Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 28, 2017

Week Ahead Economic Preview

Worldwide PMI survey releases next week will provide an early steer on global growth and inflation trends at the start of the third quarter, thereby giving important signals for central bank policy. US non-farm payrolls will likewise provide an important insight into Fed policy, and second quarter GDP and July inflation data for the euro area will be eyed for confirmation of the region's upturn. The Bank of England's Monetary Policy Committee will meanwhile meet alongside publication of the Bank's updated forecasts.

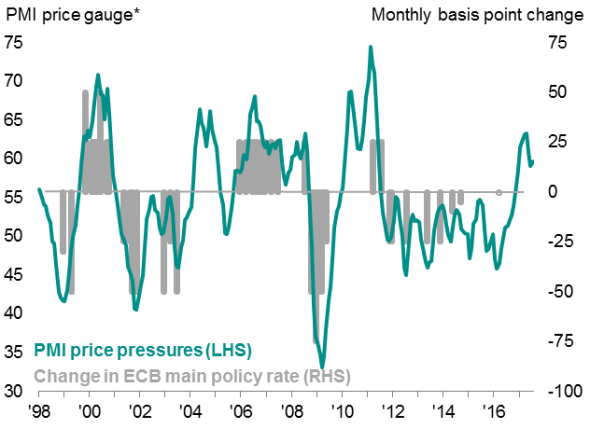

ECB policy and PMI price pressures

Recent PMI releases showed global growth enjoying steady momentum in the second quarter, albeit with signs of a widening underperformance in the emerging markets. Analysts will monitor July's data for clues as to whether global growth " particularly emerging economies " will pick up in coming months and if inflationary pressures will continue to ease. Manufacturing PMI data are published on Tuesday followed by services on Thursday.

With the US Fed hinting at starting to reduce its balance sheet in September, policy watchers will be eager for signs of the economy being on track for tighter policy. A key official data release will therefore be US non-farm payrolls. June figures confounded analysts on the upside, showing a gain of 222,000. Data including the flash PMI point to another strong month job gains in July, with our expectations running at 180,000.

The week also sees final US PMI figures published, together with a host of data for home sales and factory orders, as well as the ISM numbers. Flash July PMI data signalled that US economic growth gained momentum at the start of the third quarter, with signs that growth could accelerate further in coming months.

In the UK, a highlight of the coming week will be the Bank of England's Monetary Policy Committee meeting and its updated forecasts. The lacklustre performance of the UK economy in the first half of this year seems to have diminished the likelihood of an interest rate hike any time soon, especially as growth prospects have become increasingly gloomy. Preliminary official data showed that the UK economy expanded at a meagre rate of 0.3% during the second quarter. The publication of PMI data for July will provide an early look as to how the economy fared at the start of the third quarter.

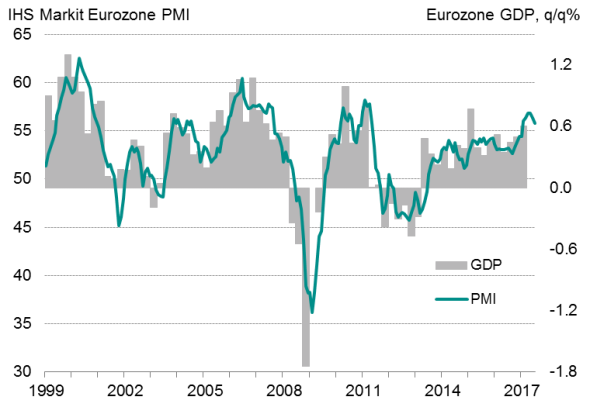

Second quarter flash GDP numbers for the euro area, alongside July inflation data, will meanwhile be monitored for further clues of the direction of future ECB policy. PMI surveys have signalled a 0.7% expansion. However, the flash Eurozone PMI has signalled a slowing in the pace of economic growth and an accompanying easing of price pressures, adding to the belief that ECB policymakers will be in no rush to taper policy. Updated IHS Markit's PMI surveys will provide further clues.

Eurozone PMI v GDP

In China, Caixin and NBS PMI surveys for manufacturing and service sectors will meanwhile provide an early gauge as to third quarter GDP. The Chinese economy is widely expected to slow in Q3 after the strength of China's first half expansion took analysts by surprise.

Download the report for more details and a full diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072017-Economics-Week-Ahead-Economic-Preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072017-Economics-Week-Ahead-Economic-Preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}