Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2018

UK inflation remains stubbornly high at start of 2018

- UK consumer price inflation held steady at 3.0% in January, above expectations of easing to 2.9%

- PMI data suggest strong price pressures will persist

- Bank of England faces dilemma as high inflation is accompanied by slowing economy

UK inflation came in higher than expected in January, adding further pressure for policymakers to hike interest rates again, possibly as soon as May.

However, with mounting signs of economic growth slowing at the start of 2018, a May rate rise is by no means a done deal and will likely be dependent on the data flow improving in coming months.

Consumer prices rose at an annual rate of 3.0% in January, according to the Office for National Statistics, unchanged on December and remaining well above the Bank of England’s 2.0% target.

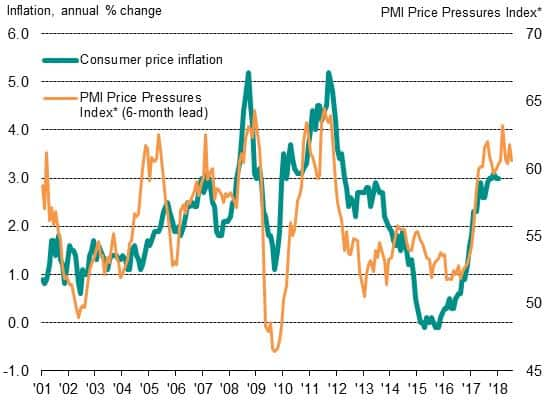

UK inflation (CPI) and survey price pressures*

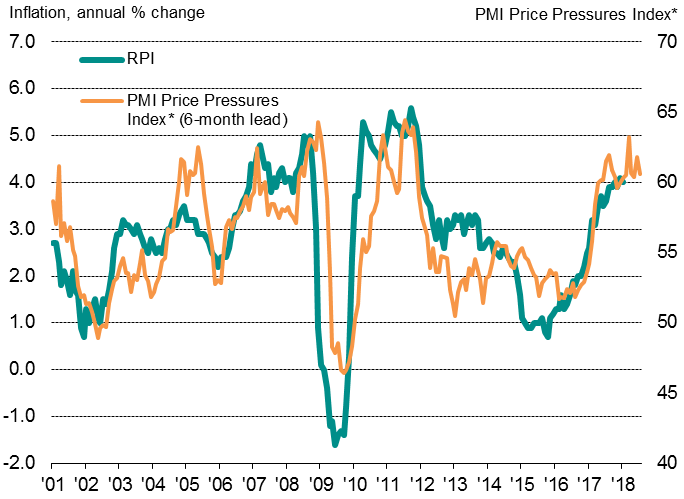

UK inflation (RPI) and survey price pressures*

*A PMI index of price pressures constructed from indicators of input costs in manufacturing, services and construction, blended with the manufacturing PMI suppliers’ delivery times index (which acts as a proxy for the amount of spare capacity in the economy).

Sources: ONS, IHS Markit

Moreover, survey data tracking companies’ costs and the amount of spare capacity in the economy suggest that inflation could remain stubbornly high for some time to come. The data indicate that the inflationary impact of the weaker pound has been supplanted as the main driver of higher prices in recent months by higher global commodity prices, notably for oil, amid the strengthening global upturn.

The data come on the heels of recent warnings from the Bank of England that interest rates may have to be hiked more aggressively than previously thought in order to control inflation, putting a May hike in play.

The dilemma facing policymakers is that the pace of economic growth appears to have wilted at the start of 2018. PMI survey data registered the slowest growth of business activity for one-and-a-half years in January. Data from mortgage lender Halifax have also shown house prices falling for a second successive month while an index of consumer spending from Visa showed a 1.2% annual decline as shoppers struggled with the combination of high prices and sluggish wage growth.

While the stickiness of inflation will make for itchy trigger fingers among rate setters at the Bank of England, the signs of the economy faltering suggest there’s a risk of higher interest rates exacerbating a nascent slowdown. While the door remains open for a May interest rate hike, the Bank of England will likely need to see indicators of the economy’s health improve to be sufficiently reassured that the economy is ready for another rise in borrowing costs.

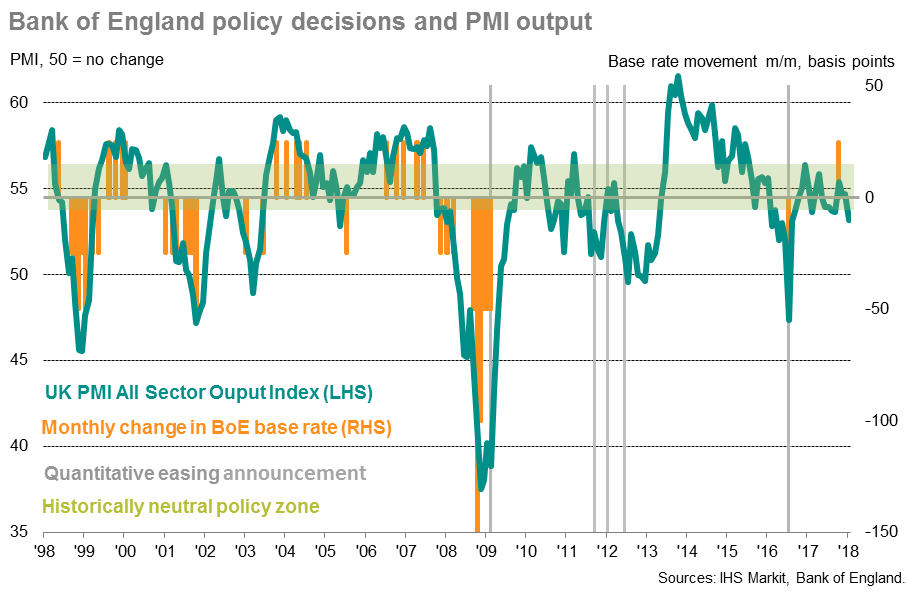

Bank of England decision data dependent

A historical comparison of previous Bank of England interest rate decisions illustrates how past interest rate hikes (since 1999) have not occurred when the all-sector PMI output index has been below 56.5, with the exception of last November, when a 0.25% hike in bank rate occurred with the output index at 55.4. What appears to have tipped the balance towards higher interest rates in November was the presence of underlying inflationary pressures.

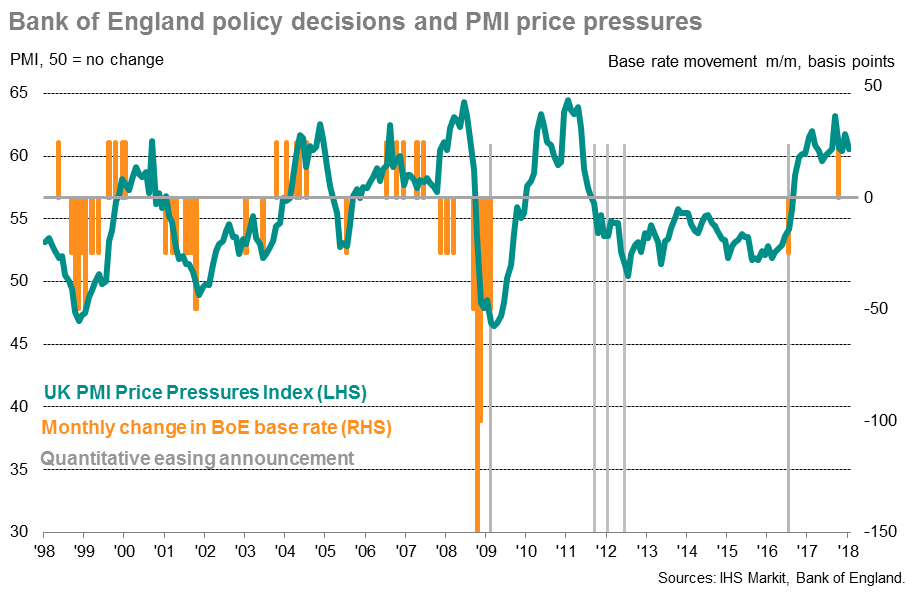

A PMI index of price pressures constructed from indicators of input costs in manufacturing, services and construction, blended with the manufacturing PMI suppliers’ delivery times index (which acts as a proxy for the amount of spare capacity in the economy), clearly highlights how price pressures have intensified in recent months, up to a level which is historically commensurate with tighter monetary policy.

The sustained elevated level of the PMI price pressures index in January suggests that the current inflation upturn, as measured by both CPI and RPI, will persist for some time. The inflationary impact of the weaker pound has been supplanted as the main driver of higher prices in recent months by higher global commodity prices, notably for oil, amid the strengthening global upturn.

Chris Williamson, Chief Business Economist at IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-inflation-remains-stubbornly-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-inflation-remains-stubbornly-high.html&text=UK+inflation+remains+stubbornly+high+at+start+of+2018","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-inflation-remains-stubbornly-high.html","enabled":true},{"name":"email","url":"?subject=UK inflation remains stubbornly high at start of 2018&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-inflation-remains-stubbornly-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+remains+stubbornly+high+at+start+of+2018 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fUK-inflation-remains-stubbornly-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}