Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 04, 2016

Global manufacturing stagnates at start of second quarter

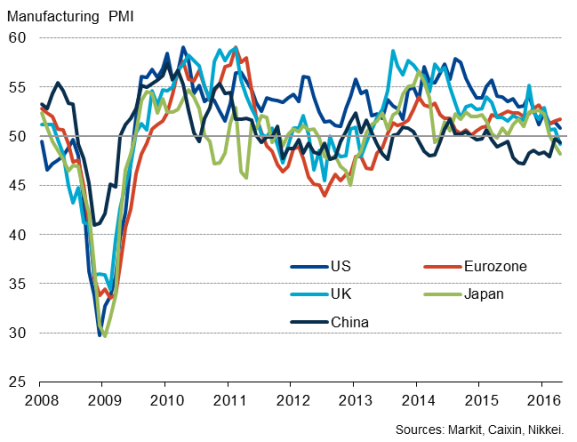

Global PMI data indicated a near-stagnation of the manufacturing economy in April. The JPMorgan PMI, compiled by Markit from its worldwide business surveys, fell from 50.6 in March to 50.1, barely above the no-change threshold of 50.0. The latest reading was the lowest since December 2012 with the exception of the stagnation seen in February of this year.

Both output and new orders saw only marginal gains, with global exports dropping at the fastest rate since last September, pointing to one of the worst months for global trade seen over the past three years.

Meanwhile, factory headcounts and purchases of inputs showed the largest monthly declines since June 2013 and October 2012 respectively as manufacturers pared-back capacity in line with a deteriorating order book situation: April saw the largest fall in backlogs of work for three years as companies worked through existing orders faster than new work came in the door.

Input prices rose globally for the first time since last August, in part due to the increase in oil prices seen during the month. Higher costs were often passed on to customers, causing factory gate prices to rise, albeit only marginally, for the first time since last June.

Global factory output growth

Eurozone dominates growth rankings

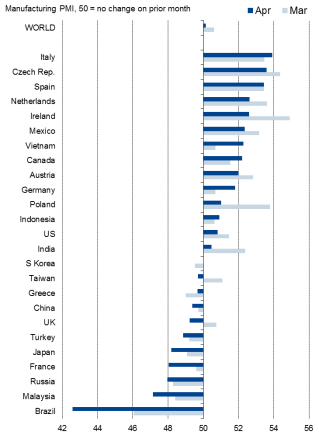

Once again, national divergences were marked, ranging from robust growth to severe decline.

Ten countries reported a deterioration in business conditions in April compared to nine in March, as the United Kingdom slid into decline for the first time for over three years and Taiwan returned to contraction. The biggest fall, by a wide margin, was seen in Brazil, whose downturn deepened to the worst since March 2009.

Worldwide manufacturing PMI rankings

Four of the five fastest-growing countries were eurozone members, the exception being the Czech Republic, a eurozone neighbour. The eurozone as a whole was also the only major economy to see an upturn in the rate of growth. In Asia, both Japan and China contracted, the former recording the sharpest deterioration since January 2013 and the latter reporting the fourteenth successive monthly decline.

While the malaise in Asia has been a long-standing feature of the global manufacturing weakness for over recent years, a worrying recent development has been the worsening situation seen in the US, where the PMI fell to its lowest since September 2009 to indicate a near-stalling of what has been a key engine of global manufacturing growth over the past six years.

Key economies

Trade flows

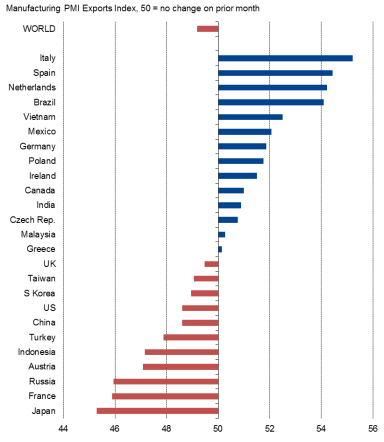

Global export orders (measured in volume terms) fell for a third month running, dropping at the steepest rate since last September to register one of the biggest monthly deteriorations seen since 2012.

Japan's exporters, facing a steep rise in the yen, suffered the biggest fall in export sales of all countries surveyed. Meanwhile, the three fastest growing exporters - each benefitting from recent weakening of exchange rates - were all found in the eurozone, led by Italy, with Brazil in fourth place. However, with France second to bottom on the growth rankings, the survey data highlight how a weaker exchange rate does not guarantee export success.

Export orders in April

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-Global-manufacturing-stagnates-at-start-of-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-Global-manufacturing-stagnates-at-start-of-second-quarter.html&text=Global+manufacturing+stagnates+at+start+of+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-Global-manufacturing-stagnates-at-start-of-second-quarter.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing stagnates at start of second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-Global-manufacturing-stagnates-at-start-of-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+stagnates+at+start+of+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-Global-manufacturing-stagnates-at-start-of-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}