Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2018

Diverging manufacturing, trade and construction trends paint mixed picture of UK economy

- Manufacturing sees robust end to 2017

- Construction output drops further in Q4

- Trade deficit widens

Official data confirmed the solid performance of the UK’s manufacturing sector at the end of 2017, with factories buoyed by the weaker exchange rate. The trade deficit swelled, however, despite non-oil goods exports rising at a steady pace. Meanwhile, construction output remained a drag on the economy in the fourth quarter, underscoring the mixed picture of the economy at the end of the year.

The data come on the heels of warnings from the Bank of England that interest rates may have to be hiked more aggressively than previously thought in order to control inflation.

Mixed end to 2017

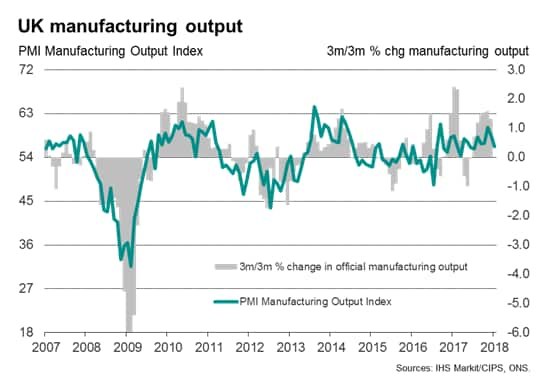

Data from the Office for National Statistics showed manufacturing output up 0.3% in December, rounding off a solid quarter in which factory production increased 1.3%. Output has now risen for eight straight months, which is the longest continual growth spell for almost three decades. However, some caution is also warranted as, after the 0.2% November rise, the latest increase was the second-weakest since last April, hinting at slower growth momentum which has also been indicated by the business surveys.

The wider measure of industrial production, which includes energy and extraction, meanwhile fell 1.3% in the closing month of the year, up just 0.5% over the fourth quarter. Oil and gas extraction slumped 24.2% due to a temporary pipeline shutdown. A rebound should therefore be seen in early 2018.

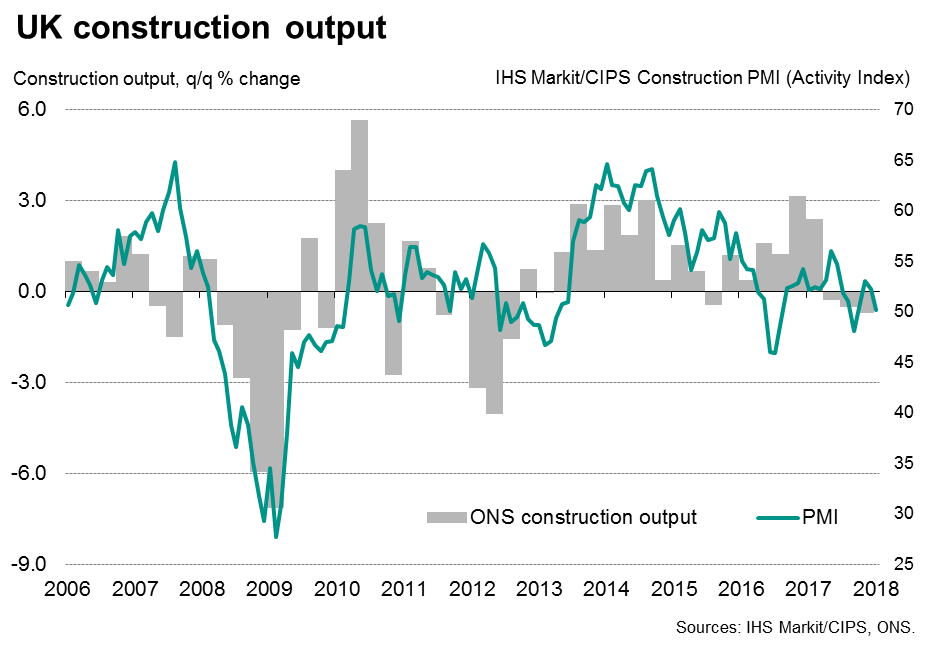

There was much-needed welcome news of an upturn in the construction sector, where output jumped 1.6% after a largely becalmed November (for which output growth was revised down from 0.4% to 0.1%).

Disappointingly, the flurry of construction activity in December failed to prevent the building sector recording a 0.7% drop in output over the fourth quarter as a whole.

Swelling trade deficit

Other data from the ONS showed that the trade deficit swelled in December to £4.9bn, its highest since September 2016, with the goods deficit also up to a 16-month high, now running at £13.6bn. Exports grew just 0.2% in the three months to December while imports were up 2.5%. Higher oil prices were a factor behind the worsening deficit. It’s also worth noting that non-oil goods exports were up 1.1% in the fourth quarter, building on a 1.4% rise in the third quarter to further highlight the extent to which export trade has been boosting the economy.

Mixed outlook

Looking ahead, the survey data suggest further manufacturing momentum was lost at the start of 2018. The IHS Markit/CIPS Manufacturing PMI fell for a second successive month in January, down to a seven-month low, suggesting the pace of expansion has slowed to one of the weakest since the EU referendum in 2016. Disappointing domestic demand appears to have been the main cause of slowing manufacturing growth, according to the survey responses.

This leaves the survey data consistent with the official (ONS) measure of manufacturing output growing at an equivalent quarterly rate of 0.6% in January and suggests manufacturing could make a much reduced impact on economic growth in the opening quarter of 2018.

Moreover, a further slackening of output growth is hinted at for February, as a softer increase in new work received by factories meant backlogs of orders fell for the first time in three months in January.

More encouragingly, solid export growth is likely to be sustained in the coming months. The UK’s export gains have occurred alongside a marked pick up in the eurozone economy, which is the UK’s largest trading partner. PMI data indicate that eurozone economic growth accelerated further to reach a 12-year high in January.

While the recent appreciation of the currency against the US dollar could represent a challenge to future export growth, history suggests that the strength of demand across major trading partners is likely to play the larger role in determining export trends.

The bigger concern is the services sector, where surveys show growth to have slowed in January. While today's data suggest that the economy grew by 0.5% in the fourth quarter, in line with recent ONS estimates, the survey data are indicating a growth rate of just 0.3% at the start of 2018. If this slowdown is confirmed in coming months, the case for a May rate hike will start to look much shakier.

Chris Williamson, Chief Business Economist at IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fDiverging-manufacturing-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fDiverging-manufacturing-trade.html&text=Diverging+manufacturing%2c+trade+and+construction+trends+paint+mixed+picture+of+UK+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fDiverging-manufacturing-trade.html","enabled":true},{"name":"email","url":"?subject=Diverging manufacturing, trade and construction trends paint mixed picture of UK economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fDiverging-manufacturing-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Diverging+manufacturing%2c+trade+and+construction+trends+paint+mixed+picture+of+UK+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fDiverging-manufacturing-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}