Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 29, 2016

Week Ahead Economic Overview

PMI results will be the focus during the week, with business survey results providing the first available information on global economic trends at the start of the second quarter. Analysts will also be interested in US non-farm payrolls and durable goods orders as well as eurozone retail sales.

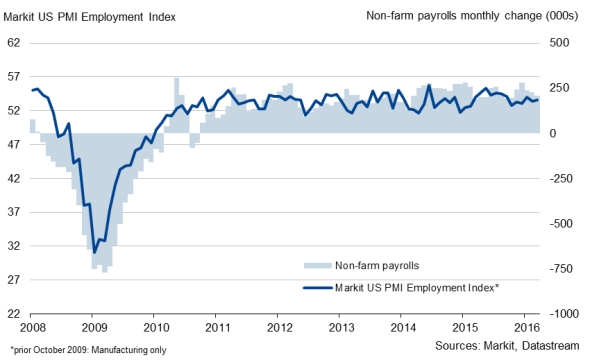

The US Fed will monitor the data flow in coming weeks and months closely for signs that the US economy is ready for another rate hike, possibly as early as June. The release of non-farm payroll and factory orders data will therefore add to the policy debate, after the Fed left interest rates unchanged at their April meeting.

Non-farm payroll numbers, out on Friday, are likely to show a slowdown in job creation, with economists polled by Thomson Reuters expecting a rise of 203k and recent survey data pointing to an even stronger easing in employment growth. Factory orders data are also out during the week and will provide analysts with more information on the health of US industry, after Markit's 'flash' PMI numbers pointed to the sector's worst performance in 6" years.

US non-farm payrolls and the PMI

Final US PMI results for April are meanwhile released by both Markit and ISM, while the US Bureau of Economic Analysis publishes trade data.

The eurozone also sees the release of final PMI results for April, which will include more national detail. The 'flash' numbers signalled that the region remained stuck in a low gear at the start of the second quarter, with moderate growth seen in both manufacturing and services. If the numbers continue to trend downwards in coming months, even more aggressive policy action may be required to drive a more robust and sustainable recovery.

Official retail sales numbers and the eurozone Retail PMI will meanwhile provide data watchers with more information on consumer spending trends. Data from Eurostat showed retail sales up 0.2% in March. Although marginal overall, it was the fourth successive month that growth has been reported. Markets are currently expecting the measure to show an increase of 0.1% in April. Meanwhile, the eurozone Retail PMI signalled a slight decline in March sales, therefore data watchers will be hoping to see a rebound when the April data are published on Friday.

With the Brexit vote looming, there will be a big focus on the UK, with business survey results published across the construction, manufacturing and service sectors. The slowdown in the UK economy in the first quarter, as highlighted by PMI numbers, was confirmed by data from the Office for National Statistics. Moreover, a tightening of financial conditions and increased risk aversion paired with a darkening mood among households suggest that economic growth could slow further in the second quarter.

UK PMI by sector

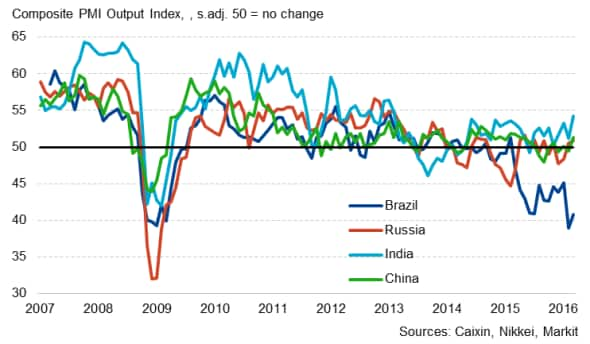

Insights into global economic trends at the start of the second quarter will be provided by PMI results released throughout the week. Global economic growth was running at its weakest for over three years in the first quarter and survey data also suggest growth could deteriorate again in April.

Although emerging markets rebounded slightly in March, it's unclear as to the extent to which growth might continue to recover, especially given the fact that staffing levels fell at the steepest rate since March 2009 and manufacturing output in Russia contracted at the fastest pace in almost seven years during April.

Emerging Markets PMI

Monday 2 May

Manufacturing PMI results are published worldwide.

The latest AIG Manufacturing Index is released in Australia.

UK house price information are updated by Halifax.

Meanwhile, trade data are issued in Brazil.

In the US, construction spending numbers are out.

Tuesday 3 May

A number of manufacturing PMI results (including China and the UK) are released.

The Reserve Bank of Australia announces its latest monetary policy decision.

Producer price numbers for the eurozone are issued by Eurostat.

Brazil sees the release of industrial output figures.

Wednesday 4 May

Service sector PMI results are out across the eurozone, Brazil and the US.

The latest AIG Services Index is published in Australia.

Eurostat releases retail sales numbers for the currency bloc.

Trade balance data are issued in Canada and France, with the latter also seeing the release.

ADP employment, international trade and factory orders numbers are all out in the US.

Thursday 5 May

Service sector PMI results are released in a number of countries (including China and the UK).

Australia sees the release of retail sales and trade data.

Building permit numbers are issued in Canada.

Friday 6 May

The JPMorgan Global Services PMI and the Eurozone Retail PMI are published.

The latest AIG Construction Index is issued in Australia.

Consumer price figures are released in Russia.

South Africa sees the release of business confidence data.

In Spain, industrial production numbers are updated.

Employment data are meanwhile out in Canada and the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f29042016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}