonds were modestly higher on the day. iTraxx and CDX credit indices were slightly wider on the day, while oil rallied for a second consecutive day. There are now over 30 million COVID-19 cases across the globe and the numbers are increasing by 1 million cases every 4-5 days, which continues to weigh on the credit/equity markets going into the fall.

Americas

- US equity markets closed lower; Nasdaq -1.3%, S&P 500 -0.8%, Russell 2000 -0.6%, and DJIA -0.5%.

- 10yr US govt bonds closed -1bp/0.69% yield and 30yr bonds -2bps/1.44% yield.

- CDX-NAIG closed +2bps/70bps and CDX-NAHY +1bp/342bps.

- DXY US dollar index closed -0.3%/92.92.

- Gold closed -1.0%/$1,950 per ounce.

- Crude oil closed +2.0%/$40.97 per barrel.

- Global coronavirus cases topped 30 million, with infections showing no signs of slowing more than six months after the pandemic was declared. The U.S., India and Brazil account for more than half of the world's cases, with India emerging as the new epicenter, reporting nearly 100,000 infections a day. The virus is spreading at a rate of 1 million cases every four or five days. From France to South Korea, former hotspots that had brought the virus under control are fighting fresh outbreaks, complicating efforts to reopen economies. (Bloomberg)

- Moderna could have to wait until as late as December to analyze data from its Covid-19 vaccine trial, longer than would be necessary to meet the Trump administration's hopes of issuing an emergency approval ahead of the US election. The Boston-based biotech company on Thursday said it had enrolled more than 25,000 participants in its trial, with more than 10,000 of those having received both doses in the vaccine course. Stéphane Bancel, Moderna chief executive, told CNBC that if the infection rate in the US slowed in the coming weeks, it may not be able to examine data until December. (FT)

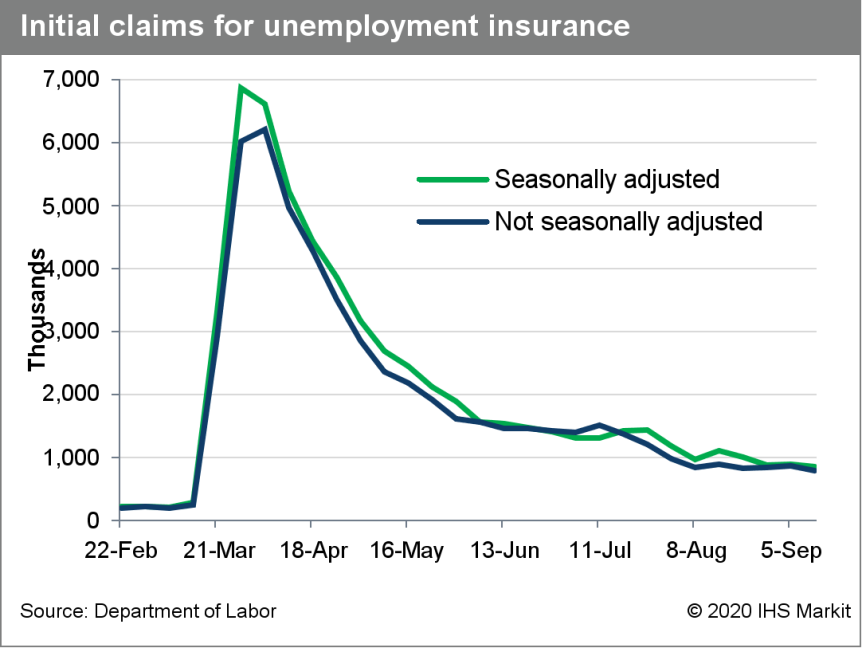

- US seasonally adjusted (SA) initial claims for unemployment

insurance fell by 33,000 to 860,000 in the week ended 12 September

but remain at historically high levels. The not seasonally adjusted

(NSA) tally of initial claims fell by 75,974 to 790,021. (IHS

Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 916,000 to 12,628,000 in the week ended 5 September. Prior to seasonal adjustment, continuing claims fell by 1,034,052 to 12,321,395, the largest decline in four months. The insured unemployment rate in the week ended 5 September was down 0.7 percentage point to 8.6%.

- There were 658,737 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 12 September. In the week ended 29 August, continuing claims for PUA fell by 189,233 to 14,467,064.

- In the week ended 29 August, there were 1,527,166 such claims for Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 29 August, the unadjusted total rose by 98,456 to 29,768,326.

- The number of claims for benefits under all programs remains

stubbornly high and has averaged 30.0 million since peaking at 32.4

million in mid-June, but some of this elevated figure (particularly

in PUA and PEUC) may be a result of new claims for prior weeks'

unemployment benefits being included in the count at the time of

the claim rather than retroactively.

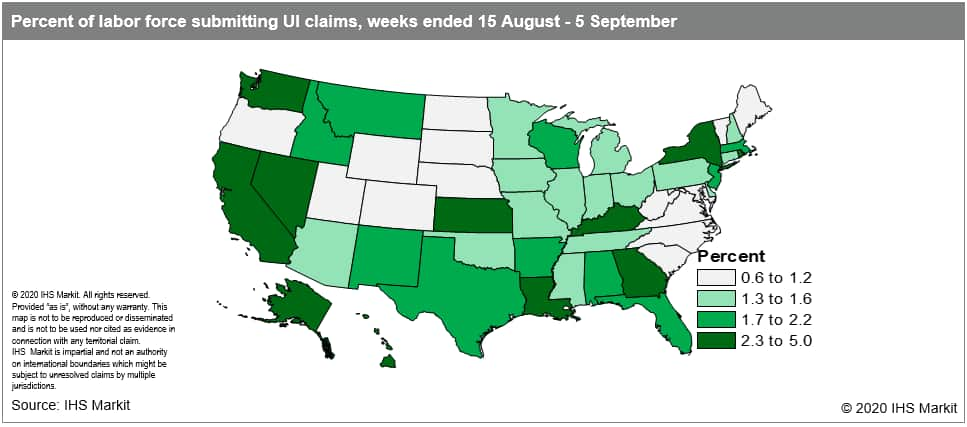

- In the week ended 5 September, initial claims reported by

states numbered 864,294, up 29,747 from the week before. Despite

slight increases over the last two weeks, initial claims have

remained under 1 million since the week ended 25 July, signaling

continued improvement in state employment but also suggesting that

labor market gains remain sluggish across most of the country. Of

the states that saw an increase in initial claims, California saw

the largest increase with 23,841 more claims than the week prior,

followed by Texas (up 8,618), Louisiana (up 8,375), New Jersey (up

2,402), Washington (up 2,173), and New York (up 1,368). These were

the only states with increases greater than 1,000, and most of the

increase is attributable to layoffs in service industries including

retail trade and accommodation/food services. In Texas, layoffs in

manufacturing also contributed to the uptick in initial claims. The

largest decreases, meanwhile, were seen in Kentucky (down 7,219),

Florida (down 5,334), Pennsylvania (down 2,257), and Kansas (down

1,915). The decrease in Kentucky's claims is likely at least partly

a result of the state's struggles to process claims in a timely

fashion. In June, the Kentucky Labor Cabinet partnered with the

firm Ernst & Young to work through unprocessed claims that have

piled up since March. This contract, which was set to expire in

August, was extended until the end of the year as the state's

backlog remains sizable. (IHS Markit Economists Alex Minelli and

Fran Hagarty)

- US single-family permits have rebounded by an astonishing

370,000 units in the past four months and jumped 6.0% (+/- 1.3%;

statistically significant) in August, surging past the

1.0-million-unit threshold for the first time since May 2007.

Single-family permits matter more than single-family starts because

they are much better measured, are less influenced by weather, and

are forward looking. Single-family construction accounts for 80% of

spending on total new construction. (IHS Markit Economist Patrick

Newport)

- The volatile multifamily permits category dropped 14.2% in August.

- Housing starts dropped 5.1% (+/- 9.6%, not statistically significant). Single-family starts climbed 4.1% (+/- 8.7%, not statistically significant). Multifamily starts plunged 22.7% to a 395,000-unit annual rate.

- All four regions have staged solid rebounds. Both the single- and multifamily categories have rebounded smartly.

- Given the state of the economy and the course of the pandemic, housing's reversal of fortune is astonishing. What accounts for it? Record-low interest rates have played a key role; that social distancing is possible in building homes has also been instrumental. Payback for depressed numbers in March and April have also boosted the numbers. Finally, telework is playing a role that so far is hard to measure, but is a major upside risk for the housing market.

- The bottom line: Although housing starts dropped in August, this was a positive update on the housing market.

- Ford has confirmed that it is to make an investment of USD700 million and create 300 jobs at a new US facility to assemble battery electric and hybrid versions of the F-150 pick-up. In addition, Ford is launching a new US advertising campaign underscoring its dedication to manufacturing in the United States. In June, Ford announced the new-generation F-150, with production due to start this month. Ford marked the milestone with a series of announcements, including confirmation of known elements and some new information on the model. In the latest announcement, Ford confirmed the USD700-million investment in a new production facility near the automaker's Dearborn Assembly Plant, Michigan (United States), which builds the F-150, and the creation of 300 jobs at the new site. The new facility is to be named the Rouge Electric Vehicle Center. Construction of the new facility is under way and it is due to be completed mid-way through 2021. The F-150 electric vehicle (EV) and hybrid EV (HEV) versions are scheduled to roll off the production line in mid-2022. Ford also confirmed that the Rouge Electric Vehicle Center will assemble Ford F-150s that have gone through the body and paint shops at the nearby Dearborn Assembly Plant. Ford's chief manufacturing and labor officer, Gary Johnson, said that the reasons for keeping production of the F-150 EV and HEV versions separate from the ICE versions included ensuring flexibility as the automaker worked to meet a new mix of customer demand. He said keeping assembly of the EV and HEV versions separate would enable Ford to build the new electrified vehicles without affecting production capacity of the traditional powertrain truck. Johnson also stated that it would enable the company to more easily deal with the production complexity of the two electrified versions of the truck having somewhat different equipment. The new facility is also part of Ford's efforts to create the "factory of tomorrow". It will leverage smart tools and smart processes, including elements such as autonomous sleds to move the beds within the plant and use of collaborative robots. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Cadillac says that its US dealers need to invest at least USD200,000 each to prepare for selling and servicing its upcoming electric vehicles (EVs). The brand expects that, by the end of 2022, all of its US dealers will have installed the necessary capabilities. Cadillac has told its 880 US dealers that they will need to make the minimum USD200,000 investment to support EV sales and servicing, according to comments from GM and media reports. Cadillac revealed a concept version of its first EV utility vehicle in August and plans to have it on the market by the end of 2022. Automotive News reports that the current standard franchise agreement with Cadillac dealers expires on 1 November 2020. The agreement outlines terms that its dealers must adhere to, and the EV standards are being integrated into the agreement. Dealers could decline to continue with after 1 November, Automotive News reports. However, their future would be subject to discussions with the brand's officials, the report states, citing Rory Harvey, recently appointed vice-president of Cadillac sales, service and marketing. Harvey reportedly said that high-volume dealers might need to spend more than USD200,000 and the expenses could increase as Cadillac introduces more EV models. GM expects that dealers will make the changes by the end of the fourth quarter of 2022; however, they can spread out the investment. Harvey reportedly said, "Now's really the time to start engaging with our dealers in preparation for [the Lyriq in late 2022]. There is a lot of planning that has to be put into place to make sure [the dealers] are absolutely ready. The key finish line is that they have the infrastructure in place to be able to support the customers when we have Lyriq on the ground." Harvey acknowledged that not all the dealers would necessarily be eager to make the investment, saying, "Our dealer council did say there may be a few dealers that don't necessarily share the Cadillac vision. We believe that most dealers will." Cadillac has about 880 dealers in the United States who will need to make the investment, which includes installing charging stations, purchasing tools, and making service-bay changes to service the vehicles, as well as training service and sales personnel. (IHS Markit AutoIntelligence's Stephanie Brinley)

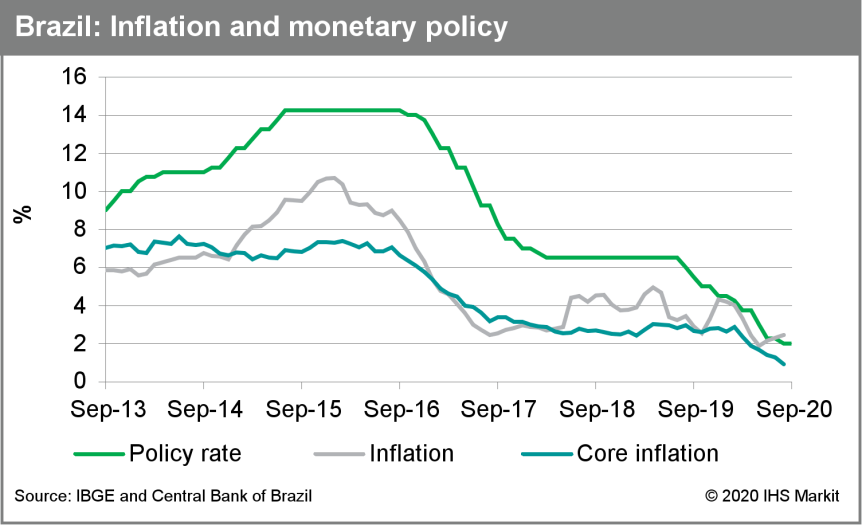

- The Central Bank of Brazil (Banco Central do Brasil: BCB) has

left the policy rate at 2.0% and stated that it does not foresee

further cuts in the policy rate using the same forward guidance

language implemented in August. (IHS Markit Economist Rafael Amiel)

- Still, it did not say that the easing cycle had come to an end. Annual inflation has increased in the past three months and, although still low at 2.4%, it is higher than the policy rate.

- Prices in the food and beverages category jumped 0.8% in August, while the cost of services continued to decline (down 0.5%). Another driver of inflation in the past three months has been the correction of gasoline (petrol) prices, driven in turn by international oil prices.

- At current levels, the policy rate is at a record low. The BCB is targeting inflation of 4.0% +/-1.5 percentage points.

- The bank assesses that in the short term inflation will

continue to increase, driven by higher food prices. The BCB

assesses that the current policy rate is below its structural

value; this value is relatively high as it is pushed up by a

sizeable fiscal deficit and high debt that needs to be financed and

rolled over, offering higher rates. However, the very weak state of

the Brazilian economy justifies a strongly stimulative monetary

policy. IHS Markit assesses that current monetary policy is only

relatively stimulative as the rates commercial banks charge for

their loans to corporations and consumers are still sizeable.

Europe/Middle East/Africa

- European equity markets closed lower across the region; Italy -1.1%, France -0.7%, UK -0.5%, and Spain/Germany -0.4%.

- 10yr European govt bonds closed modestly higher across the region; UK -3bps and Italy/France/Germany/Spain -1bp.

- iTraxx-Europe closed +1bp/55bps and +5bps/297bps.

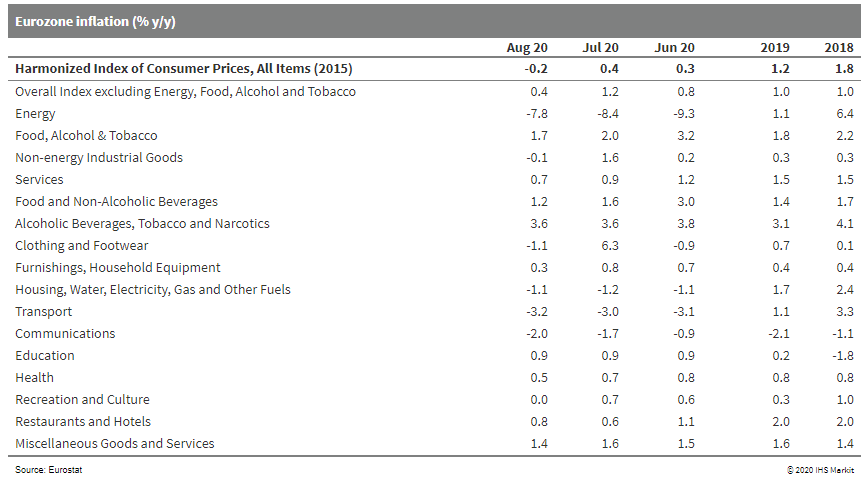

- Eurostat's release of final HICP data for August confirmed the

downward surprises to both headline and core inflation rates

already signaled in the prior 'flash' release. HICP inflation

dropped from 0.4% to -0.2%, well below the initial market consensus

expectation (of +0.2%), going sub-zero for the first time since May

2016. (IHS Markit Economist Ken Wattret)

- Unusually, the deceleration was not driven by energy prices. Rather, the recent gradual upward pressure on the inflation rate for energy continued (see table and first chart below), owing to the lagged impact of prior oil-price gains and base effects.

- The key reason for the fall below zero was the steep decline in underlying inflation. August's plunge in the rate excluding food, energy, alcohol, and tobacco prices from 1.2% in July to just 0.4% in August was confirmed in the final release. This is a record low.

- Non-energy industrial goods inflation (which accounts for around one-third of the core measure above) plunged from 1.6% in July to -0.1% in August (see table and third chart below), more than reversing July's sharp acceleration and well below the average rate of 0.2% between April and June.

- The recent volatility in this HICP item's inflation rate in part reflects delays to the timing of seasonal price reductions, captured in the extreme swings in clothing and footwear inflation rates in July and August (see table below).

- The deceleration in eurozone services inflation (the other two-thirds of the core measure above) was also confirmed in August's final HICP data. It slipped from 0.9% to just 0.7%, also a record low.

- The more detailed breakdown available with the final release illustrates that this was driven in large part by a sharp drop in inflation for recreation and culture (see table below), an area relatively hard hit by the COVID-19 virus pandemic.

- Decelerating inflation for unprocessed food has also

contributed to the lower headline inflation rate over the last few

months, with August's 2.3% rate being well below April's 7.6%

peak.

- The European Commission presented today its 2030 climate target plan, in which it sets out a program to reduce EU greenhouse gas (GHG) emissions by at least 55% by 2030, compared with 1990, despite a call from the European Parliament earlier this month for GHG emissions to be reduced 60% by 2030. The new target is based on a comprehensive assessment of the social, economic, and environmental impacts, which shows that this "course of action is realistic and feasible," the Commission says. The raised target puts the EU on a balanced pathway to reaching climate neutrality by 2050 and underlines the EU's continued global leadership in this area, ahead of the next UN climate conference (COP26), it says. "We are doing everything in our power to keep the promise that we made to Europeans: make Europe the first climate-neutral continent in the world, by 2050. Today marks a major milestone in this journey. With the new target to cut EU greenhouse gas emissions by at least 55% by 2030, we will lead the way to a cleaner planet and a green recovery. Europe will emerge stronger from the [COVID-19] pandemic by investing in a resource-efficient circular economy, promoting innovation in clean technology and creating green jobs," says Ursula von der Leyen, president of the European Commission. The plan includes an amendment to the proposed European climate law, which aims to write into legislation a goal set out in the EU Green Deal, to include the 2030 emissions-reduction target of at least 55% as a stepping stone to the 2050 climate-neutrality goal, the Commission says.

- According to the UK's Office for National Statistics (ONS), CPI

fell back notably to a five-year low of 0.2% in August, after

rising to 1.0% for a second, straight month in July. (IHS Markit

Economist Raj Badiani)

- During the first eight months of 2020, inflation averaged 1.0%, which was well below the Bank of England's target of 2.0%.

- A major development is new government measures to help the hospitality sector recover from the shock caused by the COVID-19-virus pandemic. The ONS reported that the value-added-tax (VAT) cut from 20% to 5% in the hospitality, accommodation, and holiday attractions sectors was an important trigger in lowering inflation in August. Also, the government introduced an eating out scheme, which ran from Monday to Wednesday, offering 50% off food up to the value of GBP10. This scheme provided discounts for more than 100 million meals in August.

- Overall, restaurant and cafe prices fell by 2.6% year on year (y/y) - the first annual drop since records began in 1989.

- Clothing and footwear prices continued to waver because of extended mid-year sales, falling by 1.4% y/y in August and 1.3% y/y in the first eight months of 2020. In addition, they have fallen in 15 out of the past 19 months, which illustrates continued pressure on some retailers to price generously to attract absent consumers.

- Transport prices continued to slide on an annual basis, falling by 1.0% y/y in August, led by fuels and lubricants being 11.0% lower than a year ago. A key factor is global crude oil prices falling by 24.2% y/y to average USD44.8 per barrel in August. Finally, the continued impact of the COVID-19-virus pandemic and quarantine restrictions on travel and tourism triggered a fall in airfare prices in August, unprecedented in the peak month of the holiday season.

- Meanwhile, all-services price inflation was just 0.6% in August, down from 2.0% in July; for goods, it stood at -0.2% from 0.0% in July.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, fell from 1.8% in July to 0.9% in August.

- IHS Markit expects inflation to be moderately positive in the next few months. The IHS Markit September update forecast that inflation is likely to average 0.9% in 2020, after standing at 1.8% in 2019. However, with CPI being lower than expected at 0.2% in August, we anticipate a moderately lower 2020 inflation forecast in our October update.

- Statistik Austria data show that consumer prices partly

corrected for July's unexpected firmness in August, declining by

0.2% month on month (m/m). This is about 0.2 percentage points

lower than the long-term average for this month, dampening headline

inflation according to the national measure from 1.7% to 1.4% year

on year (y/y). Nevertheless, this remains far above May's interim

four-year low of 0.7%. (IHS Markit Economist Timo Klein)

- The European Union-harmonized measure, which displays a different seasonal pattern (relatively higher weights for fuel and restaurants and hotels, and lower weights for insurance services and housing maintenance), declined somewhat more strongly at 0.3% m/m, allowing its annual rate to soften from 1.8% to 1.4% y/y. This nonetheless leads to a record gap with the eurozone average (-0.2%) at 1.6 percentage points. This compares to a 0.6% average differential during 2011-19.

- The key factor in August (details see table and charts below) was the unwinding of July's jump of the annual rate for clothing & footwear, with additional downward pressure stemming from household goods and food. Clothing prices had already been discounted during May and June as retailers tried to boost overall revenues immediately after the lockdown as fast as possible, with July then showing an annual uptick as the normal end-of-summer discounts were delayed into August.

- Energy prices were broadly flat (0.1% m/m), with next to no difference between mineral oil products (0.0%) and household energy (0.1%) this time. The annual decline of energy prices has diminished modestly from -7.1% to -6.6%.

- Seven of the 12 main Classification of Individual Consumption According to Purpose (COICOP) groups of goods and services posted a softening rate, with offsetting upward pressure being confined to alcohol/tobacco, transport, health, and communication.

- Prices of seasonal goods declined by 1.6% m/m in August, allowing their y/y rate to correct downwards from 5.7% to 5.1%. This meant that the index excluding seasonal goods, while also posting -0.2% m/m like the headline measure, shows a slightly softer picture (dip from July's 1.6% to 1.3% y/y).

- German biopharma major Bayer confirmed that it has completed the acquisition of United Kingdom-based clinical stage biopharma KaNDy Therapeutics, thereby gaining access to the non-hormonal oral compound NT-184, which is currently in Phase IIb trials in the treatment of vasomotor symptoms of the menopause. The deal was initially announced in August, and antitrust proceedings have now been concluded. Bayer will pay an upfront sum of USD425 million to acquire KaNDy Therapeutics, as well as potential milestone payments amounting up to USD450 million. NT-814, which is an oral neurokinin-1,3 receptor antagonist, is due to start Phase III trials in 2021. This is the latest in a series of new ventures for Bayer in the female health market space; early in the year, it formed a new strategic alliance with fellow German company Evotec focusing on developing treatments for polycystic ovary syndrome, as well as announcing a licensing agreement with Daré Biosciences (US) for an investigational hormone-free monthly contraceptive. It is speculated that KaNDy's NT-814 has the potential to achieve annual global sales of EUR1 billion (USD1.2 billion). (IHS Markit Life Science's Brendan Melck)

- Two European truck-makers have announced new and upgraded electrified medium- and heavy commercial vehicles (MHCVs), while another has revealed a hydrogen fuel cell electric vehicle (FCEV) concept as part of the strategy for electrification of its heavier models. Scania has revealed its first commercially available electrified trucks, and is offering both plug-in hybrid (PHEV) and battery electric (BEV) variants. According to a statement, both can be had with 'L-Series' low-floor or P-series cabs. The PHEV variant combines a 9-litre diesel engine of between 280hp and 360hp with an 115kW electric motor, which is located between the engine and the transmission. It uses three battery packs giving 90kWh of capacity, which is said to offer up to 60km of zero emission range, depending on gross total weight, type of body and topography of the road. In order to use the zero-emission range more effectively, Scania has introduced the Scania Zone tool, which automatically switches the modes to comply with traffic and environmental regulations as well as allowing the operator to set its own policies in relation to speed, noise and other emissions. The BEV variant features a 230kW electric motor and comes with one of two battery options: five packs offering 165kWh, or nine packs totaling 300kWh. The former is said to offer a range of around 130km depending on the gross total weight, type of body and topography of the road. Separately, DAF has revealed an upgraded CF Electric, which improves range and vehicle payload. According to a statement, the benefit has come from a new generation lithium-ion battery pack which has a capacity of 350kWh (or a 315kWh effective capacity). However, at the same time the battery pack has benefited from a weight reduction. The company has also said that the battery is conditioned to ensure it remains between 25 degrees Celsius and 45 degrees Celsius to ensure consistent performance and durability. Although production of electric and hybrid trucks in Europe has been modest up to now, IHS Markit expects it to grow over the next few years. Just under 400 BEVs were built in Europe in 2019, according to our data, helped by the introduction of Volvo Group's Volvo and Renault Truck brands' launches in this space, and this is expected to increase to almost 1,700 units when Mercedes, MAN and Iveco's offerings come onstream alongside Scania. Ewa Root, manager of IHS Markit's Global Truck Sales Service, notes that this is being driven by CO2 legislation and rapidly increasing clean air zones across the region. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Swedish government is said to be planning to make changes to the support being offered to customers buying electrified vehicles. Göteborgs Posten reports that the bonus for customers purchasing a zero-emission light vehicle will be raised to around SEK70,000 (USD7,933) in 2021. Furthermore, Dagens Industri reports that the government is also proposing to grant funding of more than SEK1 billion to support the investment in electric charging infrastructure and hydrogen for medium and heavy commercial vehicles (MHCVs). The changes are likely to come as part of the country's budget announcement for 2021, which is set to take place next week. A report published by Reuters suggests that this will include SEK9.7 billion of funding to support emissions reductions. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Monetary Policy Committee (MPC) of the National Bank of

Georgia (NBG) in its monetary policy meeting on 16 September

decided to keep the refinancing rate unchanged at 8.0%. In two

previous meetings in August and June, the policy rate had been

lowered by 25 basis points each, following a larger 50-basis-point

cut in April. (IHS Markit Economist Venla Sipilä)

- Inflation has continued to ease in line with the central bank's expectations; the latest data form the National Statistics Office of Georgia (GeoStat) show that consumer prices in August increased by 4.8% year on year (y/y), following gains of 5.7% y/y and 6.1% y/ in July and June, respectively. This was the fourth consecutive month of decelerating inflation.

- The NBG continues to expect that the downward inflation trend will continue throughout the year, and inflation will fall below the target of 3.0% during the first half of 2021, then approach it from below. Weak aggregate demand is suppressing inflation pressures.

- On the other hand, the MPC also recognizes inflation risks from increased foreign exchange market volatility, which may affect inflation expectations, and from the fact that inflation in any case still remains above target. In addition, supply-side inflation risks persist.

- The NBG also notes that, in addition to more traditional fiscal stimulus, the aggregate demand is at present enjoying support from a partial mortgage interest subsidy, which acts as effective monetary stimulus.

- The NGH reiterates its intention to exit from the still tightened monetary stance by way of continuing monetary policy normalization in the future, as allowed by developments in inflation expectations and overall economic activity. Preliminary estimates from GeoStat signal economic contraction of 12.6% in the second quarter of 2020, while the latest "First estimate of economic growth" suggests a fall of 5.5% y/y for July.

Asia-Pacific

- APAC equity markets closed mixed lower across the region; Hong Kong -1.6%, Australia/South Korea -1.2%, India -0.8%, Japan -0.7%, and Mainland China -0.4%.

- The BoJ left its monetary policy unchanged at its 16 and 17

September monetary policy meeting (MPM). The bank will continue

quantitative and qualitative monetary easing (QQE) with yield curve

control. The BoJ also maintained the pace of its asset purchasing

and special lending program intended to support financing in

response to the pandemic. (IHS Markit Economist Harumi Taguchi)

- The BoJ revised up its view on the current economy as domestic and overseas economic activity has started the resume gradually. That said, the bank stated that severe business conditions because of the pandemic have dampened firms' financial positions, implying declines in fixed investment and weakness in employment and household income.

- The BoJ maintained its outlook for moderate recovery and weak inflation because of the persistent effect of COVID-19 worldwide. Uncertainties over the consequences of the pandemic remain a major downside risk. The bank is still concerned about the risk of a substantial decline in medium-long-term growth expectations and financial system stability under the prolonged effect of the pandemic.

- BoJ's decision to maintain its monetary policy and special lending program is in line with IHS Markit expectations, given that monthly economic indicators have signaled that economic activity has begun to pick up. A resurgence in new confirmed cases from mid-June is declining in trend, and financial markets have stabilized thanks to the bank's aggressive asset purchasing and special lending program.

- Takeda (Japan) has agreed to sell its TachoSil Fibrin Sealant Patch (human fibrinogen and human thrombin) to Corza Health (US) for EUR350 million (USD412 million), the Japanese company said in a statement. Under the agreement, Corza Health will acquire the assets and licences related to TachoSil, while Takeda will retain ownership of the manufacturing facility in Linz, Austria. In addition, Takeda and Corza Health have signed a long-term manufacturing agreement under which Takeda will continue to manufacture TachoSil products to supply to Corza Health. Further financial details were not disclosed. The deal follows an attempt by Takeda to divest TachoSil Fibrin Sealant Patch to Ethicon (a unit of Johnson & Johnson, US), which was subsequently abandoned in April after the US Federal Trade Commission said it was likely to block the planned deal over antitrust concerns. The proposed deal met similar resistance from European regulators. The agreement with Corza Health marks a further step by Takeda to divest its non-core assets as the Japanese drug maker continues to pay down debt following its 2019 acquisition of Shire. (IHS Markit Life Sciences Sophie Cairns)

- Chinese technology startup Human Horizons has launched a Level 4 Autonomous Valet Parking (AVP) system on its production vehicle, the HiPhi X. The system uses sensors and communications devices deployed in parking areas to identify and track the vehicle and obstacle positions. The information is sent to the vehicle using a 5G network that will guide it to a safe parking space. Ding Lei, founder and CEO of Human Horizons, said, "Human Horizons leverages technology to enhance the driving experience and efficiency while prioritizing user safety for our projects. With this in mind, we seek to promote autonomous driving and launch V2X [vehicle-to-everything] technology ready for mass-market application." Automated valet parking saves time and effort and resolves the shortage of parking spaces by locating a suitable parking spot. Human Horizons will debut the HiPhi X equipped with the AVP system at the 2020 Beijing Motor Show. According to the company, the HiPhi X is equipped with an advanced, highly personalized onboard artificial intelligence (AI) assistant, HiPhiGo, which has been developed in collaboration with Microsoft. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- GAC NIO, a joint venture (JV) established by GAC Group and NIO, has partnered with multiple autonomous vehicle (AV) and mobility companies to build an intelligent mobility ecosystem that integrates both software and hardware. The partners include PKU Jinqiu New Technologies Limited, Horizon Robotics, WeRide, eHi Car Services, and Xinding Capital, reports Gasgoo. In partnership with PKU Jinqiu, GAC NIO will establish an intelligent automotive institute that will research trends for intelligent mobility ecosystems. Horizon Robotics will offer its on-board chips to support computing capability, WeRide will provide its AV technology to ensure an innovative travelling experience, and eHi Car Services will collect and integrate driving data. GAC NIO will jointly fund this project with Xinding Capital, involving capital of USD1 billion. The GAC NIO JV was founded in April 2018 with registered capital of CNY500 million (USD70.63 million). The JV announced earlier this year that it is working on developing a new vehicle platform based on Level 4 AV technology. GAC NIO currently only has the Hycan 007, a mid-size electric sport utility vehicle, on the market. The model shares the same platform as GAC's Aion LX and is positioned in the same segment. With the Hycan brand, GAC is eager to explore a new business model under its partnership with NIO. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Geely celebrated the opening of its first battery-swapping station in Chongqing, western China, on 16 September. The automaker says it plans to complete the construction of 35 battery-swapping stations in Chongqing by the end of the year and its target is to set up another 65 new battery-swapping stations in 2021. The automaker's first battery-swapping station in Chongqing, located in Liangjiang district, is able to service 1,000 electric vehicle per day. Geely demonstrated its battery-swapping technology with the Maple 80V electric multipurpose vehicle. The model, scheduled for market launch later this year, will become the first model from Geely group to feature a swappable battery pack. Geely is the latest of the major Chinese OEMs to commit to investing in battery-swapping stations. The technology enables the driver to replace a vehicle's battery pack at a service station when the battery is running low. The benefit of the technology is significantly shortened recharging time and the possibility of opting for a high-capacity battery in the future. The challenge is the high upfront investment costs faced by OEMs to build and operate such facilities. (IHS Markit AutoIntelligence's Abby Chun Tu)

- LG Chem has decided to spin off its battery business into a new company amid growing demand for electric vehicle (EV) batteries. It plans officially to launch the new entity with the tentative name LG Energy Solutions on 1 December 2020 after approval from an extraordinary shareholders' meeting to be held on 30 October. LG Chem will be 100% owner of the new battery company. It says it would consider an initial public offering (IPO) for the business. LG Chem is the biggest producer of EV batteries. Its worldwide market share has grown rapidly to an estimated 25%. The company says that "it came to the judgment that this is the right time for the corporate spin-off as the battery industry is growing rapidly and structural profits in the EV battery sector are being made in earnest." LG Chem is targeting sales for the new company of 30.0 trillion South Korean won ($25.5 billion) in 2024. The expected revenue of the business this year is about W13 trillion. LG Chem says it will review plans for an IPO for the new company. Analysts say it may launch an IPO next year and use proceeds to fund capital expenditure. As worldwide exhaust gas emission and fuel economy regulations are further tightened, major international automakers are advancing the launch of EV models, and the EV battery market is growing rapidly, according to LG Chem. The company is expanding its orders to global automakers to supply the next-generation EV market and plans to strengthen production and quality capabilities. LG Chem says it will be possible, through the spin-off, to attract large investments, while easing financial burdens by establishing an independent financial structure for each of its business sectors. The company says it will be able to receive appropriate evaluations of the business value for each of its business units including the battery business.

- Kia has suspended production operations at two plants in Gwangmyeong, just south of Seoul, from late 16 September and sent all of the 6,000 plant workers home, as at least eight workers have been confirmed to have contracted the COVID-19 virus, reports Yonhap News Agency. The automaker will decide on when to resume the plants' operations depending on the health authorities' guidance, according to an unnamed Kia spokesperson. The latest development is another setback for Kia, which is already suffering from sluggish overseas demand owing to a contraction in consumer spending as a result of the pandemic. During January-August, Kia's global sales plunged by 11.3% year on year (y/y) to 1.60 million units. Kia produces the Carnival, K9, Stinger, and Stonic models at the two plants in Gwangmyeong. (IHS Markit AutoIntelligence's Jamal Amir).

- Indonesia's Trans-Pacific Petrochemical Indotama (TPPI) will restart aromatics production from end September to December, market sources said Thursday. TPPI, located at Tuban, is able to produce 550,000 mt/year of paraxylene and 360,000 mt/year of benzene. However, aromatics production was halted in August 2019 in favor of gasoline. TPPI has a 100,000 b/d splitter and a 50,000 b/d reformer. It bought at least 300,000 bbls of condensate for October delivery and another 900,000 bbls for October loading, trade sources said. If the plant is able to run at full capacity, it will add an additional nine cargoes of PX (5,000 mt each) and 10 cargoes of benzene (3,000 mt each) to the spot market. Indonesia is one of the largest gasoline importers in the region but demand has fallen sharply following travel curbs imposed by the government in the wake of COVID-19. The country first imposed a partial lockdown on April 10 and reopened the economy slowly. Last week, however, daily new infections in Jakarta surged to more than 1,000 and a second large-scale social restriction was re-imposed on Sep 14 for two weeks. With gasoline demand in the doldrums, the switch to aromatics was also questionable given the negative margin and current supply length. Both benzene and paraxylene have come under pressure as supply turned long as new facilities start up in the region and other refineries also switch back to aromatics production due to poor gasoline demand. India's ONGC Mangalore Petrochemicals Ltd. (OMPL) reverted to aromatics mode in late August, OPIS reported. The plant is able to produce 900,000 mt/year of PX and 270,000 mt/year of benzene. It switched to reformate mode in early May because of better gasoline blendstock demand and margins. However, as COVID-19 infections rose, India had to implement travel lockdowns which then affected gasoline demand. The switch back to aromatics was also prompted by supply commitments, according to OPIS.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-september-2020.html&text=Daily+Global+Market+Summary+-+17+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 17 September 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+17+September+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}