Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 29, 2015

Questions hang over extent of rebound after US economy dips at start of the year

The US economy sank into decline in the first quarter, but looks set to rebound in the second quarter. From a policy perspective, the first quarter lull is already history; it's the extent of the rebound that will be critical in determining the timing of the Fed's first move on interest rates.

The latest estimate of gross domestic product for the first quarter showed the economy shrinking at an annualised rate of 0.7%, revised from an initial estimate of 0.2% growth.

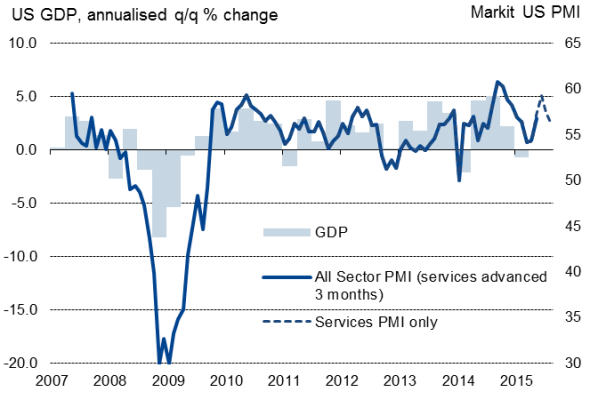

The decline has already been shrugged off as a temporary blip by policymakers, linked to extreme weather, port closures and what looks to be a regular pattern in the official data of the economy weakening at the start of the year . Survey evidence is already pointing to a second quarter pick-up. Markit's flash PMI data, for example, have signalled robust growth, especially in the service sector. The monthly data are running at levels broadly consistent with 2-3% annualised GDP growth in the second quarter. Job creation has also held up surprisingly well.

US GDP and the Markit PMI

The bigger the drop the bigger the rebound?

The extent of the decline in the first quarter is therefore of little concern. After all, the bigger the drop, the stronger the rebound, right? Not necessarily. Some economic activity is lost forever due to events such as extreme weather, and not replaced when conditions improve. Obvious examples include cinema visits and meals out. Furthermore, manufacturing surveys show the strong dollar to be hurting the goods-producing sector, making exports more expensive and imports cheaper, as well as hurting earnings of companies at which overseas profits are converted back into dollars. After-tax corporate profits were already reporting to have been falling at an 8.7% annualised rate in the first quarter.

The latest report also showed consumer spending rising 1.8% in the first quarter, revised down slightly but confirming the important role households are playing in supporting the economy this year. This is due in no small part to low prices. Any rise in inflation could cause this effect to fade, and therefore weaken growth later this year.

While a second quarter rebound therefore looks to be almost certain, the extent of the recovery from the first quarter weakness may disappoint. Any such signs of underlying weakness will inevitably cause the Fed to push out the timing of the first rate hike into next year. However, if the data continue to show robust growth and hiring, with wage growth also reviving, a September rate hike remains firmly on the table.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Economics-Questions-hang-over-extent-of-rebound-after-US-economy-dips-at-start-of-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Economics-Questions-hang-over-extent-of-rebound-after-US-economy-dips-at-start-of-the-year.html&text=Questions+hang+over+extent+of+rebound+after+US+economy+dips+at+start+of+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Economics-Questions-hang-over-extent-of-rebound-after-US-economy-dips-at-start-of-the-year.html","enabled":true},{"name":"email","url":"?subject=Questions hang over extent of rebound after US economy dips at start of the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Economics-Questions-hang-over-extent-of-rebound-after-US-economy-dips-at-start-of-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Questions+hang+over+extent+of+rebound+after+US+economy+dips+at+start+of+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29052015-Economics-Questions-hang-over-extent-of-rebound-after-US-economy-dips-at-start-of-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}