Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 11, 2020

Daily Global Market Summary - 11 December 2020

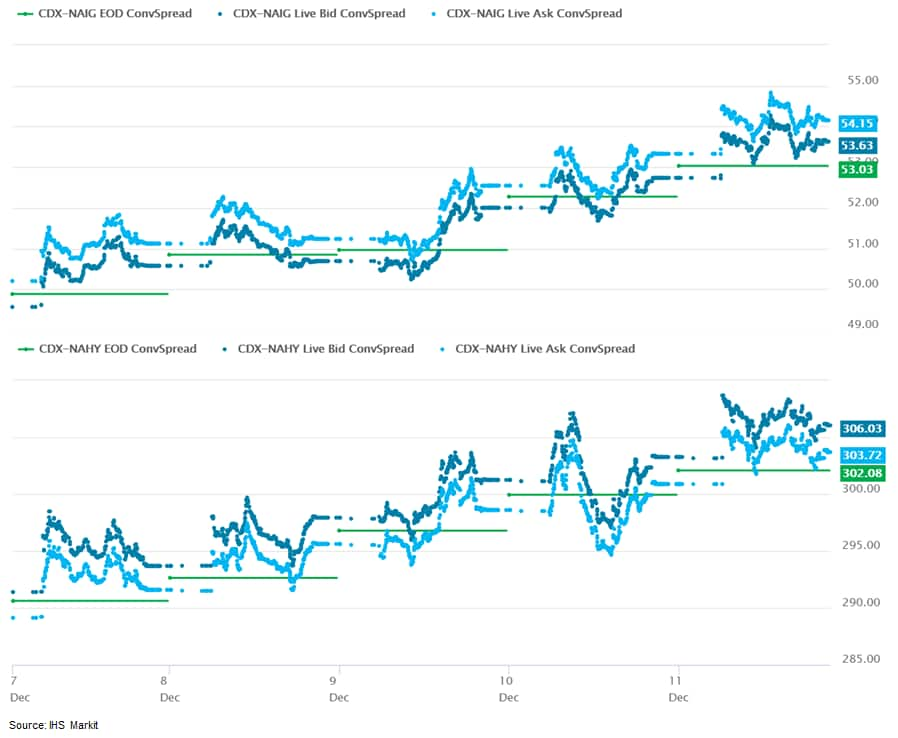

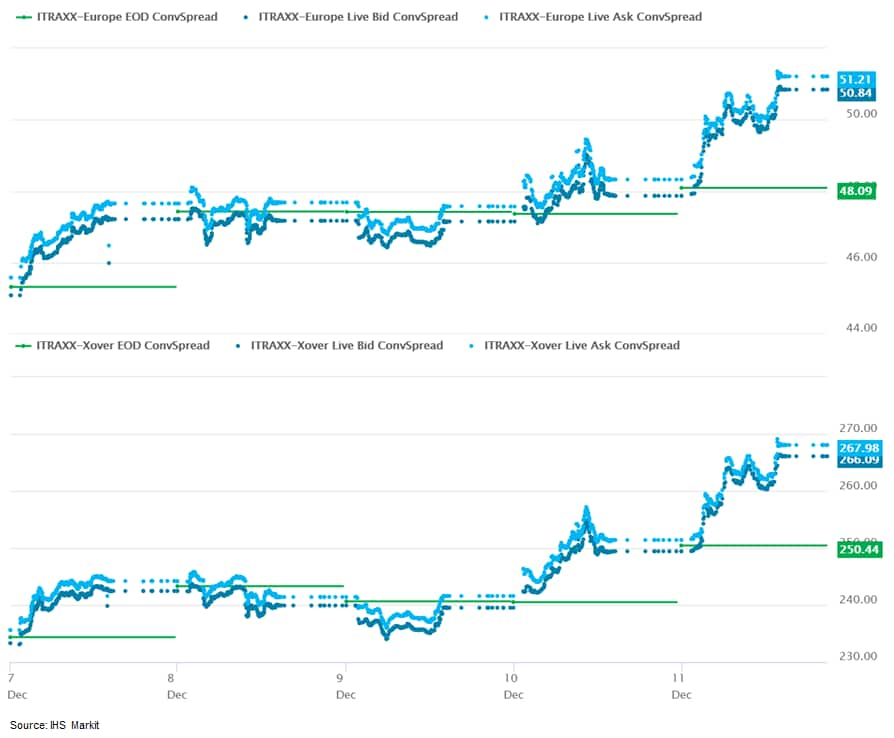

All major European and most US equity indices closed lower, while APAC markets were mixed. The US dollar closed higher along with US and European government bonds. European iTraxx credit indices closed sharply wider across IG/high yield and CDX-NA was only modestly wider on the day. Gold closed higher, while silver was flat and copper/oil were lower.

Americas

- Most US equity markets closed lower except for the DJIA +0.2%; Russell 2000 -0.6%, Nasdaq -0.2%, and S&P 500 -0.1%.

- 10yr US govt bonds closed -1bp/0.90% yield and 30yr bonds flat/1.63% yield.

- CDX-NAIG closed +1bp/54bps and +3bps/305bps, which is +4bps and +14bps week-over-week, respectively.

- DXY US dollar index closed +0.2%/90.98.

- Gold closed +0.3%/$1,844 per ounce, silver flat/$24.09 per ounce, and copper -1.4%/$3.53 per ounce.

- Crude oil closed -0.4%/$46.57 per barrel.

- Economists fear that low-wage service workers face a devastating winter as the latest surge of COVID-19 shutdowns keep shoppers and diners home once again. Starting Monday, indoor dining will be banned in New York City, governor Andrew Cuomo announced on Friday. California governor Gavin Newsom has limited restaurants in several regions to pick up and delivery, restricted capacity in retailers and asked residents to remain in their homes "as much as possible." Pennsylvania banned indoor dining for three weeks starting Saturday, while Delaware announced capacity limits and a 10pm curfew on its bars and restaurants. (FT)

- The US total producer price index (PPI) for final demand rose 0.1% in November, the slimmest gain since a drop of 1.3% in April. The 12-month change (y/y) was +0.8%, up from 0.5% in October, as November 2019 prices fell. (IHS Markit Economist Michael Montgomery)

- Total goods prices rose 0.4% with food up 0.5%, energy up 1.2%, and everything else in goods up 0.2%. Fruit and vegetable prices fell but chicken and pork prices climbed 7.0% and 8.8%, respectively. Food prices are up 1.2% y/y, so most of this is noise.

- Oil-based products drove the monthly rise in energy prices in October, but natural gas, propane, and electricity prices did so in November. Energy prices are down 11.2% y/y.

- Total services prices posted a goose egg with trade margins down 0.3% and transportation and warehousing piece off 0.9%. "Other" services prices firmed 0.2%. Airline fares plunged 7.1% to push transportation down while hospital fees climbed to push up "other."

- Producer prices are now back into the black on a y/y basis broadly in the components, but energy and transportation are not. Low fuel prices are helping hold down airfares, while the pandemic ravages travel volumes. More broadly, prices are drifting higher under anemic wage gains and recession-restricted volumes.

- The University of Michigan US Consumer Sentiment Index rose 4.5 points (5.9%) to 81.4 in the preliminary December reading, erasing most of a November decline. The level of the index remains consistent with our expectation for slowing growth in consumer spending in the fourth quarter. (IHS Markit Economists David Deull and James Bohnaker)

- The increase was reflected in views regarding both future and current conditions. The index measuring consumer expectations rose 4.2 points to 74.7, while the index measuring views on current conditions rose 4.8 points to 91.8. This suggests a modest boost to expectations from encouraging news on vaccines, which are expected to be widely available by late spring or early summer.

- Consumer sentiment also rose irrespective of household income. Sentiment reported for households earning less than $75,000 a year rose 4.4 points to 78.0, while sentiment for higher-income earners rose 4.9 points to 84.4.

- Views on the economy were likely bolstered by the performance of equity markets, which attained record highs in early December. They appeared relatively unaffected by the alarming rise in new COVID-19 cases and deaths that escalated during November, which have prompted some state and local governments to reimpose business restrictions and lockdowns.

- According to the University of Michigan, partisan leaning has been the key factor driving trends in consumer sentiment since the November elections. Among self-identified Democrats, the index of expectations rose by 39.5 points over the last five months, while it has fallen by 34.9 points among Republicans. Self-identified Independents reported sentiment comparable to levels expressed in the early stages of the pandemic.

- The index of buying conditions for large household durable goods rose 9 points in December to 123, the highest since March. The index for vehicles slipped 2 points to 119, while that for homes edged up 1 point to 133.

- The expected one-year inflation rate plunged 0.5 percentage point to 2.3%, an eight-month low, while expected five-year inflation was steady at 2.5%.

- Toyota has announced that its latest fuel-cell electric Class 8 trucks are beginning a pilot program service in California. Two prototypes will be used for drayage between the ports of Los Angeles and Long Beach in California; eight more trucks are planned to begin service in 2021. Toyota is one of several OEMs working towards fuel-cell electric vehicle (FCEV) propulsion as a solution for medium and heavy commercial vehicle applications, which typically use diesel fuel. The FCEV solution offers zero emissions and, with trucks for this application and consistent duty cycles, installing fueling infrastructure to support it is more manageable than for light vehicles. Toyota is also participating in similar programs in other countries, including Japan. Other truck-makers looking to develop potential FCEV solutions in this space include Hyundai and Daimler, as well as startup Nikola; as with Toyota, their development of the solution is occurring in several regions and is not particularly focused on the US. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Performance electric-car startup Polestar has begun delivering vehicles in Canada, starting with the Polestar 2 on 10 December, reports Automotive News Canada. According to the report, these first Polestar deliveries are to retail operators, and customers will be able to have their cars delivered or will be able to schedule a time to pick them up at the retail location. In Canada, the price of the Polestar 2 starts at CAD71,800 (USD56,200), including shipping. Polestar has created a digital-first retail model in which customers order online, although it has "retail spaces" in the Canadian cities of Toronto, Montreal, and Vancouver (see Canada: 15 July 2020: Polestar announces first retail locations in Canada). Unlike traditional dealerships or showrooms, the retail spaces have no inventories. Customers can arrange for an at-home test drive and contactless delivery through the website. Automotive News Canada reports the Polestar 2 is being launched with financing as low as 0.9% and numerous leasing options, a four-year vehicle warranty, and free pick-up and delivery within 240 kilometers of a retail space. Country manager for Polestar Canada Hugues Bissonnette reportedly said, "The Polestar 2 places us directly in the center of the burgeoning premium electric vehicle segment and is the car that will propel Polestar toward future growth." Polestar is expected to start out slowly in the Canadian market, in part because of its limited product line-up and retail locations. By 2023, IHS Markit forecasts Polestar sales in the Canadian market of 500 units per annum. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In a press release, Petronas announced a hydrocarbon discovery at Sloanea-1 exploration well in Block 52 offshore Suriname. The Sloanea-1 well encountered several hydrocarbon-bearing sandstone packages and drilled to a total depth of 4,780 meters (15,682 feet), the company said. Block 52 is located approximately 75 miles (120.7 kilometers) north of the coast of Paramaribo in the Suriname-Guyana basin and covers an area of 4,749 square kilometers. The water depths on the block range from 50 - 1,100 meters (160 - 3,600 feet). The block was awarded to Petronas in April 2013. In May 2016, Petronas and its former partner Deutsche Erdoel AG drilled the Roselle-1 wildcat well on Block 52. The well was drilled to a total depth of about 5,000 meters (16,404 feet) in 87 meters (285.4 feet) of water. In May 2020, ExxonMobil completed the farm-in for a 50% interest in Block 52. Petronas operates the block with a 50% interest, and ExxonMobil holds the remaining 50% interest. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

Europe/Middle East/Africa

- European equity markets closed lower across the region; Spain -1.5%, Germany -1.4%, Italy -1.0%, and UK/France -0.8%.

- 10yr European govt closed higher across the region; Spain/France/UK/Germany -3bps and Italy -1bp.

- iTraxx-Europe closed +3bps/51bps and iTraxx-Xover +17bps/267bps, which is +6bps and +33bps week-over-week, respectively.

- Brent crude closed -0.6%/$49.97 per barrel.

- The U.K. will become the first major industrialized nation to end all public finance for fossil fuel projects overseas, in an effort to mark itself out as a leader in tackling climate change. Prime Minister Boris Johnson will make the announcement at a virtual United Nations summit on Saturday, which he's co-hosting with France, Italy and Chile. More than 70 world leaders are due to attend the event, alongside Pope Francis and Apple Inc. Chief Executive Tim Cook, who will each pledge to step up ambitions to curb emissions. (Bloomberg)

- RWE has chosen Van Oord as its preferred supplier for the engineering, procurement, construction and installation (EPCI) of the monopile foundations and array cables for the 1.4 GW Sofia Offshore Wind Farm, sited 195 km off the United Kingdom at the North Sea's Dogger Bank. Van Oord's UK subsidiary MPI Offshore will create a logistics hub from its Stokesley office in Teesside, to deliver the comprehensive scope of work. Installation vessel Aeolus will install the 100 extended monopile foundations without transition pieces, while the 350 km of array cables will be installed by cable-laying vessel Nexus. Van Oord will sub-contract the fabrication of the foundations and array cables. Work on the foundation and array package is set to begin after the project's financial investment decision in the first quarter of 2021, with installation scheduled for 2024. The Sofia project will be the fifth and largest UK offshore wind farm that RWE and Van Oord have worked on together. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Britishvolt has announced that it has selected a site for its new battery manufacturing facility. According to a statement, the company has acquired rights to land in Blyth in Northumberland (UK). It added that it plans to invest around GBP2.6 billion in this location. Construction is set to begin in mid-2021, while production after the initial phase of construction would begin at the end of 2023. It has said that on the completion of the final phase of the project in 2027, it expects to employ around 3,000 people on site producing over 300,000 lithium-ion batteries for the domestic automotive industry. It also sees 5,000 jobs being created in the wider supply chain. (IHS Markit AutoIntelligence's Ian Fletcher)

- Daimler Trucks and Linde has signed an agreement to jointly develop a new generation of liquid hydrogen refueling technology to service the fuel cell trucks that Daimler is developing. According to a company statement, the collaboration is aimed at making 'the refueling process with hydrogen as easy and practical as possible'. The two companies will focus on developing a new process for handling liquid hydrogen known as "subcooled" liquid hydrogen. This approach will allow for higher storage density, greater range, faster refueling and superior energy efficiency. The new process will use higher than ambient pressure levels and special temperature control which avoids boil-off effects and "return gas" (gas from the vehicle's tank returning to the filling station) during refueling and will not require complex data communication between the filling station and the truck during refueling. Linde is a global leader of engineering and industrial, process and specialty gases. The two companies are planning for the first refueling of a prototype vehicle at a pilot station in Germany in 2023. (IHS Markit AutoIntelligence's Tim Urquhart)

- Spain breached European habitats protection and water laws in allowing Andalusian strawberry producers to take out too much groundwater from the Doñana natural area, according to an advisory opinion from an EU judge. In the 3 December opinion on a case (C-559/19) that the European Commission brought against Spain, Advocate General Juliane Kokott, concluded the excessive abstraction of groundwater in the Andalusian Doñana natural area infringes EU law. The water is used for strawberry irrigation but exceeds groundwater recharge levels in certain areas meaning the water table has been falling for many years, drying out the protected natural areas. The opinion contends that this excess water extraction infringes the habitats directive in causing "significant adverse effects" on three protected areas of European importance - Doñana (a bird protection area since 1987), Doñana Norte y Oeste and Dehesa del Estero y Montes de Moguer. Prohibition of deterioration However, the opinion does not accept that that Spain has breached the "prohibition of deterioration" requirement in the EU water framework directive. A court statement on the opinion explains that for Advocate General Kokott, "the prohibition of deterioration does not require groundwater abstraction to be reduced such that less water is abstracted than is recharged, but only that overexploitation does not increase. Simply lowering the groundwater level, that is to say, reducing groundwater reserves, is therefore not to be regarded as deterioration per se." Nevertheless, the opinion does find that Spain breached the water framework directive on other counts. Notably, it failed to take into account abstraction of drinking water when reviewing the impact of human activity on groundwater status in the Doñana natural area. (IHS Markit Food and Agricultural Commodities' Sara Lewis)

- Lonza has declined to comment on reports that Lanxess and private equity groups including Advent International, Carlyle Group, Partners Group, and a consortium comprising Bain Capital and Cinven have been shortlisted to bid for the Lonza Specialty Ingredients (LSI) division, which is up for sale. Lonza tells CW that it is in discussions with potential buyers, but does not "comment on speculation," and that "as soon as we have more information, we will share it with the markets." According to anonymous sources cited in a Reuters report, a total of six companies have been allowed to proceed to the next round of bidding for LSI. Private equity firm Lone Star Funds as well as SK Innovation are mentioned as possible bidders, but it is not clear whether they have been shortlisted, the report says. Separately, a Bloomberg report says that private equity firms Blackstone Group, CVC Capital Partners, and Clayton Dubilier & Rice are no longer in the running. It adds that no final decisions have been made, and there is no certainty that the shortlisted bidders will make binding offers. LSI is one of two segments within Lonza. The other is pharma, biotech, and nutrition. Lonza's plans to carve out LSI were first announced in June 2019. LSI is estimated to be worth 3.0-3.5 billion Swiss francs ($3.4-3.9 billion). (IHS Markit Chemical Advisory)

- Saipem and Eni have signed a memorandum of understanding (MoU) to identify and engineer decarbonization projects in Italy, with a focus on potential collaborations in the sector of the carbon capture, utilization and storage (CCUS) of carbon-dioxide (CO2). The objective is to contribute towards the decarbonization process of entire industrial production chains, particularly those of the highest energy intensity, by taking clear steps with immediate action to combat climate change and to achieve CO2 reduction targets at national, European and global levels. Through the MoU, Eni and Saipem will also evaluate participation in programs financed by the European Union as part of the Green Deal Strategy, proposing the possible inclusion of specific initiatives within the plan for the use of funds intended to support member states of the European Union in the post-COVID-19 phase. According to Saipem, the company has designed more than 70 plants for the capture of CO2 and over 40 plants for the subsequent transformation into urea. Saipem acquired CCUS technology and intellectual property from Canadian firm CO2 Solutions in January 2020; the acquisition included a CO2 capture plant in Saint-Félicien, Québec. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Greek industrial production declined by 3.1% month on month (m/m) in October, according to seasonally adjusted figures released by the Greek statistical authority. Production had risen by 1.5% m/m in September and declined by 1.2% m/m in August. (IHS Markit Economist Diego Iscaro)

- Output levels fell by 3.8% year on year (y/y) in October. Moreover, they remained 4.1% below their pre-coronavirus disease 2019 (COVID-19) virus pandemic level in February.

- While production of capital and intermediate goods rose by 2.1% m/m and 0.6% m/m, respectively, production of energy (-9.1% m/m) and consumer non-durables (-1.4% m/m) were a major drag in October.

- Meanwhile, figures also published by the statistical office show Greece's consumer prices (measured by the EU-harmonized index) declining by 2.1% y/y in November. Prices thus fell for the eighth month in a row, and are down by an average of 1.2% since the start of 2020.

- Falling energy prices continued to be a major drag on inflation in November (see Chart 1). However, core inflation was also extremely weak, at -2.3% y/y.

- Core inflation was hit by falling prices in the service sector (-2.2% y/y) as demand collapsed as a result of the restrictions implemented to contain the COVID-19 virus pandemic.

- On the other hand, food prices (including alcohol and tobacco) rose by 1.9% y/y in November, up from 1.6% in October. Marked increases in prices of unprocessed food products, which rose by an average of 5.7% during the three months to October (November's data are not available yet), have kept food inflation relatively high recently.

- The data point to very weak underlying growth momentum at the start of the fourth quarter. The industrial sector is likely to make a negative contribution to GDP growth during the fourth quarter, while the service sector is expected to exert an even larger drag on activity due to the tightening of COVID-19 virus-related restrictions in November.

- The South African manufacturing sector's output edged up by 2.6% month on month (m/m) during October. However, overall manufacturing production has not yet recovered to pre-COVID-19 levels, with manufacturing production contracting by 3.4% year on year (y/y) during the month. (IHS Markit Economist Thea Fourie)

- Production losses compared with a year earlier were recorded by manufacturing sub-sectors including petroleum, chemical products, rubber and plastic (down 6.8% y/y). Other sub-sectors recording y/y output losses included basic iron and steel, non-ferrous metal products, metal products and machinery (down 5.0%); motor vehicles, parts and accessories and other transport equipment (down 6.8%); and wood products, paper and publishing and printing (down 3.4%).

- Output gains compared with a year earlier were recorded in the food and beverages (up 0.5% y/y) and glass and non-metallic metals (up 4.2% y/y) sub-sectors.

- Overall manufacturing production fell by 12.8% during the first 10 months of 2020, the Statistics South Africa (StatsSA) statistical service reported.

- South Africa's GDP bounced back by 13.5% quarter on quarter (q/q) during the third quarter. The sharp rebound in economic activity during the third quarter was not enough to bring GDP back to the pre-COVID-19 virus outbreak level. Instead, the country's headline GDP fell by 6.1% y/y during the third quarter, leaving overall GDP down by 7.9% y/y during the first nine months of 2020.

- South Africa's annual inflation rate fell marginally to 3.2% in November, from 3.3% in the previous month. This leaves South Africa's annual inflation rate at 3.3% for the first 11 months of 2020, from 4.1% for the same period last year. (IHS Markit Economist Thea Fourie)

- The month-on-month (m/m) inflation fell to zero in November, from 0.3% in the previous month. Food prices contributed 0.1 percentage point to the monthly rate, but this was mitigated by a 0.1-percentage-point fall in transport costs over the period.

- Prices of food and non-alcoholic beverages have been edging in up in the past two months, with statistical service Statistics South Africa (StatsSA) reporting food and non-alcoholic price increases of 5.9% year on year in November, from 4.2% y/y in September.

- Overall goods inflation remained unchanged, nonetheless, averaging 2.6% in November, unchanged from the October level. Services inflation slowed marginally to 3.7% y/y in November, from 3.8% y/y in the previous month.

- South Africa's headline inflation rate remains close to the lower end of the South African Reserve Bank (SARB)'s inflation target range of 3-6%.

- Price increases in South Africa remain low, benefiting from weak domestic-demand price pressures, lower transport costs, and limited feed-through of the rand's weaker exchange rate on the overall price level in the economy. The decision by private medical aid funds not to raise their premiums during the first half of 2021 could push headline inflation as low as 2.5% by February 2021.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +0.9%, Hong Kong +0.4%, India +0.3%, Japan -0.4%, Australia -0.6%, and Mainland China -0.8%.

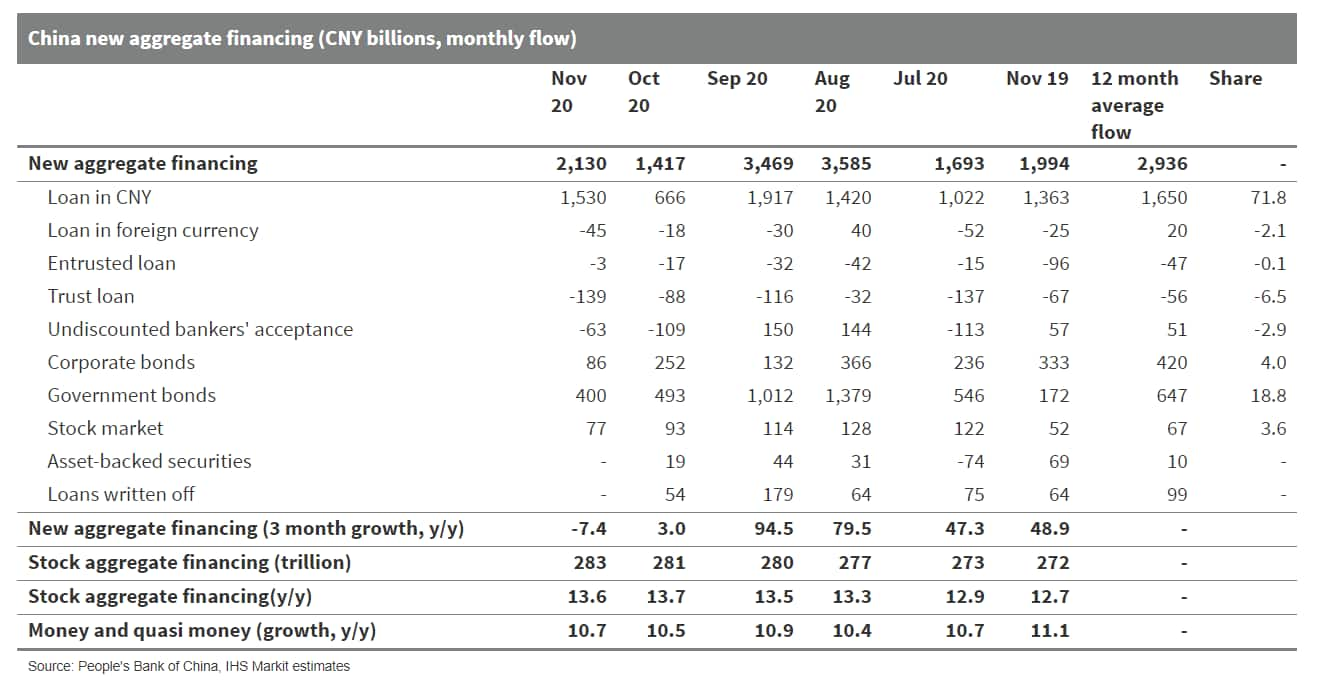

- China's new aggregate financing, the widest measure of net new financing to the real economy, increased by CNY2.1 trillion in November 2020, up CNY136 billion from the amount a year ago, compared with a CNY549.3 billion increase in the previous month, according to the release of the People's Bank of China (PBOC). The stock total social financing (TSF) rose 13.6% year on year (y/y), edging down from 13.7% y/y increase in October, the first further deceleration since March. (IHS Markit Economist Yating Xu)

- The issuance of local government bond continued to decline month on month to CNY400 billion in November, but it remained CNY228.4 billion above the level a year ago, which was the main contributor to the headline TSF increase. Bank loans to the real economy increased by CNY1.5 trillion, up CNY167.6 billion compared to a year ago, which was the second largest contributor to the new TSF. Particularly, household borrowing continued to increase, reflecting the broad-based recovery in property sales in November. Meanwhile, continuous recovery in manufacturing investment and strong export growth continued to support corporate borrowing.

- Broad money supply (M2) growth rose by 0.2 percentage point to 10.7% y/y in November as fiscal deposit declined, largely reflecting acceleration fiscal spending in the year end. M1 growth further increased to 10%, reflecting steady improvement in real economy.

- TSF increased by CNY31.84 trillion through November, up CNY9.6 trillion from a year ago. Bank loans increased by CNY18.8 trillion, compared with an annual target of CNY20 trillion.

- Although the local government bond may continue to support TSF in December given the low base effect, the moderation trend in new TSF is likely to continue as this round of credit expansion could have ended and monetary policy gradually normalizes.

- However, since domestic economy is yet to recover to potential growth, consumer inflation is on a downward trend, and there is a lot of uncertainties with the pandemic, monetary policy is expected to maintain stable in the short term.

- Telecoms equipment company Huawei Technologies is reportedly planning to construct research and development (R&D) center in Chinese city of Guangzhou to develop intelligent vehicle-related technologies. The company is permitted to use a piece of land in city's Baiyun District that will be used to set up this R&D center, reports Gasgoo. The center will support projects such as smart city, cloud computing and Internet of Things (IoT), promoting the application of Huawei's information communications technology in various industries of Guangzhou. Huawei is looking to expand its presence in the automotive industry. The company has R&D centers in Shanghai and Suzhou. Huawei's 5G technology offers advantages such as high transmission speed, reliability and latency that meet the technical connectivity requirements for autonomous vehicles. This year, Huawei partnered with 18 Chinese automakers to accelerate the use of 5G in vehicles. Last year, the company announced plans to use its 5G technologies to develop millimeter-wave radar and laser radar sensors for autonomous vehicles. In May 2019, Huawei established its intelligent vehicle business unit, which focuses on five aspects: smart driving, smart cockpit, intelligent connectivity, smart electrification, and cloud service. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Qingdao city in China's Shandong province is planning to construct more than 50 hydrogen-refueling stations and to have around 8,000 fuel-cell vehicles (FCVs) on roads by 2030, reports Gasgoo. According to the report, Qingdao's authorities expect to set up a hydrogen industrial cluster and demonstration zones, as per the city's near-term plan for 2020-22. Between 2023 and 2025, Qingdao is planning to build a hydrogen industrial ecosystem and application system and support the mass application of hydrogen energy and fuel cells. In the longer term, between 2026 and 2030, Qingdao plans to see a comprehensive utilization of hydrogen energy in such areas as transport, logistics, power generation, and supply of heat. Additionally, technologies such as the Internet of Things (IoT), 5G, and big data will be introduced to enhance the intelligence, reliability, and operational efficiency of the hydrogen infrastructures. With electric vehicles (EVs) gaining popularity in China, the country is focusing on promoting hydrogen fuel-cell technology as well. China aims to build 1,000 hydrogen-refueling stations by 2030 to support the commercializations of FCVs in both the commercial and the passenger car sectors. In June last year, Shanghai announced plans to establish an ecosystem for the hydrogen industry, a hydrogen park occupying over two square kilometers by 2025, with an expected annual output value of the FCVs reaching CNY50 billion. (IHS Markit AutoIntelligence's Nitin Budhiraja)

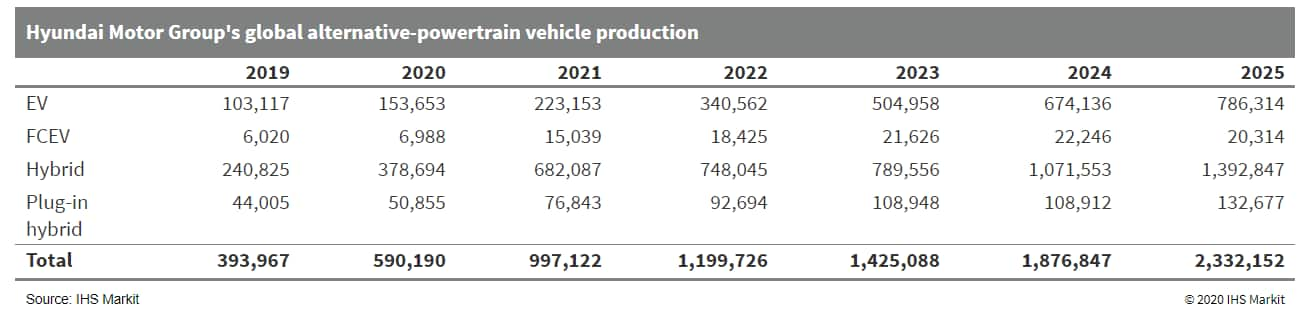

- Hyundai's updated Strategy 2025 roadmap is supported by three key pillars: Smart Mobility Device and Smart Mobility Service - both part of the original plan revealed in 2019 - as well as H2 Solution, the addition of which reflects Hyundai's commitment to fuel-cell development and commercialization. IHS Markit forecasts that global production of Hyundai Motor Group's light vehicles, including those of affiliate Kia, will grow to around 8.0 million units in 2025, up from 7.4 million units in 2019. We also forecast that the group's global production of alternative-powertrain vehicles will grow to around 2.3 million units in 2025, up from 394,000 units in 2019. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-december-2020.html&text=Daily+Global+Market+Summary+-+11+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 11 December 2020 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+11+December+2020+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}