Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 14, 2018

April PMI signals improving demand as India economy recovers from twin shocks

- India continues to recover from recent twin shocks (demonetisation and the Goods and Services Tax)

- Manufacturing continues to outperform the service sector

- Recent easing of inflationary pressures at risk as crude oil prices rise

India's economic performance accelerated to the strongest in three months at the start of the second quarter, suggesting the economy is recovering from the recent twin structural shocks of demonetisation and the Goods and Services Tax (GST).

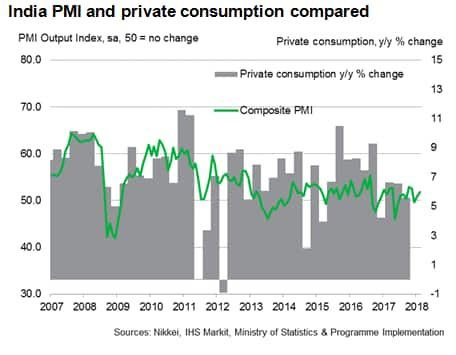

Recent growth rates have been modest because private consumption remained weaker than seen pre-demonetisation. The recent data suggest that private consumption will continue to recover, and the rate of that recovery will play an instrumental role in determining the pace of economic growth.

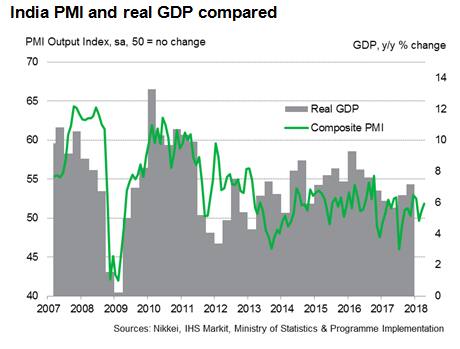

The transition from recent disruptions is evident in the Nikkei PMI data, compiled by IHS Markit, which provides a gauge of economic conditions. The Nikkei Composite Output PMI Index hit 51.9 in April, its highest since January, suggesting growth has reaccelerated after a soft patch. Companies have reported improvements in underlying domestic demand as the country adjusts to recent structural shocks.

The upturn in growth momentum helps corroborate recent upbeat views on the economy. The IMF estimates that India is projected to be the fastest growing major economy this year. IHS Markit forecasts real GDP growth of 7.3% in 2018, supported by a recovery in investment and consumer spending.

This more positive narrative follows encouraging news of GDP growth perking up to 7.2% for the October-December quarter, and the RBI reporting in April that bank credit growth reached its highest since July 2014.

PMI remains below historical average

Investment has also started to recover, partially driven by the improvement in bank credit, which rose at an annual rate of 12.6% in the fortnight ended April 27th.

In contrast, consumer spending looks subdued by comparison, acting as a significant drag on the economy. December 2017 saw 5.6% annual consumer spending growth as customers experienced the lingering effects of the cash ban. This picture is likely to have persisted into the first quarter, during which the Nikkei Composite Output PMI Index remained weaker than the pre-demonetisation average.

Looking ahead, the pace at which private consumption recovers will play a key role in determining the strength of output growth.

Further insight can be obtained by examining the sector fundamentals.

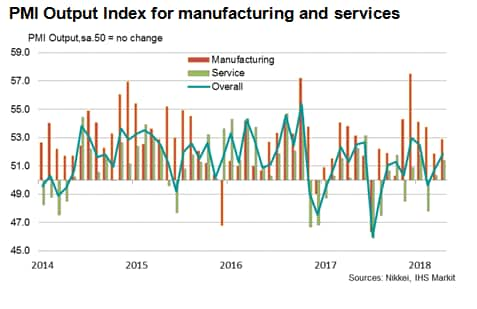

Sector breakdown - imbalanced recovery

The manufacturing PMI data highlighted a healthy recovery from the implementation of the Goods and Services Tax as it experienced solid and uninterrupted growth in the nine months up to April.

By comparison, the service sector remained a laggard, reporting only a modest expansion in activity. PMI data, therefore, hint that growth in the service economy, which is the largest contributor to real GDP, will require an accelerated rebound to be equivalent to pre-demonetisation levels.

The survey data also show that manufacturing companies are relatively more confident than the service sector counterparts towards future business prospects in the year ahead.

Formal employment measured by PMI

It is promising to see that government efforts to formalise the economy translated into the best round of job creation since March 2011 across the service sector, as recorded by the PMI data. Moreover, as the economy continues to overcome the short-term slowdown as a result of recent policy and structural changes, it will be encouraging for investors to see the benefits of this reform materialising and driving growth in the long-run.

Key threats to India's positive outlook

PMI data meanwhile also signalled inflationary pressures moderating further in April, with input cost and output charge inflation running at the lowest since September 2017 and June 2017 respectively. A reversal of this trend is to be expected as oil prices continue on an upward trajectory. Downward pressure on the Indian rupee will also potentially lead to higher imported inflation costs.

Government finances and real GDP are also some of the key economic components that are threatened by higher crude oil prices.

Other risks to India include the US fed tightening programme, and the banking crisis, particularly the uncertainty surrounding the extent to which banking fraud is prevalent.

It will be interesting to see how India's recent strong performance and resilience is tested as it faces these headwinds going forward. Therefore, we will need to closely monitor key PMI indicators, which will provide a clear signal of the underlying economic trends over the coming months.

Aashna Dodhia, Economist, IHS Markit

Tel: +44 1491 461003

Email: aashna.dodhia@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-pmi-signals-improving-demand-as-india-economy-recovers-from-twin-shocks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-pmi-signals-improving-demand-as-india-economy-recovers-from-twin-shocks.html&text=April+PMI+signals+improving+demand+as+India+economy+recovers+from+twin+shocks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-pmi-signals-improving-demand-as-india-economy-recovers-from-twin-shocks.html","enabled":true},{"name":"email","url":"?subject=April PMI signals improving demand as India economy recovers from twin shocks | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-pmi-signals-improving-demand-as-india-economy-recovers-from-twin-shocks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=April+PMI+signals+improving+demand+as+India+economy+recovers+from+twin+shocks+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapril-pmi-signals-improving-demand-as-india-economy-recovers-from-twin-shocks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}