Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

Mar 20, 2018

Short sellers retreat from Mall REITs

- Short balances for mall REITs down 20% YTD

- Demand for related corporate bonds also declining

- Short sellers pick spots as operators look to gain footing

“They’re not there to shop, they’re not there to work, they’re just there.”

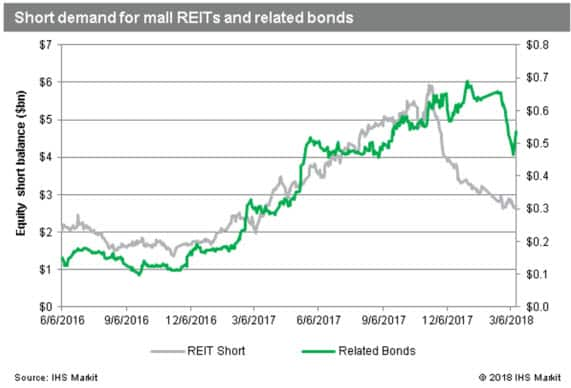

So said the poster advertising the 1995 film Mallrats. More recently, some investors have expressed a similar sentiment with regard to the malls themselves, as consumers continue to move online. In the last four months however, the scale of short bets in nominal terms have declined markedly. Since peaking on November 10th, demand for equities has declined by $2.3bn.

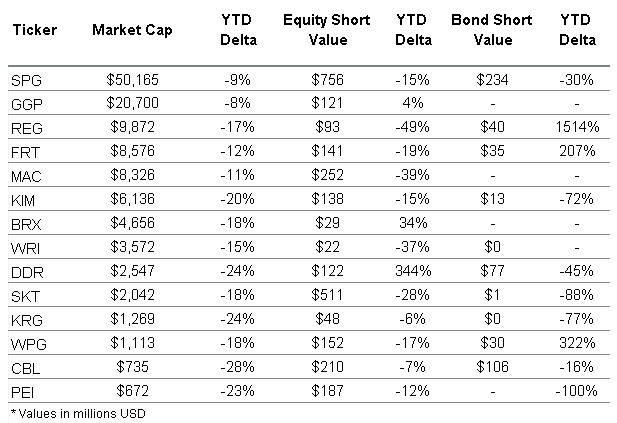

These reductions largely represent profitable short covering, as the group has seen a $10bn decline in overall market cap in that time, with each equity in the group seeing a share price decline. Following the price declines, short demand as a percentage of shares outstanding remains elevated, with short sellers continuing to pursue profits, albeit with a much smaller portfolio allocation.

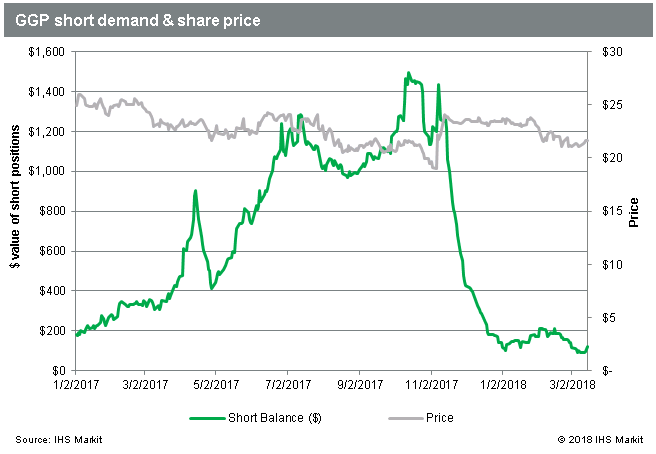

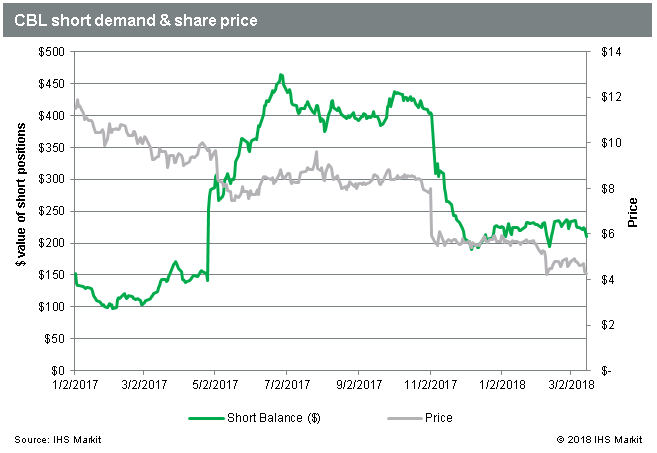

The stark decline in short value from early November is largely the result of two key events, the Brookfield offer for GGP and the downgrade of CBL and Associaties.

On November 7th, it was reported that Brookfield Property Partners was planning to make an offer for the remaining shares of General Growth Properties in a bid to take the trust private, having previously acquired 34% of the shares. The offer sparked short covering across the mall REIT group, particularly GGP and Simon Property Group, which combined for $2.3bn of the subsequent $2.9bn decline in short balances.

Shares of GGP were up over 25% in the days following the offer, however, after rejecting the offer in early December, shares have given back half of the gains. Short sellers sized back up a little in mid-February, but have since covered further, leaving the smallest short position in GGP since May 2016.

The other key event in early November was CBL & Associates being downgraded to junk status by both Moody’s and S&P. While the initial reaction to the downgrade driven sell-off was short covering – which is understandable given the share price was down more than 50% for 2017 at that point – short sellers have subsequently increased shares short to nearly the same level as the start of November. But keep in mind that those shares are worth half as much now.

Given that a credit event sparked the sell-off in CBL, it’s worth considering short flows in credits related to mall REITs. Demand for the related bonds rose in lockstep with the equities in 2017 and continued to rise into 2018 reaching a peak of $690m the first week of January. Since then, balances have since declined by 21%, almost exactly matching the percentage decline in equity balances YTD.

While it’s certainly been a challenging run for mall operators, there have been some signs that correlations amongst the group performance may be in decline. So far in 2018 the seven REITs with decreasing shares short have an average return of -12%, whereas the seven with increasing shares short have an average return of -19%. With the equity and credit short balances in decline the sector may be nearing an inflection point or at very least the point where it’s no longer painted with a broad brush by investors.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fShort-sellers-retreat-from-Mall-REITs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fShort-sellers-retreat-from-Mall-REITs.html&text=Short+sellers+retreat+from+Mall+REITs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fShort-sellers-retreat-from-Mall-REITs.html","enabled":true},{"name":"email","url":"?subject=Short sellers retreat from Mall REITs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fShort-sellers-retreat-from-Mall-REITs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+retreat+from+Mall+REITs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fShort-sellers-retreat-from-Mall-REITs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}