Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 26, 2018

Advance US GDP growth estimate confirms PMI signal of slower expansion

- GDP rises by weaker than expected 2.6% in Q4

- Final demand growth accelerates

- Flash PMI points to steady, but weakened, growth in January

The US economy grew less than expected in the closing quarter of 2017, according to fresh official data. However, in a sign of underlying strength, domestic demand growth was reported to have picked up. Moreover, the fourth quarter expansion rounded off the economy’s best year since 2014, with GDP up 2.3% compared to 1.5% in 2016.

Mixed end to 2017

The advance estimate of a 2.6% annualised increase in GDP, down from 3.2% in the third quarter, was in line with PMI survey data from IHS Markit. The composite PMI Output Index had averaged 54.6 in the three months to December, down from 54.9 in the third quarter.

More encouragingly, final sales grew at an annualised rate of 3.2%, up from 2.4% in the third quarter to register the strongest gain since the second quarter of 2015. Stronger domestic demand also sucked in more imports, dampening the GDP figure.

Part of the weakening in the GDP data also came from a lower than expected contribution from inventories, which in turn suggests that stockbuilding could contribute to stronger GDP growth at the start of 2018. Note that the January flash PMI survey showed the largest increase in inventories of manufacturing inputs for a year and the largest rise in finished goods inventories for six months.

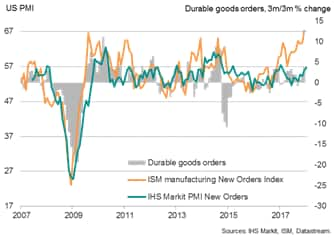

A strong upsurge in economic growth in the first quarter still looks unlikely, however, as the flash PMI showed that a recent improvement in manufacturing growth (corroborated by an upswing in durable goods orders – see chart) was countered by the weakest rise in service sector activity for nine months. The resulting overall PMI signal for January was consequently one of slower, though still steady, GDP growth in the region of 2.0-2.5%. On a more positive note, a marked upswing in new orders from the flash January PMI surveys, to the highest for five months, suggests that the slowdown could prove temporary.

US GDP and the IHS Markit PMI

US durable goods orders

Chris Williamson, Chief Business Economist, IHS Markit

Posted 26 January 2018

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fadvance-us-gdp-growth-estimate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fadvance-us-gdp-growth-estimate.html&text=Advance+US+GDP+growth+estimate+confirms+PMI+signal+of+slower+expansion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fadvance-us-gdp-growth-estimate.html","enabled":true},{"name":"email","url":"?subject=Advance US GDP growth estimate confirms PMI signal of slower expansion&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fadvance-us-gdp-growth-estimate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Advance+US+GDP+growth+estimate+confirms+PMI+signal+of+slower+expansion http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fadvance-us-gdp-growth-estimate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}